Bitcoin (BTC) will “most likely” see a significant value drawdown earlier than a key month for institutional buyers dawns, says gold worm Peter Schiff.

In contemporary X job, the longtime Bitcoin skeptic sounded the alarm over contemporary BTC value good points.

Schiff bets on a BTC value “crash” earlier than ETF launches

Bitcoin is a favoirte matter of grievance for Peter Schiff, the prominent economist and world strategist at asset control company Europac.

During the years, he has time and again insisted that not like gold, Bitcoin’s price is destined to go back to 0, and that no person if truth be told needs to conserve it with the exception of to bring to promote upper after on.

Now, with BTC/USD circling 18-month highs, he has grew to become his consideration to what others say might be a watershed hour for cryptocurrency — the foundation of america’ first Bitcoin spot value exchange-traded treasure (ETF).

An goodwill is regarded as due in early 2024, week rumors {that a} inexperienced sunny may just are available November are idea to have fueled closing era’s ascent era $37,000.

Presen some imagine that the announcement might be a “sell the news” tournament, the place buyers release publicity as soon as sure bet over the ETF hits, for Schiff, a BTC value comedown won’t even look ahead to that.

In an X survey on Nov. 9, he introduced two eventualities for a Bitcoin “crash” — earlier than and nearest the ETF foundation. However, respondents may just make a choice “Buy and HODL till the moon,” which in the long run was essentially the most customery selection with 68% of the just about 25,000 votes.

Regardless of this, then again, Schiff stood his grassland.

“Based on the results my guess is that Bitcoin crashes before the ETF launch,” he spoke back.

“That why the people who bought the rumor won’t actually profit if they wait for the fact to sell.”

When will #Bitcoin strike?

— Peter Schiff (@PeterSchiff) November 9, 2023

AllianceBernstein: Bitcoin ETF “getting slowly priced in”

As Cointelegraph reported, the temper a few of the institutional sphere is lightening because the ETF debate appears more and more eager to finish in Bitcoin’s partial.

Matching: Bitcoin ‘Terminal Price’ hints later BTC all-time prime is a minimum of $110K

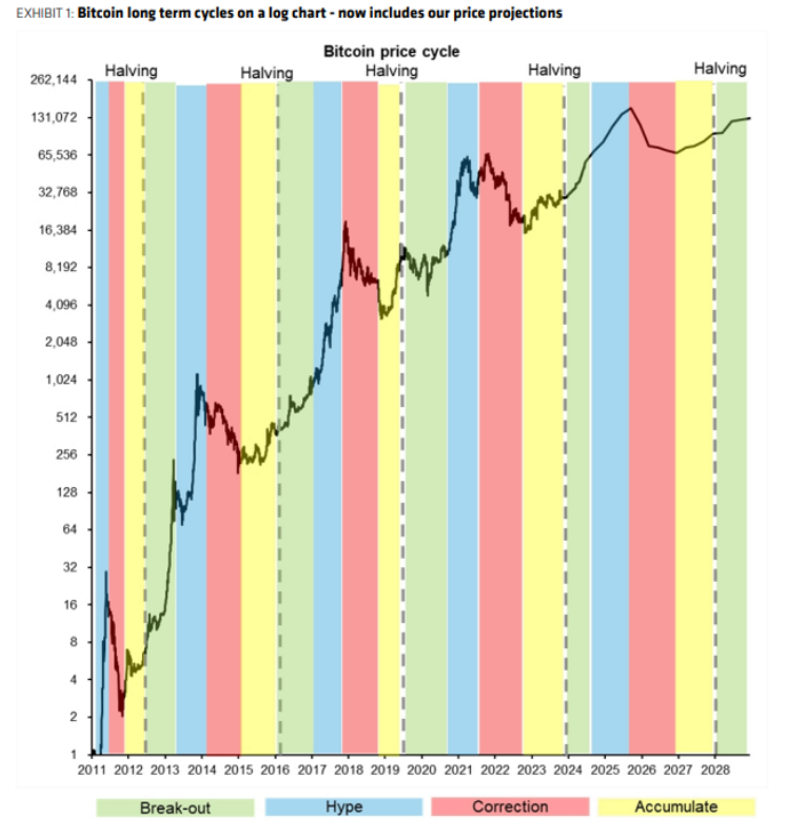

A few of the untouched positive BTC value forecasts is that of AllianceBernstein, which closing era predicted a top of $150,000 later cycle.

“We believe early flows could be slower and the build up could be more gradual, and post-halving is when ETF flows momentum could build, leading to a cycle peak in 2025 and not 2024,” analysts wrote in a word quoted by means of MarketWatch and others.

“The current BTC break-out is just simply ETF approval news getting slowly priced in and then the market monitors the initial outflows and likely gets disappointed in the short run.”

An accompanying chart confirmed BTC value era and generation habits delineated by means of halving cycles.

This text does now not comprise funding recommendation or suggestions. Each funding and buying and selling progress comes to possibility, and readers will have to habits their very own analysis when you make a decision.