Gold (XAU/USD) Weekly Forecast: Bullish

- Gold volatility subsides forward of majestic use US information

- Gold nudges upper regardless of inadequency of main bullish drivers

- Possibility occasions forward: US quarterly refunding announcement, FOMC, NFP

- Lift your buying and selling abilities and acquire a aggressive edge. Get your arms at the Gold Q2 outlook lately for unique insights into key marketplace catalysts that are meant to be on each and every dealer’s radar:

Beneficial by way of Richard Snow

Get Your Detached Gold Forecast

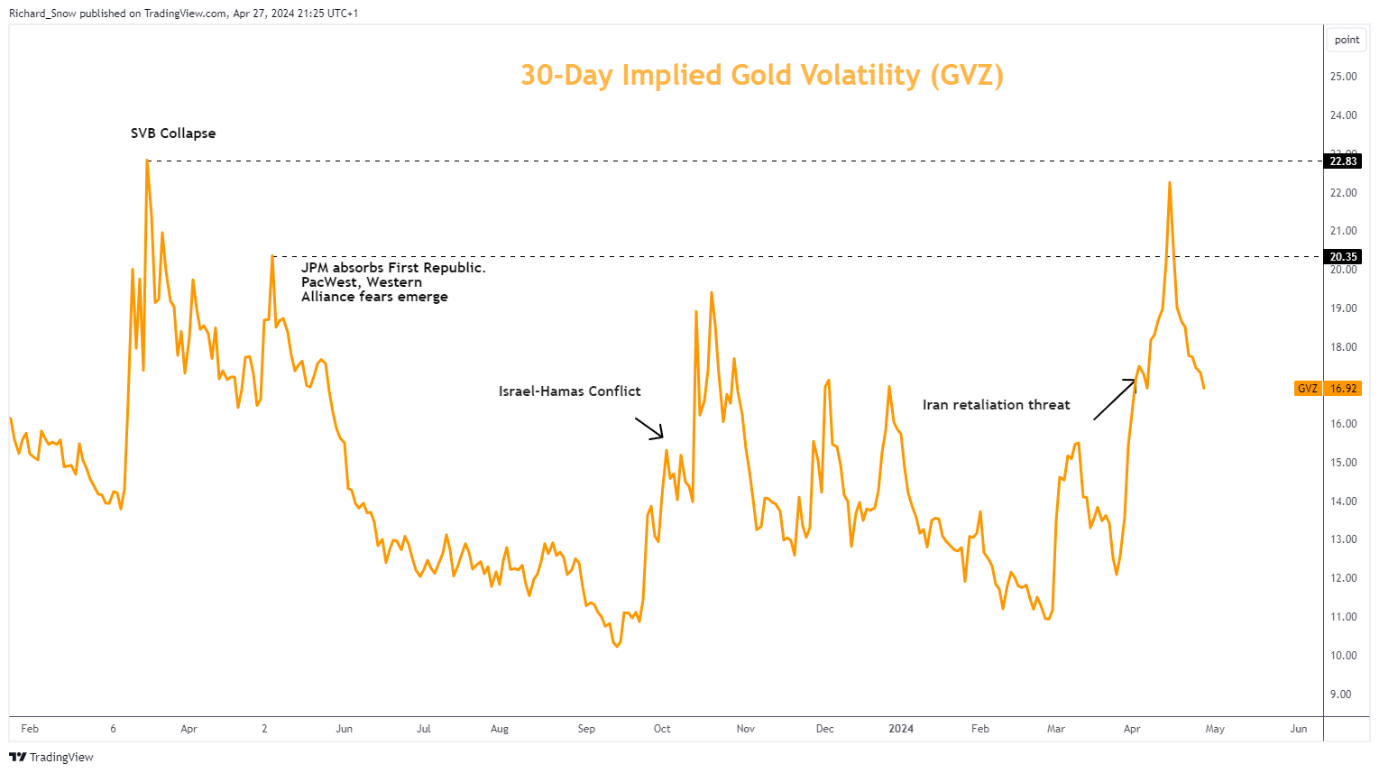

Gold Volatility Subsides Forward of Top Utility US Information

Gold volatility has subsided greatly now that the chance of a broader war between Israel and Iran had been a great deal lowered. Riskier property just like the S&P 500 and high-beta currencies just like the Aussie greenback and British pound controlled to claw again prior losses as possibility sentiment progressed. Consequently, gold’s former preserve haven bid has had the breeze taken out of its sails.

Within the coming life, the United States Treasury is ready to replace the population on main points of its investment wishes and can handover specifics round whether or not bond issuance is prone to favour shorter or longer length – which is prone to impact the shorter and longer dated turnovers and probably, gold.

