Ethereum (ETH) has develop into a beacon within the sea of blockchains, boasting a staggering 92% surge in dApp (decentralized utility) quantity over the hour day. This information, alternatively, comes with a layer of complexity, revealing a soil of each alternative and attainable setbacks for the well-known blockchain.

Alike Studying

Affordable Gasoline Fuels The Hearth

Analysts detail the dApp quantity explosion to the Dencun improve in March, which considerably lowered gasoline charges – the price related to processing transactions at the Ethereum community.

Decrease charges have traditionally enticed customers, and this contemporary building appears to be incorrect other. The surge in task suggests a revitalized Ethereum, doubtlessly attracting fresh initiatives and fostering a extra colourful dApp ecosystem.

NFT Mania Drives The Numbers

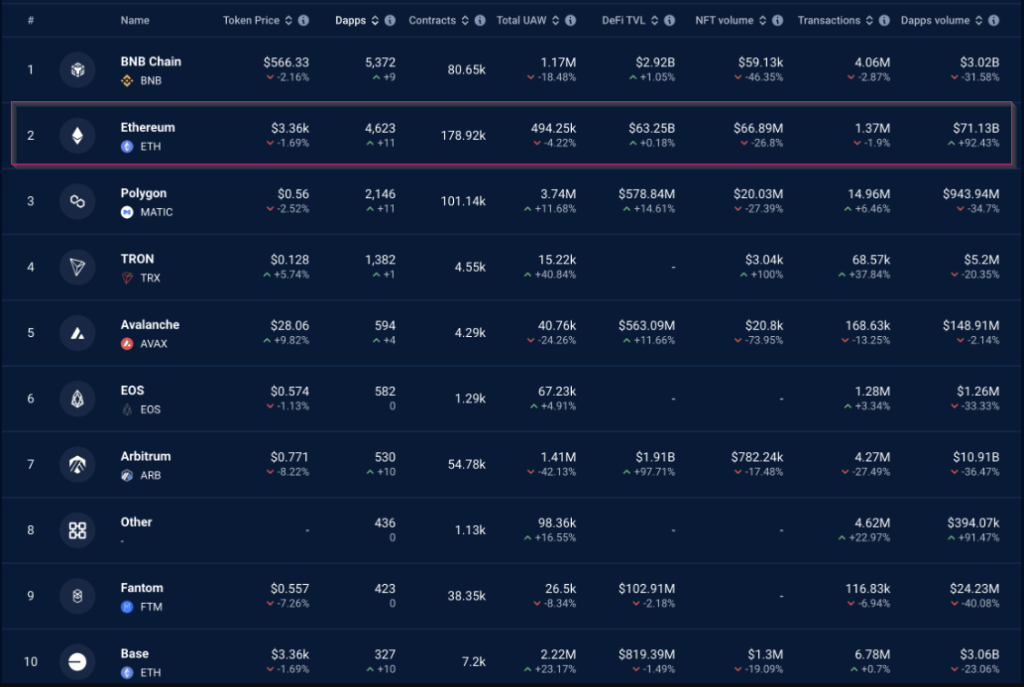

Moment the whole dApp quantity (see chart underneath) paints a rosy image, a better glance unearths a extra nuanced tale. The surge seems to be pushed basically via a surge in NFT (Non-Fungible Token) buying and selling and staking task.

Packages like Blur and Uniswap’s NFT aggregator noticed vital hikes, highlighting the booming NFT marketplace on Ethereum. This development signifies a thriving area of interest throughout the Ethereum dApp soil, however raises questions in regards to the platform’s diversification past NFTs.

A Glance At Consumer Engagement

A curious line emerges when inspecting person engagement metrics. In spite of the noteceable quantity building up, the choice of distinctive lively wallets (UAW) at the Ethereum community has in truth lowered.

This disconnect means that the tide task may well be pushed via a smaller, extra lively person bottom. Moment top quantity is undoubtedly a favorable indicator, it’s the most important to peer broader person participation to assure the sustainability of the dApp ecosystem.

A Shine Of Hope?

One sure long-term indicator for Ethereum is the rage of lowering change holdings, as reported via Glassnode. This means ETH holders are shifting their property off exchanges, doubtlessly lowering promote drive and contributing to worth steadiness.

If this development continues, ETH may just doubtlessly goal achieving $4,000 this quarter and even surpass its all-time top. On the other hand, this worth prediction extra speculative and will depend on numerous marketplace forces.

Ethereum At A Crossroads

Ethereum unearths itself at a crossroads. The Dencun improve has demonstrably revitalized dApp task, in particular within the NFT range. On the other hand, the asymmetric dApp efficiency and declining UAW carry considerations in regards to the long-term viability of this enlargement. Community enlargement, leisurely via the choice of fresh addresses becoming a member of the community, may be slowing indisposed, in keeping with Santiment, doubtlessly hindering wider adoption.

Alike Studying

The fast-term worth outlook for ETH extra unsure. Moment the long-term signs, like lowering change holdings, counsel attainable for worth revere, the community’s enlargement slowdown may top to a momentary worth dip.

Having a look Ahead

The approaching months can be the most important for Ethereum. The platform must capitalize at the renewed hobby in dApps via attracting a broader person bottom and fostering a extra numerous dApp ecosystem past NFTs. Addressing scalability problems and making sure user-friendly interfaces can also be key to maintaining enlargement.

If Ethereum can navigate those demanding situations, it has the prospective to solidify its place because the premier platform for decentralized packages. On the other hand, if it fails to conform, alternative blockchains ready within the wings may capitalize on its shortcomings.

Featured symbol from Pexels, chart from TradingView