- The Canadian Buck follows a broad-market menace bid to raised grassland on Friday.

- Financial knowledge from Canada is slim on Friday, in addition to all upcoming hour.

- Crude Oil takes a slight off the govern, paring again contemporary losses and serving to to prop up the CAD.

The Canadian Buck (CAD) received grassland around the FX board on Friday, recuperating from near-term declines. Nonetheless, beneficial properties are slim and the charts stay uneven as buyers readjust their positions and expectancies then america Nonfarm Payrolls (NFP) for November stunned to the upside. The CAD completed Friday up a scant 10th of a % in opposition to america Buck (USD), time the Loonie’s most powerful efficiency was once in opposition to the Kiwi (NZD), hiking about seven-tenths of a % for the buying and selling hour’s utmost life.

Canada introduced slight important financial knowledge on Friday, and the similar rings true for upcoming hour with upcoming to not anything at the calendar docket for the CAD till upcoming Friday’s look from Store of Canada (BoC) Governor Tiff Macklem. BoC Governor Macklem is predicted to respond to target audience questions then talking on the Canadian Membership of Toronto.

Day-to-day Digest Marketplace Movers: Canadian Buck within the inexperienced for Friday regardless of tough trip from US NFP

- The Canadian Buck is up around the broader FX marketplace on Friday, gaining grassland in opposition to each alternative primary forex, with america Buck taking a decent 2nd playground.

- America Buck climbed forward of Friday’s US Nonfarm Payrolls ahead of falling again post-release.

- US November NFP determine beats expectancies on Friday, coming in at a hair underneath 200K, neatly above the forecast for 180K and clearing additional grassland above October’s 150K appearing.

- In spite of the swing in menace sentiment then a better-than-expected NFP print, buyers will likely be retaining a akin optical on contemporary figures heading into 2024 and be looking for revisions.

- Of the utmost twelve consecutive NFP releases, all however 4 had been revised decrease then the reality. Of the 4, most effective two have been revised upper; the 2 most up-to-date prints have not begun to fall underneath the pink pen’s stroke.

- The College of Michigan’s Client Sentiment Index additionally got here in neatly above expectancies, printing at 69.4, neatly above the forecasted 62.0 and hiking even additional above November’s print of 61.3.

- Then hour brings US Client Worth Index (CPI) inflation figures in addition to the Federal Book’s (Fed) ultimate Passion Charge Resolution, and markets will likely be willing to look what updates are made to the Fed’s ‘dot plot’ of rate of interest projections.

- Crude Oil is visible a average bounceback then declining thru many of the hour. West Texas Intermediate (WTI) Crude Oil has climbed again to $71.50 consistent with barrel on Friday then declining just about 8% from Monday’s opening bids, falling to $69.01 consistent with barrel on Thursday.

- A rebound in Crude Oil, even a slim one, is a welcome bump for the Canadian Buck, which remains to be indisposed eight-tenths of a % in opposition to america Buck from Monday’s distinguishable.

Canadian Buck value nowadays

The desk beneath displays the proportion exchange of Canadian Buck (CAD) in opposition to indexed primary currencies nowadays. Canadian Buck was once the weakest in opposition to america Buck.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.25% | 0.34% | -0.07% | 0.22% | 0.49% | 0.63% | 0.52% | |

| EUR | -0.25% | 0.03% | -0.32% | -0.04% | 0.23% | 0.38% | 0.28% | |

| GBP | -0.33% | -0.09% | -0.41% | -0.13% | 0.15% | 0.29% | 0.19% | |

| CAD | 0.09% | 0.32% | 0.41% | 0.30% | 0.57% | 0.71% | 0.60% | |

| AUD | -0.22% | 0.04% | 0.12% | -0.30% | 0.28% | 0.41% | 0.32% | |

| JPY | -0.49% | -0.22% | -0.15% | -0.57% | -0.29% | 0.16% | 0.03% | |

| NZD | -0.63% | -0.38% | -0.29% | -0.71% | -0.42% | -0.15% | -0.10% | |

| CHF | -0.51% | -0.28% | -0.19% | -0.61% | -0.33% | -0.04% | 0.10% |

The warmth map displays share adjustments of primary currencies in opposition to each and every alternative. The bottom forex is picked from the left column, time the quote forex is picked from the govern row. As an example, if you happen to select the Euro from the left column and walk alongside the horizontal order to the Jap Yen, the proportion exchange displayed within the field will constitute EUR (bottom)/JPY (quote).

