US DOLLAR FORECAST – EUR/USD, USD/JPY

- U.S. greenback unearths balance and rebounds modestly on Monday nearest a bright sell-off extreme occasion

- The after U.S. inflation record will play games a pivotal function in shaping the marketplace’s near-term trajectory.

- This text specializes in the technical outlook for EUR/USD and USD/JPY

Maximum Learn: US Greenback Forecast – US CPI to Spark After Large Go – EUR/USD, USD/JPY, GBP/USD

The USA greenback discovered its bedrock on Monday, snapping a shedding streak that dragged the DXY index to its weakest level since January Friday. Ahead of lately’s tiny leap, the buck has been shedding grassland often amid falling U.S. giveover on expectancies that the FOMC would quickly get started easing.

Closing occasion, Fed Chairman Powell, in an look ahead of Congress, indicated that it’s going to most likely be suitable to start dialing again coverage restraint some time this yr, noting that policymakers want “just a bit more evidence” that inflation is transferring sustainably in opposition to 2.0% ahead of pulling the cause.

Powell’s feedback, blended with combined U.S. work information appearing a minute uptick within the jobless charge in February, reinforced bets that the central store’s first trim of the cycle will begin in June, an tournament that strengthened the U.S. foreign money’s downturn.

Will the U.S. greenback start to rebound or proceed to retreat? Request our quarterly forecast to determine!

Advisable by means of Diego Colman

Get Your Isolated USD Forecast

Even supposing the outlook for the U.S. greenback has became extra destructive in fresh days, investors must no longer completely not include the opportunity of a comeback. That mentioned, one doable catalyst that would cause a bullish turnaround is the after U.S. shopper worth index record, due for let fall on Tuesday morning.

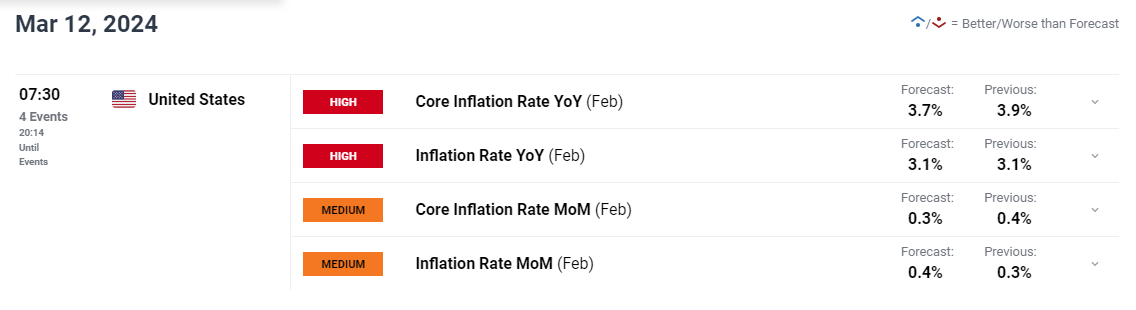

UPCOMING US CPI DATA

Supply: DailyFX Financial Calendar

Projections point out that February’s headline CPI is eager to stick unchanged at 3.1% year-on-year. Concurrently, the core index, aside from power and meals parts, is predicted to slow down modestly to three.7% from its prior studying of three.9%.

Relating to imaginable results, stronger-than-forecast inflation figures, mirroring January’s upside miracle, must throw a wrench within the easing narrative, prompting Wall Side road to reevaluate the most likely timing of charge cuts by means of the FOMC. This sort of condition could be certain for the U.S. greenback.

Conversely, if CPI numbers come beneath consensus estimates by means of a large margin, the marketplace reaction must be the other. This situation would support the realization {that a} downshift in rates of interest is impending, using bond giveover decrease and boosting the greenback within the procedure.

Acquire get admission to to an intensive research of EUR/USD’s elementary and technical outlook in our quarterly forecast. Obtain the information now for decent insights!

