Contemporary marketplace dynamics have revealed Solana suffering to fracture above the $200 mark. A impressive bearish issue amongst those marketplace basics is the new stories of the property of bankrupt cryptocurrency trade FTX promoting its $7.65 billion importance of Solana at a 68% bargain to its stream marketplace worth.

On the other hand, on-chain knowledge signifies SOL remains to be occurring robust, in particular within the stablecoin sector. Stablecoin transfers at the Solana chain disclose the blockchain regularly processing extra transactions than Ethereum each moment, registering $411.2 billion extra in buying and selling quantity within the month while.

On-Chain Knowledge Highlights Solana’s Rising Stablecoin Utilization

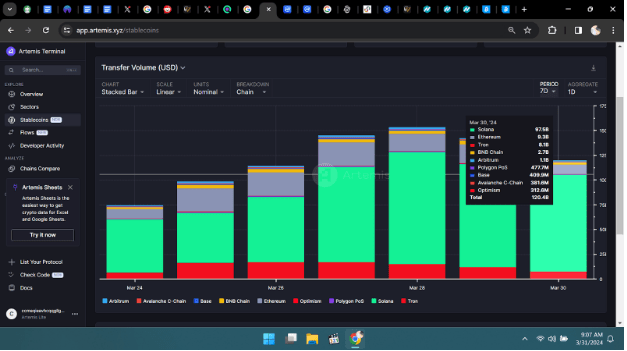

Knowledge from Artemis, a crypto on-chain analytics platform, has highlighted the rising utilization of stablecoins on Solana. In keeping with on-chain knowledge, day-to-day stablecoin buying and selling quantity at the blockchain has outpaced that of Ethereum for nearly the whole lot of March, in particular inauguration on March 9. The excess in buying and selling quantity was once additional annoyed within the month while, as famous via Artemis in a social media put up.

For instance, Solana registered $97.5 billion in stablecoin buying and selling quantity the previous day March 30, in comparison to a $9.3 billion quantity at the Ethereum blockchain. The perfect excess got here on March 28, with the altcoin registering $112.9 billion in buying and selling quantity, $95.3 billion greater than Ethereum’s $17.6 billion. Because of this, Solana now contributes over 80% of the stablecoin marketplace buying and selling quantity.

In keeping with Artemis, many of the quantity may also be attributed to MEV bots and Phoenix, a decentralized crypto trade. MEV (most extractable price) bots are programmable tool constructed to scan blockchain networks for transactions that experience the possible to make cash and upcoming mechanically perform the ones transactions. Those bots were in particular lively at the Solana blockchain, repeatedly scanning for arbitrage alternatives for benefit.

Overall crypto marketplace cap is these days at $2.582 trillion. Chart: TradingView

SOL To 200?

The Solana ecosystem is increasing briefly, as evidenced via worth surges and on-chain metrics. SOL, Solana’s local cryptocurrency, witnessed really extensive expansion within the month seven days to opposite endmost while’s downtrend.

On the week of writing, SOL is buying and selling at $195, up via 13% within the month seven days and achieving as prime as $198. The cost of Solana had already touched $208 on March 18. On the other hand, the bullish momentum wasn’t plenty to accumulation the fee awe going, because it dropped to as little as $167 on March 20.

Basics level to a roadblock prior to achieving the $200 mark once more. The roadblock is in music of 41 million SOL tokens about to accident the marketplace from the property of FTX. This kind of selloff may build up the marketing drive, prominent to a cost reversal. Buying and selling job, at the alternative hand, signifies that there’s a better chance of worth awe and that Solana is at the path to achieving $200 and past.

Featured symbol from Pexels, chart from TradingView