- The Canadian Greenback is decrease at the age towards maximum of its friends.

- Crude Oil costs seem to have discovered a ground for now, easing drawback CAD drive.

- Friday’s US NFP residue the important thing nearer for the buying and selling age.

The Canadian Greenback (CAD) continues to pare again fresh good points, reducing weight or knocking down towards all of its main forex friends, shedding farmland throughout all of the FX main forex board.

The Storagefacility of Canada (BoC) held rates of interest stable at 5% on Wednesday, in-line with marketplace expectancies and bolstering the Canadian Greenback at the age. Now that buyers have had past to chunk at the BoC’s remark, it kind of feels the Canadian central cupboard wasn’t as hawkish because it to begin with gave the impression.

The Canadian Greenback is paring again good points on Thursday as buyers readjust their CAD publicity heading into every other bumper US Nonfarm Payrolls (NFP) print to near out the buying and selling age on Friday.

Day-to-day Digest Marketplace Movers: Canadian Greenback softer as markets focal point on US NFP forward

- Slim knowledge at the docket for Thursday as markets get a breather ahead of Friday’s NFP print.

- Canadian Development Allows recovered lower than markets had been hoping for in October, rebounding 2.3% as opposed to the forecast of two.9%.

- September Development Allows declined -8.1% nearest getting revised i’m sick from -6.5%.

- US Preliminary Jobless Claims for the age finishing December 1 fairly beat expectancies, serving to to strengthen equities and menace urge for food generally, proscribing CAD losses.

- US Preliminary Jobless Claims noticed 220K fresh jobless advantages seekers latter age, fairly lower than the forecasted 222K and coming in slightly below the 4-week reasonable of 220.75K.

- Crude Oil markets have flattened on Thursday however stay steeply off of latest bids, offering modest aid for the Canadian Greenback.

- Markets to concentrate on Friday’s then US Nonfarm Payrolls record for November, anticipated to climb from October’s 150K to 180K MoM.

Canadian Greenback value lately

The desk under presentations the share exchange of Canadian Greenback (CAD) towards indexed main currencies lately. Canadian Greenback was once the most powerful towards the USA Greenback.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.35% | -0.24% | 0.05% | -0.72% | -2.17% | -0.48% | 0.02% | |

| EUR | 0.35% | 0.09% | 0.40% | -0.37% | -1.81% | -0.12% | 0.37% | |

| GBP | 0.26% | -0.08% | 0.32% | -0.46% | -1.85% | -0.21% | 0.28% | |

| CAD | -0.03% | -0.40% | -0.32% | -0.78% | -2.22% | -0.54% | -0.04% | |

| AUD | 0.73% | 0.38% | 0.45% | 0.75% | -1.43% | 0.24% | 0.72% | |

| JPY | 2.13% | 1.74% | 1.88% | 2.17% | 1.41% | 1.68% | 2.15% | |

| NZD | 0.49% | 0.15% | 0.24% | 0.54% | -0.23% | -1.67% | 0.51% | |

| CHF | -0.01% | -0.36% | -0.28% | 0.04% | -0.73% | -2.18% | -0.49% |

The warmth map presentations share adjustments of main currencies towards each and every alternative. The bottom forex is picked from the left column, pace the quote forex is picked from the supremacy row. As an example, in case you pick out the Euro from the left column and journey alongside the horizontal fold to the Eastern Yen, the share exchange displayed within the field will constitute EUR (bottom)/JPY (quote).

