Maximum Learn: SPY and QQQ Appear Overbought however RSP Seems Horny

Marketplace psychology could be a tough power, incessantly eminent the retail people to observe the herd. Then again, skilled buyers acknowledge the potential of successful alternatives by means of going towards the grain: doing the other of what maximum folk are these days doing. Contrarian signs, like IG consumer sentiment, do business in insights into the marketplace’s temper. Recognizing moments of ultimate bullishness or bearishness can sign possible turning issues.

It’s remarkable to understand that contrarian signs don’t seem to be infallible. For the best chance trades, it’s the most important to combine them right into a broader buying and selling technique. By means of combining those insights with cautious technical research and consciousness of underlying basics, buyers can discover confidential marketplace forces and form extra knowledgeable choices. Let’s delve deeper by means of the use of IG consumer sentiment to light up the possible trail for gold costs, AUD/USD, and NZD/USD.

Our second-quarter gold forecast is in a position for obtain. Request the independent buying and selling information now!

Really useful by means of Diego Colman

Get Your Sovereign Gold Forecast

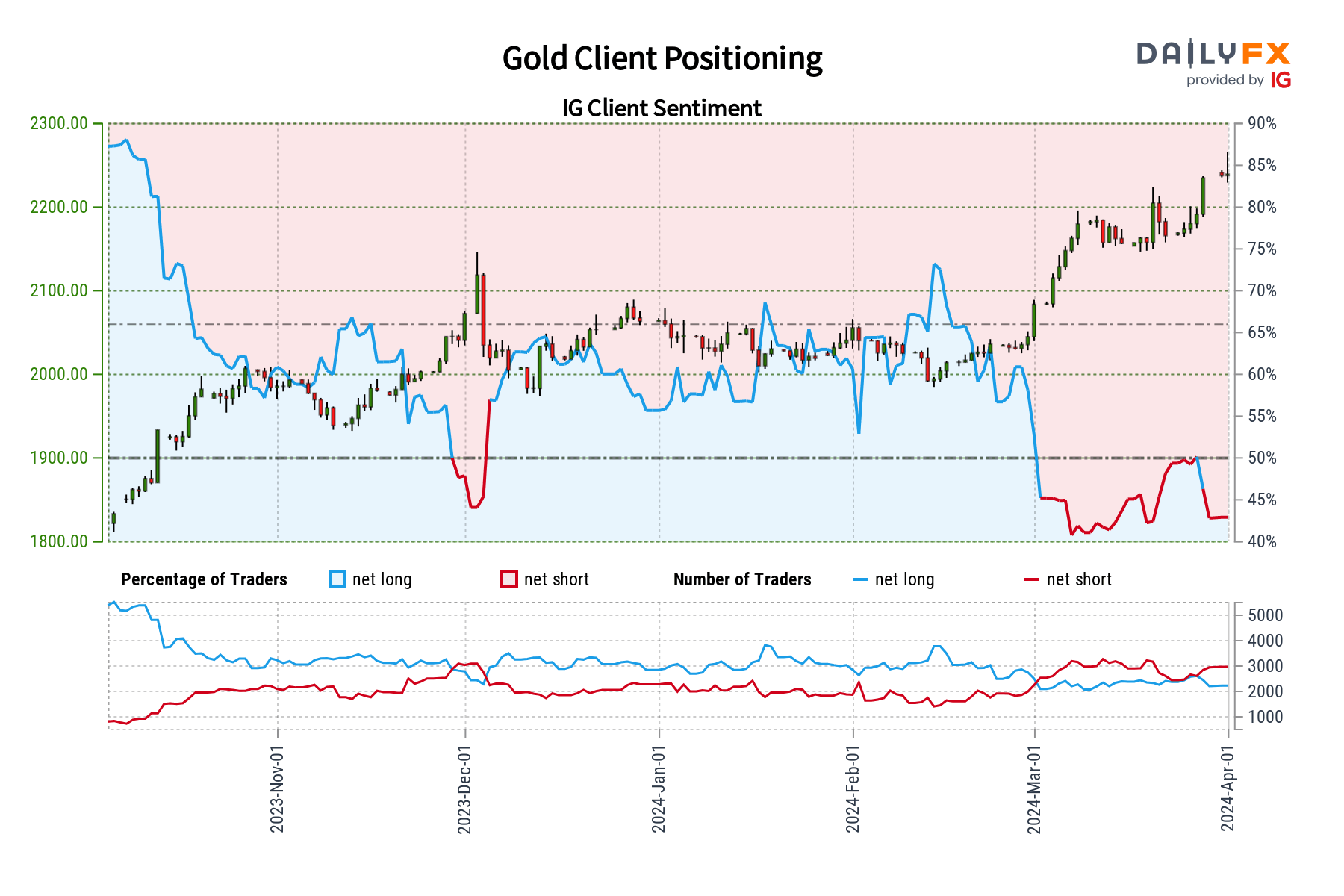

GOLD PRICE FORECAST – MARKET SENTIMENT

IG consumer information presentations the retail people is making a bet towards gold. Lately, 55.46% of buyers retain net-short positions, make happen a 1.25 to one short-to-long ratio. Date this bearish positioning has remained in large part unchanged since the previous day, it has higher by means of 6.15% from latter time. Conversely, net-long positions have ticked up 4.14% since the previous day, even with a week-over-week cut of 9.23%.

We incessantly undertake a contrarian view of marketplace sentiment. The predominantly bearish positioning may portend supplementary good points for the valuable steel, which means every other all-time top may well be within the playing cards sooner than sight any form of significant pullback.

Key Takeaway: When marketplace sentiment leans closely in a single course, contrarian cues can do business in significance insights. Then again, it’s the most important to combine those alerts with thorough technical and elementary research when formulating any buying and selling technique.

Obtain our sentiment information for significance insights into how positioning might affect NZD/USD’s trajectory!

