On-chain knowledge displays that Bitcoin momentary holders will have offered BTC virtue nearly $4.5 billion all the way through the date 4 days.

Bitcoin Shorten-Time period Holders Display Biggest Benefit-Taking Match Since Nov. 2021

As analyst James V. Straten defined in a post on X, the momentary holders have participated in a large profit-taking match just lately. The “short-term holders” (STHs) the following traders who got their Bitcoin throughout the utmost 155 days.

The STHs are the fickle-minded members who generally display some response to any FUD or FOMO that emerges out there. Against this, the “long-term holders” (LTHs) are the resolute traders who hardly promote, even all the way through sessions of prime earnings or losses.

All through the utmost few days, Bitcoin has loved some well-dressed bullish momentum because the cryptocurrency has now breached the $41,000 stage. Given the prime earnings the traders would have accrued following this rally, it wouldn’t be surprising to peer the STHs give in and harvest those positive aspects.

One method to observe whether or not those traders are promoting or no longer will also be throughout the overall switch quantity that they’re sending towards centralized exchanges. That is herbal as a result of exchanges are what holders attic once they need to go the marketplace.

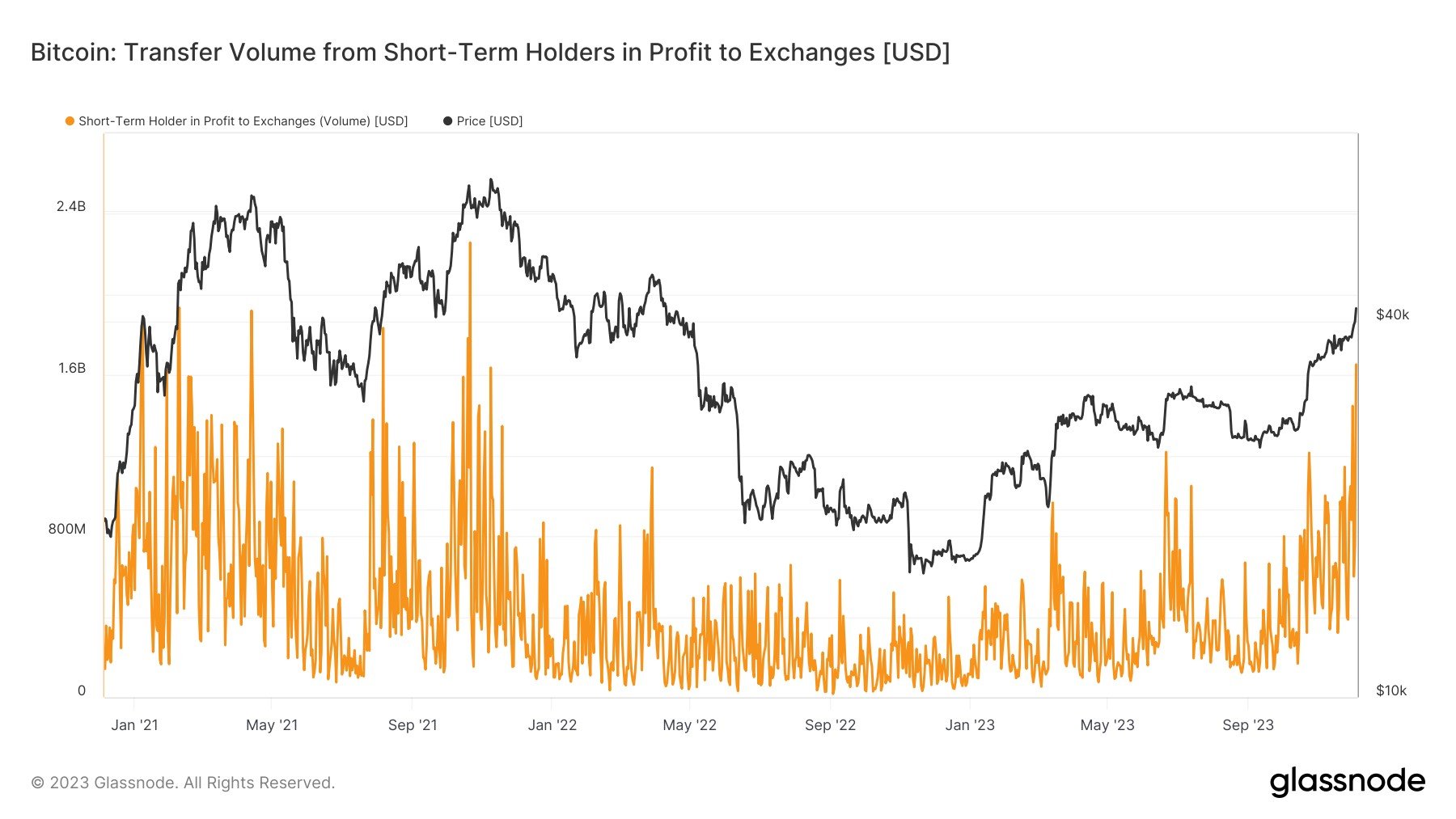

Now, here’s a chart that displays the fashion on this Bitcoin indicator over the date few years:

Seems like the worth of the metric has been reasonably prime in contemporary days | Supply: @jimmyvs24 on X

The above graph simplest shows the knowledge for the change influx quantity of the Bitcoin STHs who’re sporting some cash in. Then again, for the reason that worth has just lately been exploring untouched highs for the generation, nearly the entire STHs are certain to be in earnings, so the indicator’s worth gained’t be too other from the common one.

The chart displays that the switch quantity going from the STHs to exchanges has spiked along the actual rally, suggesting that those traders are making massive deposits to those central entities.

Now not the entire deposits can be for promoting, in fact, however all the way through alternatives as successful because the actual one, a massive bite of the inflows are certainly indicators of a profit-taking scurry.

In keeping with Straten, the Bitcoin STHs have made deposits equivalent to nearly $4.5 billion within the utmost 4 days, with $1.5 billion coming the previous day unwanted. This actual profit-taking match is the biggest this cohort has participated in since November 2021, when the BTC worth poised its all-time prime.

It’s no longer extraordinary to peer the associated fee decelerate when massive selloffs happen, like all the way through the rallies in March and June of this generation. Then again, up to now, Bitcoin has controlled to keep itself afloat since this profit-taking began and has simplest been pushing in opposition to upper ranges.

That is surely a favorable signal for the rally’s sustainability, because it implies that even supposing a massive choice of dealers are provide out there, there may be adequate call for to take in them.

BTC Value

Bitcoin is set to form any other retest of the $42,000 stage, because it’s lately floating round $41,900.

BTC has noticed a well-dressed surge all the way through the utmost few days | Supply: BTCUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com