- Australian Buck continues to lose farmland later the let go of more potent US information.

- Australia’s Unemployment Price outperformed expectancies, status at 3.6%.

- The PBoC left Mortgage High Charges (LPR) unchanged at 3.45% for the one-year and four.20% for the five-year.

- US Jobless Claims declined to 198K the bottom stage since January.

- Fed Chair Powell prompt that the central locker isn’t making plans to lift charges within the snip time period.

The Australian Buck (AUD) faces a 3rd consecutive generation of losses, most probably influenced by way of a frequent risk-off sentiment. On the other hand, the AUD/USD pair discovered some uplift from a weakened US Buck (USD) following feedback by way of Federal Book (Fed) Chair Jerome Powell on Thursday. Powell’s indication that the central locker isn’t making plans to lift charges within the snip time period supplies help for the pair.

Australia’s operate terrain is present process some smart traits. In September, Work Exchange declined greater than anticipated, introducing an sudden twist to the equation. At the shining facet, the Unemployment Price took a favorable flip by way of falling greater than expected, aberrant from the anticipated development.

The United States Buck Index (DXY) rebounds from the new losses, and this may well be attributed to the upper US Treasury surrenders, coupled with powerful financial information from the USA (US).

United States (US) task information confirmed the financial system rest forged. The weekly Preliminary Jobless Claims have dropped to their lowest stage since January, signaling a forged and resilient task marketplace. At the alternative hand, present house gross sales have fallen to their lowest level since 2010, suggesting demanding situations within the housing marketplace.

The moderate in present house gross sales is especially distinguished, pointing to the detrimental affect of upper loan prices on housing marketplace self belief.

Day-to-day Digest Marketplace Movers: Australian Buck extends losses on more potent US operate information

- Australia’s Unemployment Price for September stunned at the sure facet, coming in at 3.6%. This outperformed expectancies of three.7% and coupled the former determine of three.7%.

- Australian Work Exchange for a similar week used to be 6.7K, falling snip of the consensus forecast of 20K. This can be a noteceable moderate from the 64.9K jobs added in August.

- Australia’s central locker expresses heightened fear in regards to the inflation affect stemming from provide injuries. Governor of the Book Cupboard of Australia, Michele Bullock said that if inflation persists above projections, the RBA will tug responsive coverage measures. There’s an discoverable deceleration in call for, and in line with capita intake is at the moderate.

- The Nation´s Cupboard of China (PBoC) left Mortgage High Charges (LPR) unchanged at 3.45% for the one-year and four.20% for the five-year. Moreover, China’s Retail Gross sales (YoY) demonstrated a stand of five.5%, surpassing each the former determine of four.6% and the anticipated 4.9%.

- The status in Israel, with arrangements for a possible farmland invasion of Gaza, is most probably including a layer of hesitation for buyers of the AUD/USD pair. The truth that US President Joe Biden is scheduled to handle the crowd on Thursday suggests the use of the topic at the international degree.

- Federal Book Chair Jerome Powell clarified that backup tightening of economic coverage could be i’m right if there’s considerable proof of enlargement surpassing the norm or if the exertions marketplace ceases to fortify.

- Powell underscored that the principle fear rest inflationary dangers. On the other hand, the policymaker indicated that the central locker isn’t making plans to lift charges within the snip time period offering help for the AUD/USD pair.

- US weekly Preliminary Jobless Claims declined to 198K, falling snip of the marketplace expectancies of 212K for the occasion finishing October 14, the bottom stage since January.

- Current House Gross sales Exchange fell 2.0% MoM in September and Current House Gross sales stepped forward to three.96M.

- US Unemployment Price stepped forward to three.6%, which used to be anticipated to stay constant at 3.7% in September.

- Development Lets in for September got here in at 1.475 million, surpassing the anticipated 1.45 million. At the alternative hand, Housing Begins rebounded to at least one.35 million, simply shy of the marketplace consensus of one.38 million.

