Este artículo también está disponible en español.

Ethereum, the second-largest cryptocurrency by way of marketplace cap, has just lately proven indicators of a transferring marketplace sentiment and momentum, in line with an research by way of a CryptoQuant analyst named Percival.

The analyst disclosed that diverse marketplace statuses and technological tendencies have impacted Ethereum’s momentum and feature ended in combined perspectives on its pace enlargement trajectory.

Matching Studying

Ethereum’s Marketplace Sees Shift

Percival, highlighted that Ethereum has confronted a diminish in task because of the stand of alternative blockchains with higher accessibility, extra complicated generation, and sooner replace cycles.

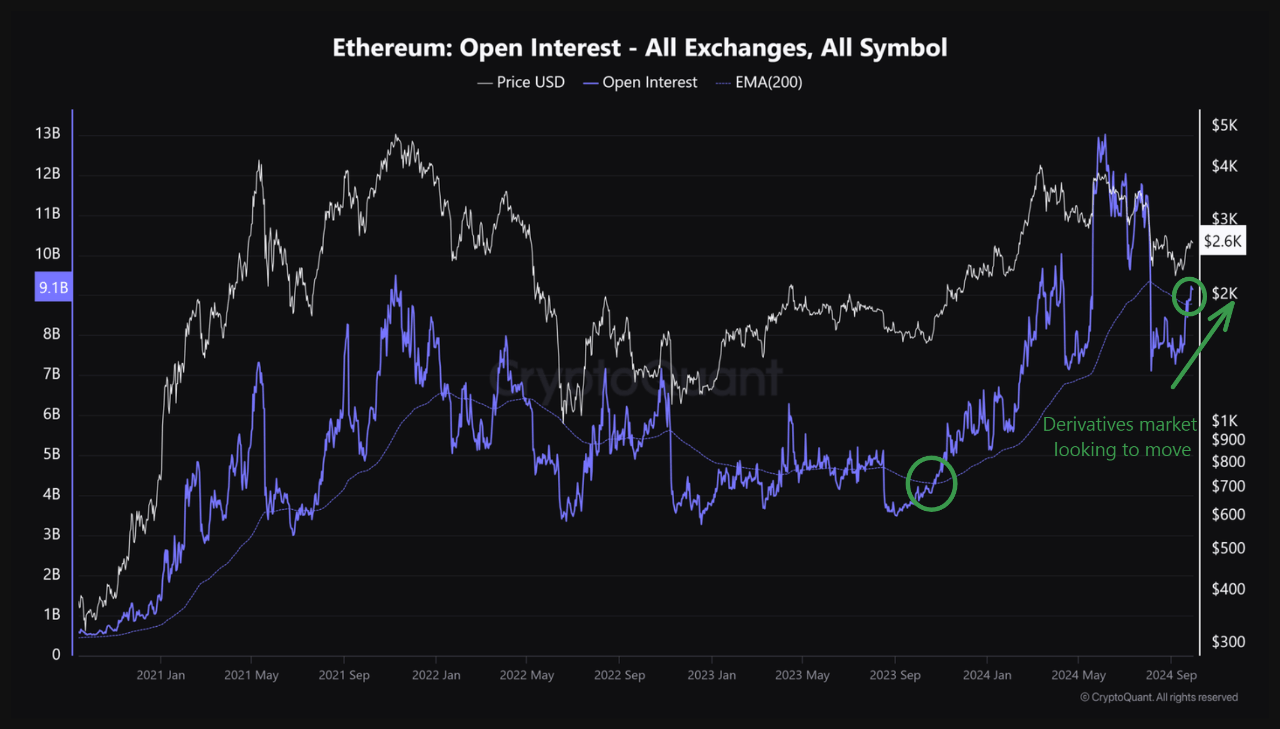

Consistent with the analyst, “the positive Momentum sentiment is far below expectations.” Up to now, the perceivable hobby in Ethereum futures—a measure of capital flowing into by-product assurances—reached $9.2 billion, with a important influx of $2.12 billion in August 2024.

This represents a 30% stand however pales in comparison to the $6 billion influx seen between April and Might, reflecting best part of that earlier momentum.

Any other main remark of the research used to be the “Coinbase Premium Gap,” indicating the differential between the cost of Ethereum on Coinbase and alternative international exchanges.

A slowdown in promoting force from US-based traders suggests a imaginable sure shift in marketplace sentiment. On the other hand, the marketplace continues to be looking ahead to a vital inflow of capital to pressure a robust rally for Ethereum.

The analyst identified that any pace value healing would rely on considerable funding inflows, which have not begun to materialize.

Moreover, nearest the Federal Revealed Marketplace Committee’s (FOMC) bulletins, Ethereum’s gasoline charges surged, hinting at a imaginable shift of capital from conventional treasuries into decentralized finance (DeFi).

The analyst discussed an example: the DeFi lending platform Aave, which operates at the ETH community, has observable a average stand in charge assortment, from $42 million in March to $43 million in August.

Ethereum Community Lags At the back of

Pace Percival famous that from an financial viewpoint, Ethereum must revert to its max charge cross gasoline heartless, aligning its enlargement with its intrinsic price, the analyst additionally means that Ethereum these days faces a number of inner gaps.

Even supposing the generation ecosystem round Ethereum is increasing, the community appears to be lagging at the back of the contest, in line with Percival. The CryptoQuant analyst unearths that this disconnect between Ethereum’s features and its technological competitors has ended in a vital shortfall in funding.

Additionally, the restricted influx of miniature capital and inadequency of constant significance recommend that even minor investments don’t seem to be being sustained over age.

Matching Studying

The analyst’s tug is additional validated by way of the truth that Ethereum’s community has confronted larger festival from extra blockchains like Solana, Binance Ingenious Chain, and others that boast upper transaction speeds and decrease charges.

This has, to some degree, diverted consideration and funding from Ethereum to those more recent ecosystems.

Featured symbol created with DALL-E, Chart from TradingView