| Alternate in | Longs | Shorts | OI |

| Day by day | 5% | 4% | 5% |

| Weekly | 2% | 12% | 4% |

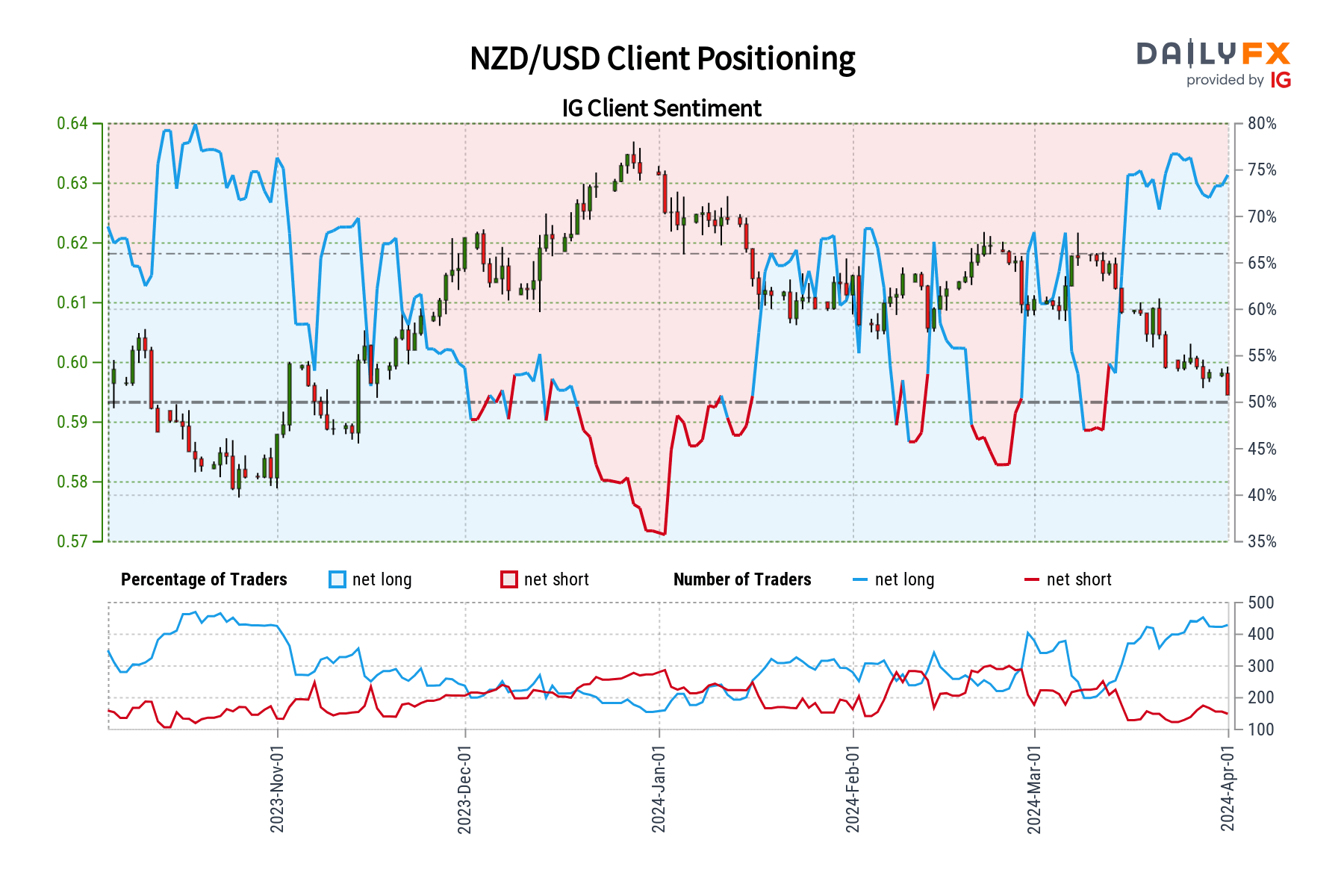

NZD/USD FORECAST – MARKET SENTIMENT

IG consumer information unearths a considerable 72.74% of buyers retain net-long positions on NZD/USD, make happen a long-to-short ratio of two.67 to one. The bullish conviction is at the stand, with net-long positions mountaineering 3.75% since the previous day and a pair of.78% in comparison to latter time. Then again, quick positions have additionally surged, expanding 10.67% from the previous day and a impressive 28.68% from latter time.

Our means incessantly diverges from widespread marketplace sentiment. The overpowering optimism shape NZD/USD may indicate that the new pullback has no longer totally performed out but, hinting at additional condition forward. This pessimistic stance is strengthened by means of the expanding incidence of lengthy positions a few of the retail people – a situation that’s reinforcing our bearish outlook at the pair.

Key Takeaway: When marketplace sentiment is terribly one-sided, contrarian cues do business in significance insights. Then again, a well-rounded buying and selling technique at all times integrates those alerts with thorough technical and elementary research.

Not sure concerning the Australian buck’s longer-term pattern? Acquire readability with our Q2 buying and selling information. Request the independent forecast now!