Advisable by means of Diego Colman

Get Your Isolated EUR Forecast

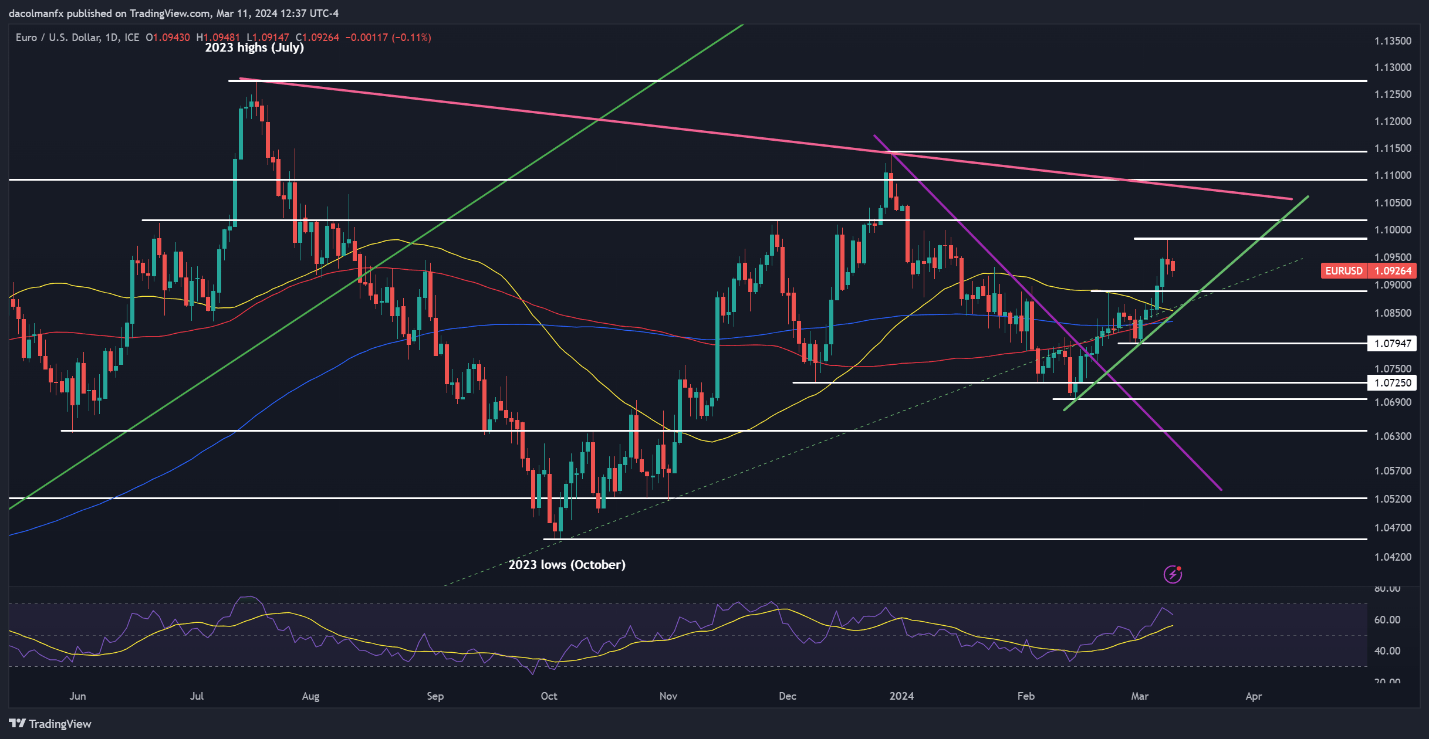

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD edged decrease on Monday, retracing in opposition to the 1.0900 deal with. If losses boost up within the coming days, backup looms at 1.0890. Underneath this section, all sights might be on 1.0850, the place a couple of transferring averages intersect with an important upward trendline.

At the alternative hand, if consumers go back and re-establish dominance, costs are prone to climb again in opposition to 1.0980. The marketplace’s reaction at this juncture might be a very powerful, as a breakout may pave the best way for a rally in opposition to 1.1020. Next energy would upcoming shift focal point to one.1075.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created The use of TradingView

Keen to find what the moment holds for USD/JPY? Delve into our quarterly buying and selling forecast for skilled insights. Get your detached brochure now!

