Crypto trade Kraken has intensified its struggle in opposition to america Securities and Change Fee (SEC) via officially filing a answer in assistance of its movement to brush aside the company’s lawsuit. The submitting, dated Might 9, 2024, demanding situations the SEC’s declare that Kraken operated as an unregistered trade coping with securities, particularly “investment contracts.”

Led via Matthew C. Solomon from Cleary Gottlieb Steen & Hamilton LLP, Kraken’s criminal staff disputes the SEC’s allegations, announcing that incorrect particular funding pledges traded, brokered, or settled on Kraken’s platform were recognized. They argue that crypto property rejected, which might be the one merchandise speculated to were treated via Kraken, don’t meet the definition of funding pledges below federal securities regulations.

Kraken Fights For The Whole Crypto Trade

The submitting emphasizes a important flaw within the SEC’s method, accusing the regulatory frame of conflating number one choices carried out out of doors of Kraken with secondary crypto marketplace transactions at the platform. Kraken’s legal professionals contend that the SEC’s method ignores the distinct criminal remedy required for number one and secondary marketplace transactions below the Securities Function of 1933 and the Securities Change Function of 1934.

Kraken’s submission states, “The transactions alleged to have occurred on Kraken are blind bid/ask secondary market sales of digital assets… unaccompanied by any contractual terms or other obligations that may have existed at the initial offering.” This, they argue, may improperly lengthen the SEC’s regulatory succeed in to just about any virtual asset or commodity via announcing an related “investment concept” or “ecosystem.”

Additional difficult the SEC’s jurisdiction, Kraken’s attorneys invoke the key questions doctrine, arguing that the expansive interpretation of regulatory authority over crypto property must be explicitly licensed via Congress, now not aspiring thru litigation. They conserve that the Howey Check’s standards — an ordinary impaired to outline what constitutes an funding word of honour — aren’t met, as there was once incorrect funding of cash in a ordinary undertaking with a cheap expectation of income predominantly from the efforts of others.

The SEC first of all sued Kraken in November, later up to now settling fees over Kraken’s staking products and services. In its opposition filed latter day, the SEC defended its movements, mentioning, “it is simply not the case that this enforcement action exceeds the authority Congress granted the SEC.” The SEC argued that its enforcement aligns with the Howey check and its Congressional mandate, pushing aside claims of overreach.

Indistinguishable Studying: Taiwan Units Points of interest On Crypto Companies With Tricky Brandnew Prison Moment Regulations

The court docket is scheduled to listen to arguments at the movement on June 12, 2024. If Kraken’s movement to brush aside is granted via Pass judgement on William H. Orrick, it would all set a vital criminal precedent for all the crypto business, probably proscribing the SEC’s talent to keep an eye on secondary marketplace transactions of crypto property below the flow legislative framework.

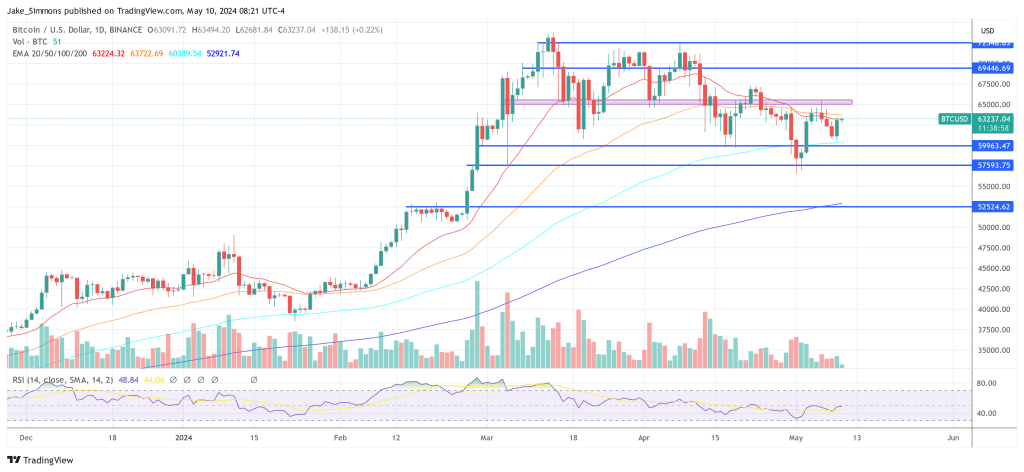

At press date, Bitcoin traded at $63,237.

Featured symbol from Koszary Tradingu, chart from TradingView.com