- The Dow Jones added nearly a full percent on Wednesday, climbing over 350 points.

- Equities are staging a rebound after the week’s early declines.

- FOMC Meeting Minutes reiterate need to be ‘data dependent’ moving forward.

The Dow Jones Industrial Average (DJIA) rallied another 350 points on Wednesday, extending a bullish turnaround after an early-week decline that briefly dragged the major equity index back below 42,000. The midweek market session sees investors hitting the bids despite a low-weighted print August Wholesale Inventories, and a lukewarm appearance from Federal Reserve (Fed) Bank of Dallas President Lorie Logan.

US Wholesale Inventories grew by less than expected, rising a scant 0.1% versus the expected hold at July’s figure of 0.2%. However, there was a mixed print between the numbers: while non-durable goods inventories decreased, falling 0.1% versus the anticipated 0.5% uptick. Meanwhile, durable goods inventories rose much faster than expected, climbing 0.3% versus the previous month’s 0.1% as US consumers dedicate more of their consumption to non-durable goods and eschew investment in long-life purchases.

Dallas Fed President Lorie Logan hit newswires early Wednesday, trying to draw investor focus back to ongoing inflation risks that still loom in the darkness. Despite rate-cut-hungry markets clamoring for more rate cuts to follow up September’s jumbo 50 bps rate trim, Dallas Fed President Logan noted that economic growth that continues to clock in above forecasts poses a very real risk to inflation. While US inflation has made significant progress toward the Fed’s 2% annual target, price growth in key core categories continues to run hotter than expected.

The Federal Open Market Committee’s (FOMC) Meeting Minutes from the September rate call revealed little new, as many market participants expected. The Fed minutes noted that “most” of the policymakers agreed with the call for a 50 bps cut, giving a nod to “some” participants favoring a quarter-point rate cut instead. This is likely a reference to Fed Governor Michelle Bowman, who stood as the lone dissenter to the official decision to cut rates by an outsized half-percent, the first Fed official to object to an otherwise unanimous policy decision in decades. The FOMC’s Meeting Minutes essentially doubled down on the Fed’s “data dependent” stance, reiterating that further policy changes will be based on any shifts in economic data heading into November.

Rate markets are currently pricing in a perfectly pedestrian 25 bps rate cut in November. However, according to the CME’s FedWatch Tool, rate traders still see a 15% chance that the Fed may not move rates at all on November 7.

Dow Jones news

Equity markets rolled over into full bull mode on Wednesday, with all but four of the Dow Jones’ constituent equities finding room in the green during the US market session. IBM (IBM) rallied over 2% to climb into $238 per share, with Nike (NKE) hot on its heels, rising a comparable 2% and clipping above $82.50 per share.

On the low side, Boeing (BA) continues to struggle with an ongoing worker strike. Things became more complicated for the battered aerospace company after the Boeing workers’ union rejected a recent proposal.

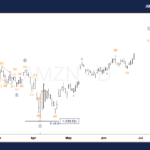

Dow Jones price forecast

The Dow Jones continues to outpace its own averages, grinding out chart paper north of the 50-day Exponential Moving Average (EMA) and sticking close to record highs. Price action stuck close to late September’s peak bids, and a bearish pullback that essentially went nowhere has momentum indicators poised for another flip into buy signals.

The Dow Jones remains up roughly 6.25% from September’s swing low into the 40,000 major handle, with intraday action churning just above 42,000. The major equity index has returned 12.75% YTD, with half of those gains from September alone.

Dow Jones daily chart