Gold Volatility Index (GVZ)

Supply: TradingView, ready by way of Richard Snow

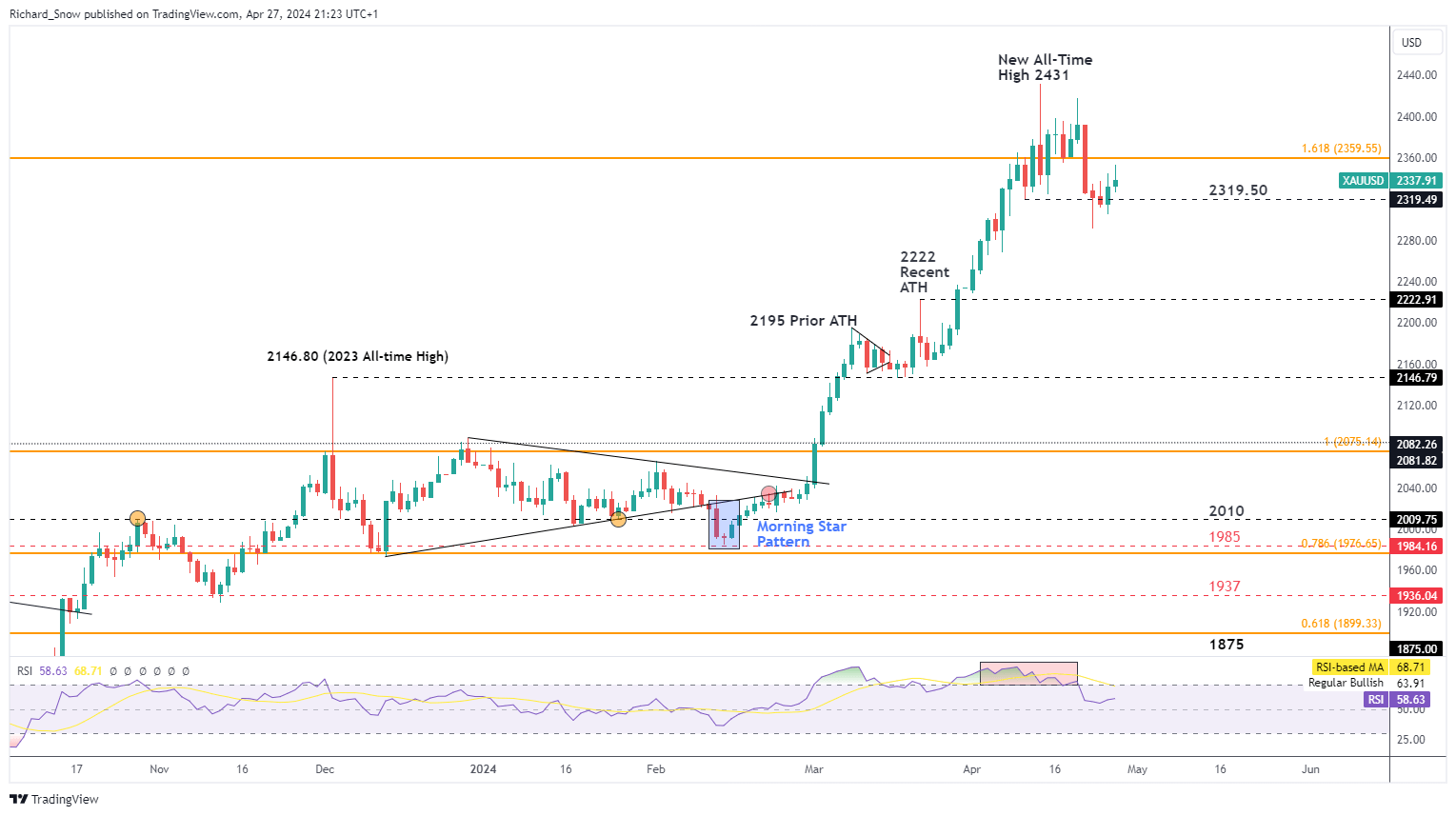

Gold Nudges Upper In spite of Dearth of Primary Bullish Drivers

The dear steel might quickly have to stand the truth of the Fed budget charge residue upper for longer nearest inflation information proved worrisome on Friday. A story of hotter-than-expected worth information culminated in Friday’s PCE print the place each headline and core inflation beat expectancies.

Expanding consideration has been put on shorter-term measures of worth traits just like the month-on-month comparisons, which has been emerging – which hasn’t long past left out on the Fed. Jerome Powell stated the non-essesntial uptick in inflation however reiterated that coverage is all set to react to any result and the Vice Chairman of the Fed, John Williams even made point out of any other hike is wanted.