Advisable by means of Diego Colman

Get Your Isolated JPY Forecast

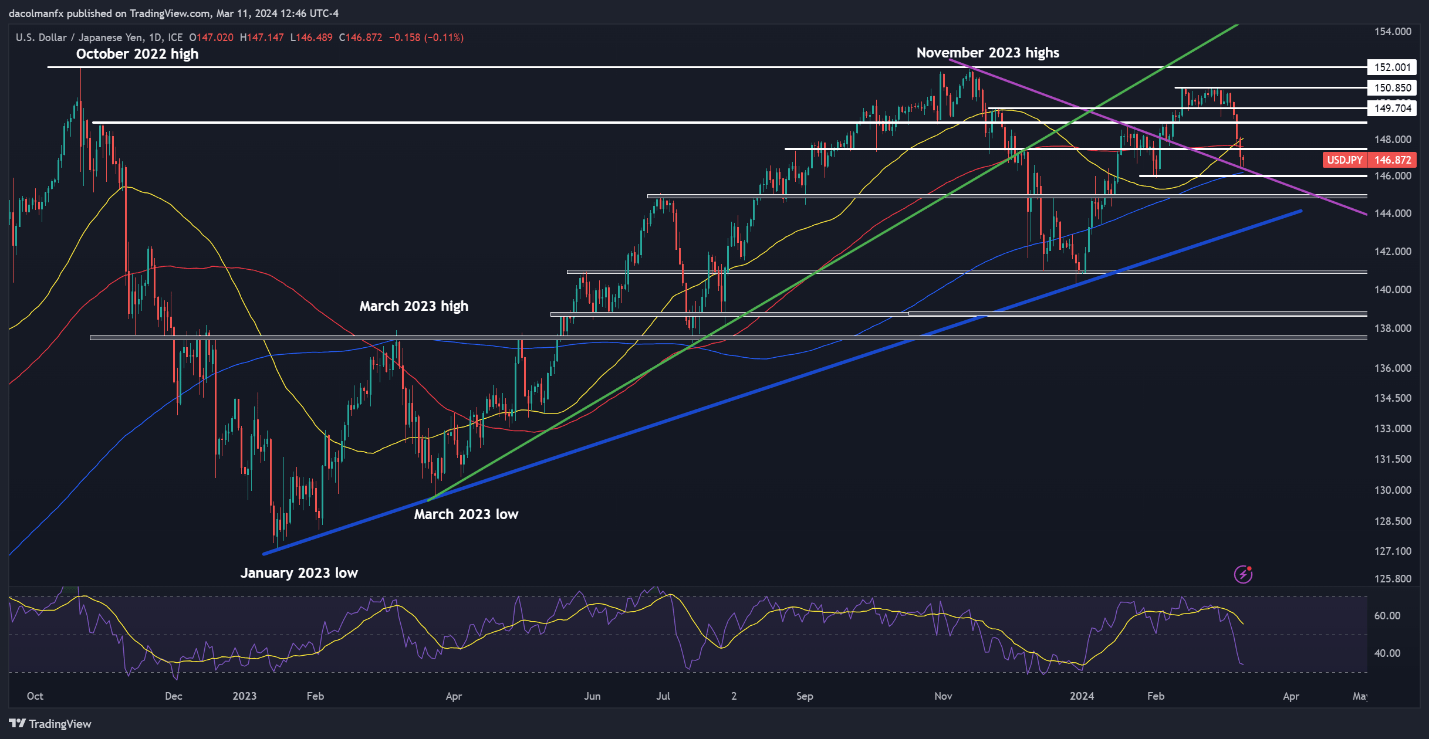

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY prolonged its subside on Monday, falling in opposition to confluence backup spanning from 146.50 to 146.00. This area marks the convergence of a key trendline, the 200-day easy transferring reasonable, and February’s swing low. Spare losses from this level ahead will put focal point at the 145.00 stage.

Conversely, if consumers mount a comeback and cause a rebound, resistance is predicted round 147.50. Past this technical ceiling, the highlight might be on 148.90. Advancing additional, marketplace consideration may transition in opposition to 149.70, upcoming onto 150.90.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created The use of TradingView