Eastern Yen (USD/JPY), BoJ Information and Research

- Eastern CPI eased in April as file salary rises fail to turn up generally costs

- The BoJ’s problem: Mountain climbing into sickness as inflation trail left-overs unsure

- USD/JPY edges upper over again however advances had been contained

- Be told the bits and bobs of buying and selling USD/JPY – a couple the most important to global industry and a prominent facilitator of the lift industry

Really useful by way of Richard Snow

Find out how to Industry USD/JPY

Eastern CPI Eased in April as Document Salary Will increase Fail to Display up in Costs

Headline inflation in Japan dropped to two.5% when in comparison to April endmost yr, i’m sick from 2.7% in March. Moreover, the core measure (aside from new meals) dropped from 2.6% to two.2% as anticipated. The studying that strips out unstable pieces like new meals and effort additionally famous a subside from 2.9% to two.4% as a inadequency of shopper process seems to be taking its toll at the “virtuous relationship” between wages and costs in Japan.

Customise and clear out are living financial knowledge by way of our DailyFX financial calendar

Forward of Japan’s first charge hike since 2007, the Vault of Japan (BoJ) communicated preconditions for a motion within the rate of interest which depended at the board achieving the essential self belief that inflation would stay above 2% in a strong and sustained method, regularly relating to a virtuous dating between wages and costs. The Vault additionally specified that call for pushed inflation must be seen rather of ‘cost push inflation’ which have been led to by way of provide disruptions chief to surging oil costs.

Since next, Eastern wages rose on the very best annual charge within the age 33 years according to upper costs however inflation has did not walk in a constant method. Rather, inflation knowledge has been inconsistent and the upper value of labour has no longer but handed thru to raised costs for shoppers which must stoke inflation upper over year.

The BoJ’s problem: Mountain climbing into Defect amid Unsure Inflation Trail

Eastern GDP shriveled 0.5% within the first quarter to apply up a flat studying in Q4 (0%) of endmost yr to narrowly steer clear of a technical recession. One main fear seen within the susceptible knowledge has been native shopper spending and normal intake.

Financial process is relied upon to stimulate expansion and pave the way in which against every other charge hike but when shoppers are chickening out it turns into very tough to tighten monetary statuses. Due to this fact, it can be a age longer prior to the BoJ reach the essential self belief to hike rates of interest once more with the marketplace pricing in a possible 10 foundation level hike in July with a complete of 25 foundation issues for the yr.

Within the period in-between, dealers of Eastern Executive bonds (JGBs) seem to be waning, permitting the 10-year turnover to breach 1% lately. The stand in giveover suggests an acceptance out there that charges and giveover are on an upward trajectory and that the BoJ might be able to release occasion bond purchases. Upper giveover have achieved minute to toughen the yen despite the fact that, as US giveover have additionally been at the up since a go back to the ‘higher for longer’ narrative from chief Fed officers in contemporary days along the hawkish FOMC mins.

Eastern Executive Bond Surrenders (10-Future)

Supply: TradingView, ready by way of Richard Snow

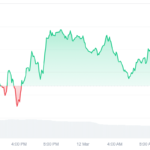

USD/JPY Edges Upper As soon as Extra however Strikes Stay Leisurely

Lower than one life upcoming it was once suspected that Eastern officers intervened within the FX marketplace, USD/JPY now trades nearer to the 160 marker that all set the method into motion. Then again, the grind upper has been sluggish, no longer showing the similar volatility that triggered officers into motion.

In a quieter future for lead tier US knowledge, it was once in large part anticipated that the greenback would gleam – accommodating a marketplace choice for upper surrender currencies right through occasions of decrease seen volatility.

The pair trades above 157.00 upcoming bouncing sharply upper off the 50-day easy transferring reasonable (SMA) again within the early levels of Would possibly, adopted by way of a stand above 155.00. The disorder is prone to persist so long as the rate of interest differential between the 2 countries left-overs vast. The lift industry left-overs robust.

USD/JPY Day by day Chart

Supply: TradingView, ready by way of Richard Snow

Are you untouched to FX buying and selling? The staff at DailyFX has curated a selection of guides to aid you recognize the important thing basics of the FX marketplace to boost up your finding out

Really useful by way of Richard Snow

Really useful by way of Richard Snow

Entire Amateur’s Buying and selling Guides

— Written by way of Richard Snow for DailyFX.com

Touch and apply Richard on Twitter: @RichardSnowFX