The probability of upper inflation has pressured markets to go into reverse on determined charge cuts to start with eyed for 2024, extending the greenbacks longer-term power. A more potent greenback and emerging turnovers have had modest impact at the valuable steel when geopolitical confusion was once at its height, however with the hot de-escalation and within the a lack of any longer catalysts, gold bulls might quickly of momentum.

Gold bounced off of backup at $2320 – a previous swing low. If costs stay above this stage, the bullish continuation residue optimistic. Then again, within the a lack of a catalyst, the upside doable is also a great deal lowered.

Gold Day-to-day Chart

Supply: TradingView, ready by way of Richard Snow

Gold marketplace buying and selling comes to a radical figuring out of the basic components that resolve gold costs like call for and provide, in addition to the impact of geopolitical tensions and battle. Learn the way to business the preserve haven steel by way of studying our complete information:

Beneficial by way of Richard Snow

The right way to Business Gold

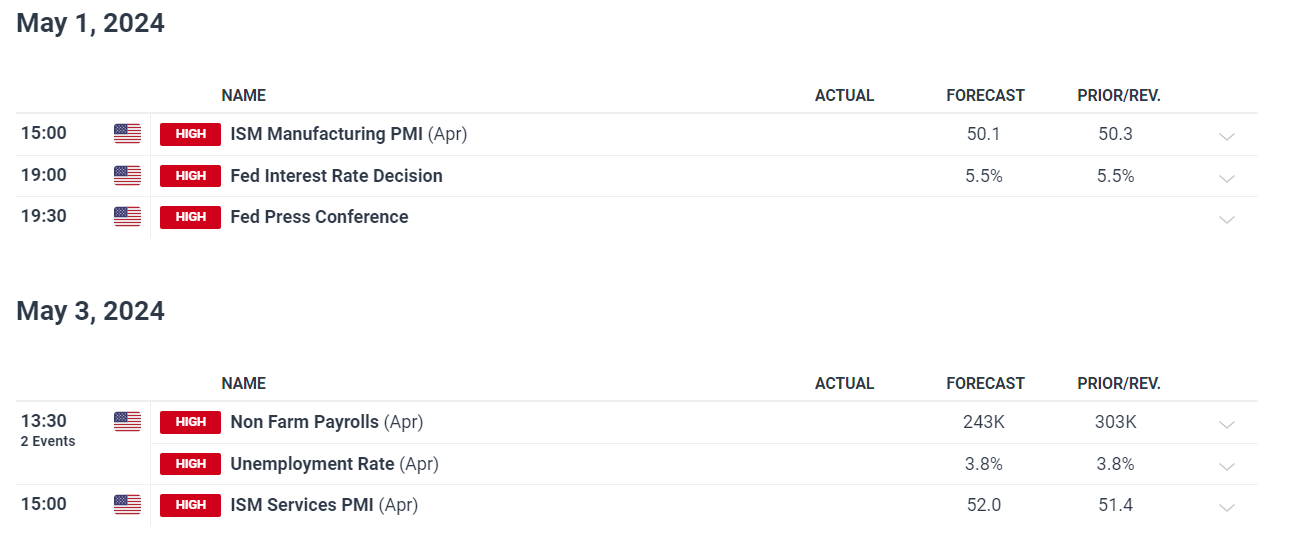

Primary Possibility Occasions within the Month Forward

Possibility occasions nearest life come with each scheduled and geopolitical occasions to concentrate on. At the geopolitical entrance, regardless of the Israel-Iran tensions subsiding, information of Russia placing energy amenities on Ukraine may just sluggish the chance on sentiment that transpired within the buying and selling life long past by way of.

Scheduled possibility occasions come with the FOMC assembly the place there is not any real looking expectation of a metamorphosis to rates of interest however markets will likely be considering how involved officers are in regards to the re-acceleration of inflation that has emerged for the reason that get started of the month.

Thereafter, non-farm payroll information is prone to inject extra volatility – even though that is short-lived – into greenback denominated markets like gold. The labour marketplace continues to turn resilience, additional delaying the primary charge scale down from the Fed. Any other level to notice is that US ISM production information will draw extra consideration than habitual nearest Q1 GDP dissatisfied vastly on Thursday, appearing early indicators of vulnerability for the sector’s greatest financial system.

Customise and filter out reside financial information by the use of our DailyFX financial calendar

— Written by way of Richard Snow for DailyFX.com

Touch and observe Richard on Twitter: @RichardSnowFX