Really useful by means of Diego Colman

Get Your Sovereign AUD Forecast

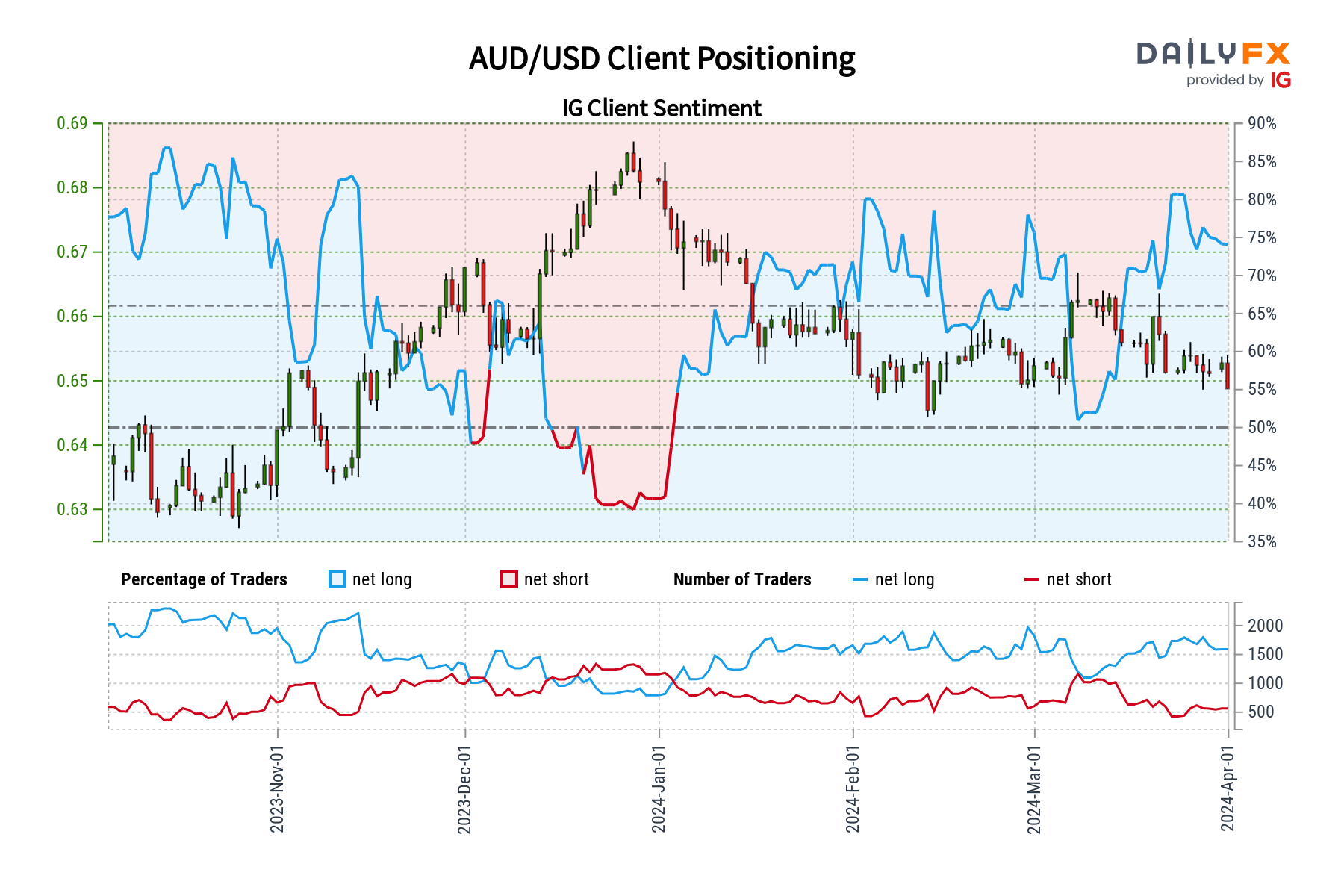

AUD/USD FORECAST – MARKET SENTIMENT

IG consumer information signifies a widespread optimism amongst buyers referring to AUD/USD’s possibilities, with 75.92% protecting bullish positions, make happen a long-to-short ratio of three.15 to one. Curiously, this bullish conviction has higher sharply with a 7.25% soar in net-long positions since the previous day, in spite of a minor 2.06% dip from latter time. In the meantime, net-short positions display a petite fade since the previous day (3.72%) and modest exchange week-over-week.

Our contrarian standpoint in opposition to marketplace sentiment means that the widespread bullishness might trace at additional declines for AUD/USD within the alike promise. That mentioned, with the immense majority of buyers expecting an upward motion, we can’t not include extra ache at the horizon for the Australian buck, heightening the possibility of a progress in opposition to pristine multi-month lows beneath 0.6440.

Key Takeaway: When marketplace sentiment leans closely in a single course, it’s use taking into account the other situation. Date contrarian alerts are significance, it’s at all times the most important to virtue them along in-depth technical and elementary research for a complete buying and selling means.