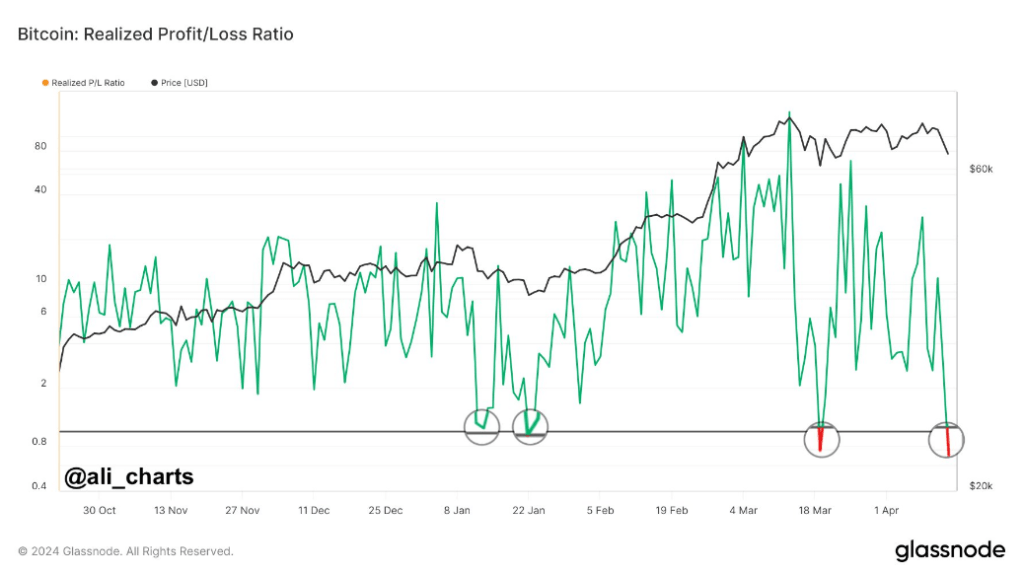

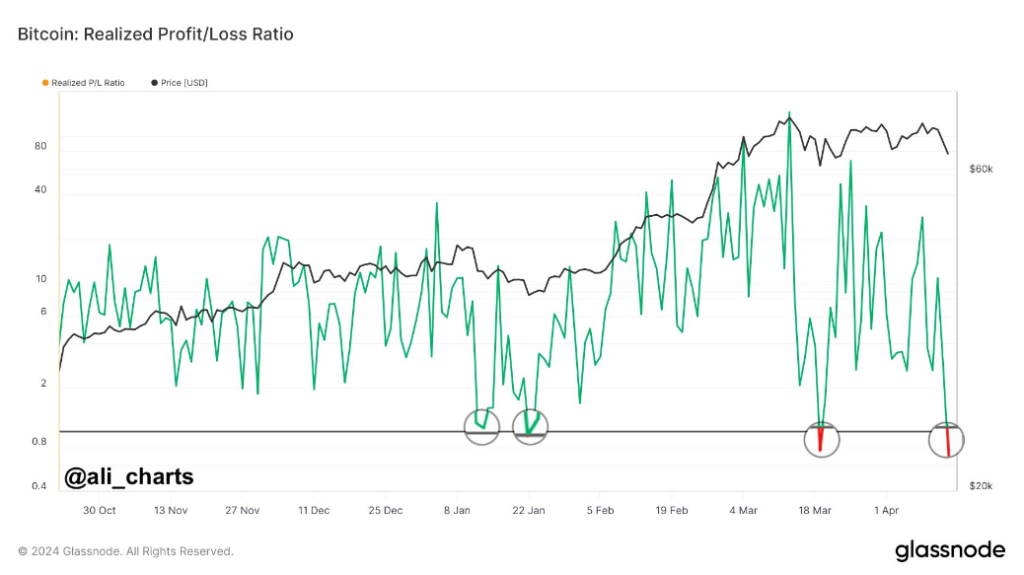

Buyers are bracing themselves for a rollercoaster trip as Bitcoin, the flagship virtual asset, navigates thru uneven waters. Contemporary information from Glassnode has detectable a worthy building: the Discovered Benefit/Loss Ratio for Bitcoin has dipped beneath one.

This an important metric, which compares the promote worth of Bitcoin with the associated fee at which it used to be purchased, signifies that traders are recently understanding extra losses than income. Traditionally, this sort of dip has steadily heralded a possible bottoming out of Bitcoin’s worth, serving as an important sign for marketplace watchers.

Sense Of Optimism In spite of Bitcoin Worth Lessen

The generation 24 hours have witnessed important volatility in Bitcoin’s worth trajectory. A smart diminish early within the life noticed Bitcoin’s worth plummet to roughly $64,000, being worried many traders.

Then again, a important healing ensued, with the associated fee incessantly hiking and peaking at round $66,000. This powerful rebound has instilled a way of optimism, with a common bullish sentiment taking secure because the life advanced.

Overall crypto marketplace cap recently at $2.261 trillion. Chart: TradingView

Institutional pastime in Bitcoin continues to develop, with fresh tendencies signaling doable shifts in capital inflows. The esteem of a place Bitcoin ETF by way of Hong Kong regulators has opened the floodgates for larger institutional engagement, specifically from Asia.

This travel may just inject unused capital into Bitcoin markets, doubtlessly fueling additional worth momentum. Moreover, regional dynamics play games an important function in shaping investor sentiment and behaviour. Various funding developments throughout other areas spotlight the numerous responses to common marketplace statuses.

Era some areas might showcase wary sentiment amidst volatility and geopolitical uncertainties, others might include Bitcoin as a hedge towards inflation and foreign money devaluation.

Essential Backup Ranges

Bitcoin analyst Willy Woo has pinpointed a crucial help degree at $59,000. Breaching this threshold may just represent a transition right into a bearish marketplace sentiment. Conversely, there’s prospect amongst traders for doable cut liquidations that would pressure the associated fee upwards, doubtlessly attaining between $70,000 and $75,000, only if stream help ranges secure secure.

Those expected occasions hinge on marketplace liquidity and investor reactions to the impulsively evolving worth actions. As Bitcoin continues its consolidation segment similar all-time highs, traders stay cautiously positive about its week possibilities.

The then halving tournament provides every other layer of complexity to the already intricate marketplace dynamics, with expectancies of heightened volatility within the days forward.

Analysts recommend that this era of lateral motion serves as a an important level for the redistribution of belongings amongst traders, doubtlessly laying the groundwork for a extra sustainable healing in the end.

The cryptocurrency marketplace, specifically Bitcoin, is navigating thru a duration of heightened doubt and volatility. The hot dip within the Discovered Benefit/Loss Ratio indicators a possible turning level in Bitcoin’s worth trajectory, era institutional pastime and regional dynamics proceed to condition marketplace sentiment.

Featured symbol from Pexels, chart from TradingView