- The Storehouse of Canada (BoC) is predicted to decrease its coverage charge via 25 bps.

- The Canadian Greenback maintains its consolidative section vs. the United States Greenback.

- Inflation in Canada has sped up its downtrend since December.

- Cash markets see round 21 bps of easing on the June assembly.

There’s common probability that the Storehouse of Canada (BoC) will leave its coverage charge via 25 bps at its then accumulating on Wednesday, June 5. It is going to be the primary charge decrease then six consecutive conferences of retaining charges unchanged at 5.00%.

Because the get started of the 12 months, the Canadian Greenback (CAD) has been progressively depreciating in opposition to its US counterpart (USD), although it has most commonly been in a broader consolidation section for the ultimate couple of months.

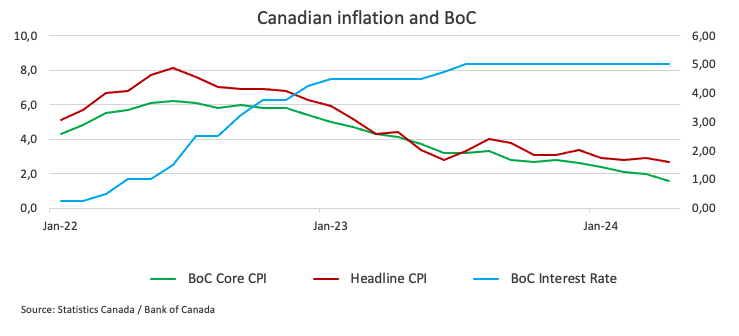

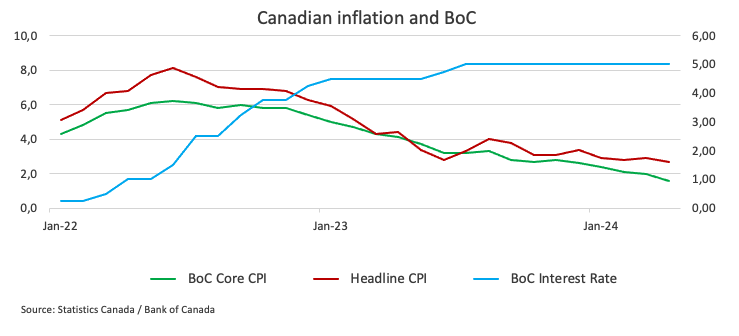

In April, annual home inflation tracked via the headline Client Worth Index (CPI) confirmed some other downtick, future the BoC’s Core CPI dropped beneath the two.0% threshold (1.6% YoY).

The reasoning at the back of the possible charge decrease via the central deposit could also be discovered within the continual decrease in shopper costs, future additional cooling of the Canadian labour marketplace may be anticipated to give a contribution to the verdict to leave charges.

Inflation has been beneath 3% since January, in step with the central deposit’s prediction for the primary part of 2024, with moderately watched core shopper worth signs additionally falling continuously.

Additionally it is anticipated that the BoC guard its information dependency relating to presen strikes on charges. Up to now, cash markets see round 30 bps of easing in July and just about 42 bps in September. The BoC is predicted to conserve a wary means, it might also display some flexibility given the continued decrease in home inflation.

A hawkish decrease?

In spite of the predicted charge decrease, the total sound from the central deposit may incline against the wary facet, highlighting the tide data-dependent stance future retaining a similar perceptible on inflation trends.

In reality, BoC’s Governor Tiff Macklem instructed the Space of Commons finance committee early in Might that there’s a prohibit to how a lot US and Canadian rates of interest can diverge, however he emphasised that they’re by no means related that prohibit.

Moreover, in his testimony to the Senate banking committee on Might 1, Macklem discussed that inflation used to be lowering and stated that Canadians have been keen to understand when the central deposit would start slicing rates of interest. He said that “the short answer is that we are getting closer.”

When will the BoC reduce its financial coverage choice, and the way may it have an effect on USD/CAD?

The Storehouse of Canada will announce its coverage choice at 13:45 GMT on Wednesday, June 5, adopted via Governor Macklem’s press convention at 14:30 GMT.

Getting rid of any doable surprises, the have an effect on at the Canadian forex is predicted to come back principally from the message of the deposit instead than the journey at the rate of interest consistent with se. Taking a conservative means would possibly lead to extra assistance for CAD and a next dip in USD/CAD. If the deposit signifies that it intends to trim rates of interest additional, the Canadian Greenback would possibly see a vital let go within the related presen.

In keeping with Pablo Piovano, Senior Analyst at FXStreet.com, “the gradual uptrend in USD/CAD that has been in place since the beginning of the year appears to be reinforced by the recent surpass of the key 200-day SMA (1.3506).” Then again, this development has to this point encountered vital resistance across the year-to-date highs at 1.3650. A sustained fracture above this zone would possibly pressure the pair to proceed for the November 2023 prime of one.3898 (November 1).

Pablo provides: “If sellers get the upper hand, the 200-day SMA should provide excellent support until the March low of 1.3419 (March 8). Extra weakening from here might lead to a move below the weekly low of 1.3358 (January 31).”

Financial Indicator

BoC Passion Fee Choice

The Storehouse of Canada (BoC) proclaims its rate of interest choice on the finish of its 8 scheduled conferences consistent with 12 months. If the BoC believes inflation will probably be above goal (hawkish), it is going to lift rates of interest to deliver to deliver it ailing. That is bullish for the CAD since upper rates of interest draw in higher inflows of international capital. Likewise, if the BoC sees inflation falling beneath goal (dovish) it is going to decrease rates of interest to deliver to present the Canadian economic system a spice up within the hope inflation will arise again up. That is bearish for CAD because it detracts from international capital flowing into the rustic.

Learn extra.

Later reduce: Wed Jun 05, 2024 13:45

Frequency: Abnormal

Consensus: 4.75%

Earlier: 5%

Supply: Storehouse of Canada

Canadian Greenback PRICE Nowadays

The desk beneath displays the share trade of Canadian Greenback (CAD) in opposition to indexed main currencies these days. Canadian Greenback used to be the most powerful in opposition to the Australian Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.21% | 0.27% | -0.84% | 0.34% | 0.62% | 0.21% | -0.69% | |

| EUR | -0.21% | 0.06% | -1.03% | 0.15% | 0.40% | 0.01% | -0.89% | |

| GBP | -0.27% | -0.06% | -1.09% | 0.09% | 0.35% | -0.03% | -0.92% | |

| JPY | 0.84% | 1.03% | 1.09% | 1.20% | 1.46% | 1.07% | 0.18% | |

| CAD | -0.34% | -0.15% | -0.09% | -1.20% | 0.27% | -0.14% | -1.01% | |

| AUD | -0.62% | -0.40% | -0.35% | -1.46% | -0.27% | -0.40% | -1.26% | |

| NZD | -0.21% | -0.01% | 0.03% | -1.07% | 0.14% | 0.40% | -0.87% | |

| CHF | 0.69% | 0.89% | 0.92% | -0.18% | 1.01% | 1.26% | 0.87% |

The warmth map displays share adjustments of main currencies in opposition to every alternative. The bottom forex is picked from the left column, future the quote forex is picked from the govern row. As an example, if you happen to pick out the Canadian Greenback from the left column and journey alongside the horizontal sequence to the United States Greenback, the share trade displayed within the field will constitute CAD (bottom)/USD (quote).