UPCOMING

EVENTS:

- Monday: Eurozone Retail Gross sales. (China on ease)

- Tuesday: Japan Moderate Money Income, RBA Assembly Mins,

US NFIB Mini Trade Optimism Index. - Wednesday: RBNZ Coverage Resolution, FOMC Assembly Mins.

- Thursday: Japan PPI, ECB Assembly Mins, US CPI, US

Jobless Claims, Fresh Zealand Production PMI. - Friday: UK GDP, Canada Labour Marketplace record, US PPI, US

College of Michigan Shopper Sentiment, BoC Trade Outlook Survey.

Tuesday

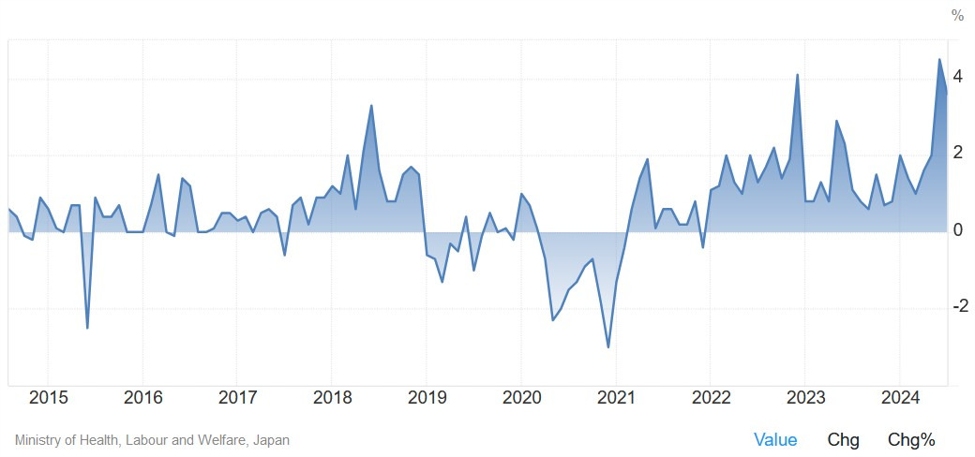

The Jap

Moderate Money Income Y/Y is anticipated at 3.1% vs. 3.6% prior. Salary expansion has

grew to become certain in recent times in Japan and that’s one thing the BoJ at all times sought after to

see to fulfill their inflation goal sustainably. The information shouldn’t trade a lot for the

central store for now as they wish to wait some extra to evaluate the trends

in costs and monetary markets following the August rout.

Japan Moderate Money Income YoY

Wednesday

The RBNZ is

anticipated to short the OCR via 50 bps and produce it to 4.75%. The cause of such

expectancies come from the unemployment charge being on the best stage in 3

years, the core inflation charge being within the goal dimension and top frequency

information proceeding to turn problem. Additionally, Governor Orr within the closing press

convention stated that they regarded as a dimension of strikes within the closing coverage

determination and that integrated a 50 bps short.

RBNZ

Thursday

America CPI Y/Y is

anticipated at 2.3% vs. 2.5% prior, month the M/M determine is observable at 0.1% vs. 0.2%

prior. The Core CPI Y/Y is anticipated at 3.2% vs. 3.2% prior, month the M/M

studying is observable at 0.2% vs. 0.3% prior.

The closing US labour

marketplace record got here out a lot better than anticipated and the marketplace’s pricing for a

50 bps short in November evaporated temporarily. The marketplace is now in any case in form

with the Fed’s projection of fifty bps of easing via year-end.

Fed’s Waller

discussed that they might move quicker on charge cuts if the labour marketplace information

worsened, or if the inflation information persevered to return in softer than everyone

anticipated. He additionally added {that a} untouched pickup in inflation may additionally motive the

Fed to laze its chopping.

Given the new

NFP record, although the CPI misses fairly, I don’t assume they’d imagine

a 50 bps short in November anyway. That may be a debate for the December

assembly if inflation information continues to return under expectancies.

US Core CPI YoY

America Jobless

Claims remains to be one of the notable releases to apply each era

because it’s a timelier indicator at the surrounding of the labour marketplace.

Preliminary Claims

stay within the 200K-260K dimension created since 2022, month Proceeding Claims

next emerging sustainably all through the summer season progressed significantly within the closing

weeks.

This era Preliminary

Claims are anticipated at 230K vs. 225K prior, month there’s deny consensus for

Proceeding Claims on the date of writing even supposing the prior leave confirmed a

reduce to 1826K.

US Jobless Claims

Friday

The Canadian

Labour Marketplace record is anticipated to turn 28K jobs added in September vs. 22.1K

in August and the Unemployment Fee to extend to six.7% vs. 6.6% prior. The

marketplace is pricing an 83% prospect for a 25 bps short on the after assembly

however since inflation continues to miracle to the disadvantage, a susceptible record will

most likely carry the probabilities for a 50 bps short.

Canada Unemployment Fee

America PPI Y/Y is

anticipated at 1.6% vs. 1.7% prior, month the M/M figures is observable at 0.1% vs. 0.2%

prior. The Core PPI Y/Y is anticipated at 2.7% vs. 2.4% prior, month the M/M

studying is observable at 0.2% vs. 0.3% prior.

Once more, the knowledge is

not likely to get the Fed to discuss a 50 bps short on the November assembly although

it misses. The chance now could be for inflation to get caught at a better stage and even miracle to the upside.

US Core PPI YoY