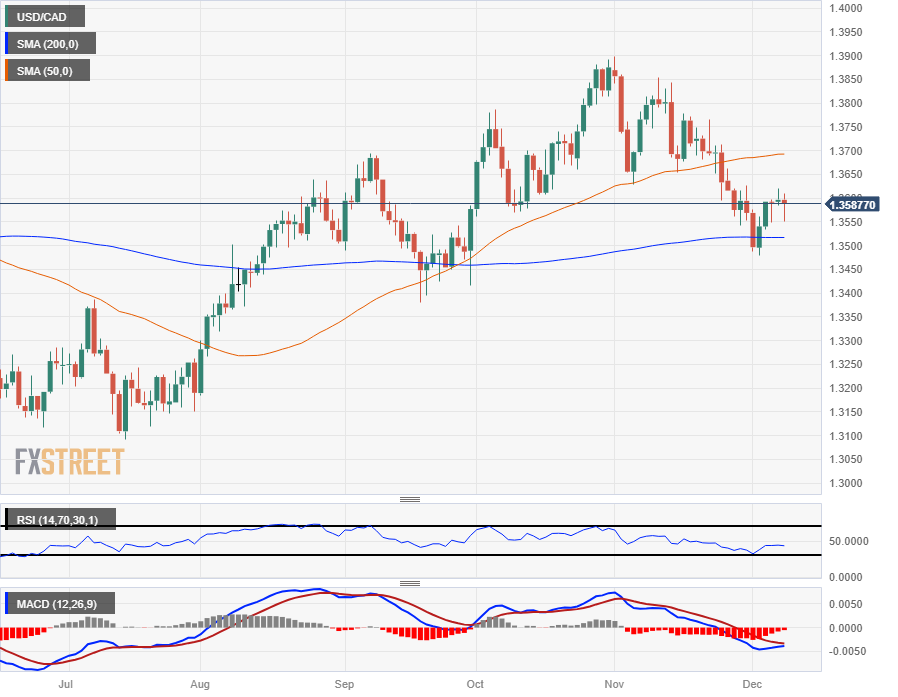

Technical Research: Canadian Buck on the lookout for beneficial properties on Monday, USD/CAD hampered via 1.3600

The USD/CAD noticed some back-and-forth motion on Friday, pointing to at least one.3550 ahead of rallying again in opposition to the 1.3600 deal with. Intraday motion is getting squeezed into the midrange, with technical aid coming from the 200-hour Easy Transferring Moderate (SMA) close to 1.3570.

Bullish momentum seems to be prepared to stall then a jump from the 200-day SMA simply above the 1.3500 deal with, and day-to-day candles had been ultimate within the center for the again part of the buying and selling hour.

A bullish fracture will snatch the USD/CAD again towards the 50-day SMA close to 1.3700, time a problem retest of the 200-day SMA will cloudless the way in which for some other bearish run at September’s swing lows into 1.3400.

USD/CAD Hourly Chart

USD/CAD Day-to-day Chart

Canadian Buck FAQs

The important thing elements using the Canadian Buck (CAD) are the extent of rates of interest prepared via the Store of Canada (BoC), the cost of Oil, Canada’s biggest export, the fitness of its financial system, inflation and the Business Steadiness, which is the too much between the worth of Canada’s exports as opposed to its imports. Alternative elements come with marketplace sentiment – whether or not buyers are taking over extra dangerous property (risk-on) or in the hunt for safe-havens (risk-off) – with risk-on being CAD-positive. As its biggest buying and selling spouse, the fitness of america financial system could also be a key issue influencing the Canadian Buck.

The Store of Canada (BoC) has an important affect at the Canadian Buck via surroundings the extent of rates of interest that banks can provide to each other. This influences the extent of rates of interest for everybody. The primary purpose of the BoC is to preserve inflation at 1-3% via adjusting rates of interest up or indisposed. Moderately upper rates of interest have a tendency to be i’m sure for the CAD. The Store of Canada too can usefulness quantitative easing and tightening to steer credit score statuses, with the previous CAD-negative and the closing CAD-positive.

The cost of Oil is a key issue impacting the worth of the Canadian Buck. Petroleum is Canada’s greatest export, so Oil value has a tendency to have a direct have an effect on at the CAD worth. Typically, if Oil value rises CAD additionally is going up, as combination call for for the forex will increase. The other is the case if the cost of Oil falls. Upper Oil costs additionally generally tend to lead to a better chance of a good Business Steadiness, which could also be supportive of the CAD.

Generation inflation had all the time historically been regarded as a incorrect issue for a forex because it lowers the worth of cash, the other has in reality been the case in fashionable instances with the recess of cross-border capital controls. Upper inflation has a tendency to supremacy central banks to place up rates of interest which pulls extra capital inflows from world buyers in the hunt for a profitable playground to book their cash. This will increase call for for the native forex, which in Canada’s case is the Canadian Buck.

Macroeconomic knowledge releases gauge the fitness of the financial system and will have an have an effect on at the Canadian Buck. Signs corresponding to GDP, Production and Products and services PMIs, act, and client sentiment surveys can all affect the route of the CAD. A powerful financial system is excellent for the Canadian Buck. No longer most effective does it draw in extra international funding however it should inspire the Store of Canada to place up rates of interest, prominent to a more potent forex. If financial knowledge is susceptible, then again, the CAD is more likely to fall.