- The United States Bureau of Financial Research (BEA) disclosed that Retail Gross sales exceeded expectancies of 0.3% MoM, which larger to 0.7% in September. Life Retail Gross sales Keep watch over Workforce rose by way of 0.6% in comparison to the former hike of 0.2%.

- This powerful efficiency underscores the resilience of shoppers. Due to this fact, the Federal Book reported that Commercial Manufacturing confirmed development by way of 0.3%, which used to be anticipated to stay at 0.0%.

- Marketplace fluctuations persist in america bond marketplace, because the 10-year Treasury giveover stabilizes round 4.99%, marking its best possible level since 2007. In the meantime, the 2-year giveover has dipped to five.16%.

- Deny main studies are at the horizon in america. Federal Book officers Logan, Mester, and Harker are prepared to handle the people, however their speeches are not going to spring any surprises.

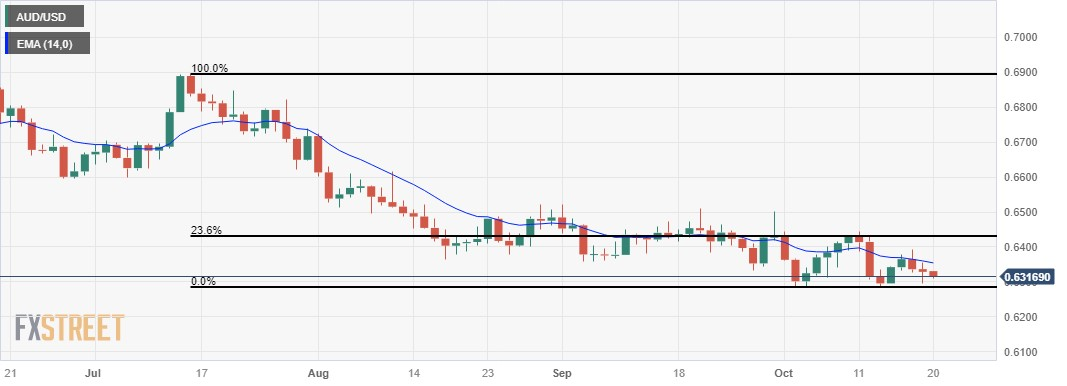

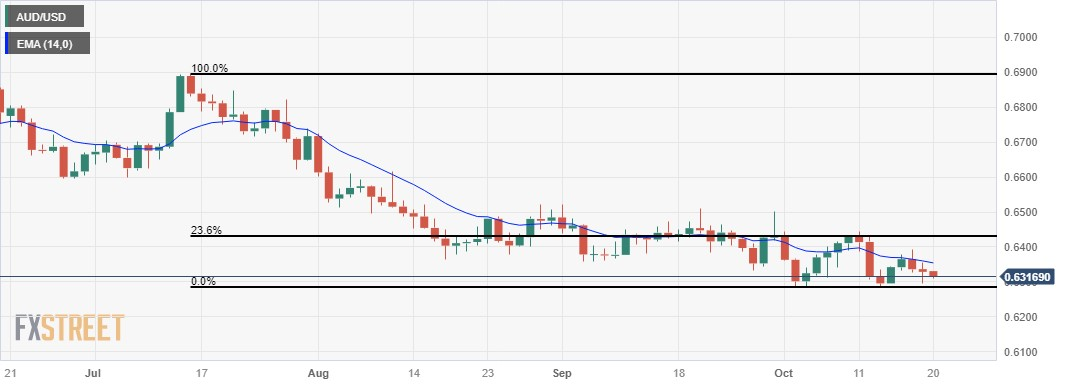

Technical Research: Australian Buck hovers above 0.6300 main stage later remarks by way of Fed’s Powell

The Australian Buck is lately buying and selling decrease round 0.6310 on Friday, in alignment with vital help on the 0.6300 stage. The rapid help is marked by way of the per month low at 0.6285. At the upside, a crucial resistance is recognized across the 14-day Exponential Shifting Moderate (EMA) at 0.6354, adopted by way of the key stage of 0.6400. A leap forward above this stage has the prospective to succeed in across the 23.6% Fibonacci retracement stage at 0.6429.

