- Gold price regains positive traction following the previous day’s range-bound price moves.

- Trade-related uncertainties and geopolitical risks underpin the safe-haven precious metal.

- A modest USD strength might cap the XAU/USD ahead of the critical US inflation figures.

Gold price (XAU/USD) attracts fresh buyers during the Asian session on Wednesday and climbs back above the $3,340 level in the last hour, closer to the weekly high touched the previous day. A federal appeals court ruled on Tuesday that US President Donald Trump’s sweeping tariffs can temporarily stay in effect, adding another twist to the trade saga. This, along with rising geopolitical tensions, is a key factor underpinning demand for the safe-haven commodity.

Apart from this, the growing acceptance that the Federal Reserve (Fed) would step in to support the economy and slash rates in September further benefits the non-yielding Gold price. Meanwhile, a positive outcome from the high-stakes US-China trade talks boosts investors’ confidence, as evident in the upbeat market mood. Moreover, a modest US Dollar (USD) uptick is holding back traders from placing aggressive bullish bets around the XAU/USD and capping the upside.

Daily Digest Market Movers: Gold price benefits from a favorable update on Trump’s tariffs

- US President Donald Trump received a favorable update on Tuesday as a federal appeals court ruled that his “Liberation Day” tariffs can temporarily stay in effect. Last month, the US Court of International Trade blocked the implementation of Trump’s tariffs, saying that the method used to enact them was unlawful.

- The latest development comes as the US and China, following two days of talks in London, agreed on a framework to implement the Geneva Consensus and ease trade tensions. US Commerce Secretary Howard Lutnick indicated the deal should resolve issues between the two countries surrounding rare earths and magnets.

- Russia continues with its strikes on Ukraine’s northeastern city of Kharkiv after rejecting an unconditional ceasefire earlier this month. Moreover, Israel continues to bombard the Gaza Strip relentlessly, keeping geopolitical risks in play and driving safe-haven flows toward the Gold price on Wednesday.

- The stronger-than-expected US Nonfarm Payrolls report released last Friday pointed to a still resilient labor market, forcing investors to scale back their bets for an imminent interest rate cut by the Federal Reserve. Markets, however, are still pricing in the possibility of two rate reductions by the end of this year.

- The US Dollar, however, remains confined to a familiar range, just above its lowest level since April 22, which it touched last week, as investors await more cues about the Fed’s rate-cut path. Hence, the focus remains glued to the release of the US Consumer Price Index (CPI) report later during the North American session.

- This will be followed by the US Producer Price Index (PPI) on Thursday, which will play a key role in influencing the near-term USD price dynamics and provide some meaningful impetus to the commodity. In the meantime, the supportive fundamental backdrop should act as a tailwind for the XAU/USD.

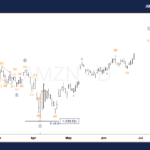

Gold price could accelerate the positive move once the $3,352-3,353 barrier is cleared decisively

From a technical perspective, the overnight bounce from the vicinity of the 200-period Simple Moving Average (SMA) on the 4-hour chart and the subsequent move up favor the XAU/USD bulls. Adding to this, oscillators on the said chart have again started gaining positive traction and back the case for further intraday move-up. A further strength beyond the $3,352-3,353 immediate hurdle will reaffirm the bullish outlook and lift the Gold price towards the $3,377-3,378 intermediate hurdle en route to the $3,400 round figure.

On the flip side, weakness back below the $3,323-3,322 area might continue to attract some buyers and find decent support near the $3,300 round figure. Some follow-through selling, leading to a subsequent fall below the $3,288-3,287 zone (200-period SMA on the 4-hour chart), might shift the bias in favor of bearish traders and drag the Gold price to the monthly swing low, around the $3,245 region. The XAU/USD could extend the corrective decline further and eventually drop to the $3,200 neighborhood.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.