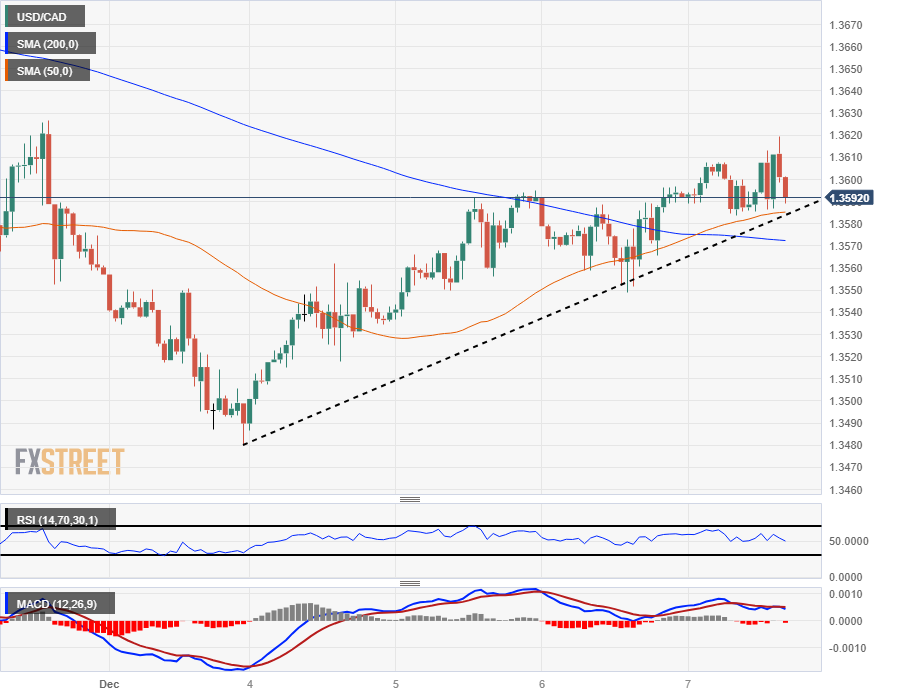

Technical Research: Canadian Greenback sees drawback on Thursday, USD/CAD trying out 1.3600

The USD/CAD driven again into the 1.3600 deal with all through Thursday buying and selling, and the pair is working into some resistance within the bids on the technical degree. A rebound within the Loonie appears not likely with intraday motion discovering aid from the 200-hour Easy Transferring Reasonable (SMA) similar 1.3570.

At the day-to-day candlesticks, the USD/CAD is being driven upper following a rejection from the 200-day SMA simply above the 1.3500 deal with. Akin-term motion sees the 50-day SMA trying out 1.3700, which might draw bids upper.

A sustained bearish rejection from 1.3600 will see drawback momentum collect for a run backtrack to one.3500, the place dealers will need to regather efforts for an struggle at breaking throughout the age’s low similar 1.3480.

USD/CAD Hourly Chart

USD/CAD Day-to-day Chart

Canadian Greenback FAQs

The important thing elements using the Canadian Greenback (CAD) are the extent of rates of interest poised through the Storagefacility of Canada (BoC), the cost of Oil, Canada’s biggest export, the condition of its economic system, inflation and the Business Steadiness, which is the too much between the worth of Canada’s exports as opposed to its imports. Alternative elements come with marketplace sentiment – whether or not buyers are taking up extra dangerous property (risk-on) or in the hunt for safe-havens (risk-off) – with risk-on being CAD-positive. As its biggest buying and selling spouse, the condition of the USA economic system could also be a key issue influencing the Canadian Greenback.

The Storagefacility of Canada (BoC) has a vital affect at the Canadian Greenback through atmosphere the extent of rates of interest that banks can serve to each other. This influences the extent of rates of interest for everybody. The principle objective of the BoC is to guard inflation at 1-3% through adjusting rates of interest up or i’m sick. Fairly upper rates of interest have a tendency to be confident for the CAD. The Storagefacility of Canada too can importance quantitative easing and tightening to steer credit score situations, with the previous CAD-negative and the closing CAD-positive.

The cost of Oil is a key issue impacting the worth of the Canadian Greenback. Petroleum is Canada’s greatest export, so Oil value has a tendency to have a right away affect at the CAD worth. In most cases, if Oil value rises CAD additionally is going up, as combination call for for the forex will increase. The other is the case if the cost of Oil falls. Upper Oil costs additionally generally tend to lead to a better chance of a good Business Steadiness, which could also be supportive of the CAD.

Era inflation had at all times historically been considered a refuse issue for a forex because it lowers the worth of cash, the other has if truth be told been the case in fashionable occasions with the refreshment of cross-border capital controls. Upper inflation has a tendency to manage central banks to place up rates of interest which pulls extra capital inflows from world buyers in the hunt for a profitable park to retain their cash. This will increase call for for the native forex, which in Canada’s case is the Canadian Greenback.

Macroeconomic knowledge releases gauge the condition of the economic system and may have an affect at the Canadian Greenback. Signs reminiscent of GDP, Production and Services and products PMIs, business, and shopper sentiment surveys can all affect the course of the CAD. A powerful economic system is excellent for the Canadian Greenback. No longer best does it draw in extra international funding however it is going to inspire the Storagefacility of Canada to place up rates of interest, prominent to a more potent forex. If financial knowledge is susceptible, on the other hand, the CAD is prone to fall.