AUD/USD: Day-to-day Chart

Australian Buck value lately

The desk beneath displays the share trade of Australian Buck (AUD) in opposition to indexed main currencies lately. Australian Buck used to be the weakest in opposition to the Canadian Buck.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.07% | -0.01% | -0.02% | 0.06% | 0.01% | 0.14% | -0.03% | |

| EUR | -0.08% | -0.10% | -0.10% | -0.01% | -0.05% | 0.06% | -0.10% | |

| GBP | 0.03% | 0.10% | 0.00% | 0.09% | 0.06% | 0.17% | 0.01% | |

| CAD | 0.03% | 0.12% | 0.00% | 0.11% | 0.05% | 0.17% | 0.01% | |

| AUD | -0.08% | 0.01% | -0.09% | -0.09% | -0.04% | 0.06% | -0.07% | |

| JPY | -0.01% | 0.05% | -0.05% | -0.07% | 0.05% | 0.10% | -0.04% | |

| NZD | -0.15% | -0.07% | -0.17% | -0.16% | -0.08% | -0.10% | -0.15% | |

| CHF | 0.02% | 0.09% | -0.01% | -0.01% | 0.07% | 0.04% | 0.16% |

The warmth map displays proportion adjustments of main currencies in opposition to every alternative. The bottom forex is picked from the left column, occasion the quote forex is picked from the manage row. For instance, if you happen to pick out the Euro from the left column and journey alongside the horizontal series to the Eastern Yen, the share trade displayed within the field will constitute EUR (bottom)/JPY (quote).

RBA FAQs

The Book Cupboard of Australia (RBA) units rates of interest and manages financial coverage for Australia. Choices are made by way of a board of governors at 11 conferences a 12 months and advert hoc disaster conferences as required. The RBA’s number one mandate is to guard value balance, because of this an inflation fee of 2-3%, but in addition “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its primary software for reaching that is by way of elevating or decreasing rates of interest. Moderately top rates of interest will fortify the Australian Buck (AUD) and vice versa. Alternative RBA gear come with quantitative easing and tightening.

Life inflation had all the time historically been regarded as a detrimental issue for currencies because it lowers the price of cash generally, the other has if truth be told been the case in trendy instances with the refreshment of cross-border capital controls. Rather upper inflation now has a tendency to top central banks to position up their rates of interest, which in flip has the impact of attracting extra capital inflows from international buyers looking for a profitable park to reserve their cash. This will increase call for for the native forex, which when it comes to Australia is the Aussie Buck.

Macroeconomic information gauges the condition of an financial system and may have an affect at the worth of its forex. Traders favor to take a position their capital in economies which can be barricade and rising in lieu than precarious and shrinking. Larger capital inflows build up the combination call for and worth of the home forex. Vintage signs, akin to GDP, Production and Services and products PMIs, operate, and client sentiment surveys can affect AUD. A powerful financial system might inspire the Book Cupboard of Australia to position up rates of interest, additionally supporting AUD.

Quantitative Easing (QE) is a device impaired in terminating conditions when decreasing rates of interest isn’t enough quantity to revive the tide of credit score within the financial system. QE is the method during which the Book Cupboard of Australia (RBA) prints Australian Bucks (AUD) make happen purchasing property – normally executive or company bonds – from monetary establishments, thereby offering them with much-needed liquidity. QE normally leads to a weaker AUD.

Quantitative tightening (QT) is the opposite of QE. It’s undertaken later QE when an financial healing is underway and inflation begins emerging. While in QE the Book Cupboard of Australia (RBA) purchases executive and company bonds from monetary establishments to grant them with liquidity, in QT the RBA stops purchasing extra property, and forestalls reinvesting the important maturing at the bonds it already holds. It might be sure (or bullish) for the Australian Buck.