Stablecoin issuer Tether, a leading participant within the cryptocurrency marketplace in the back of the commonly worn USDT stablecoin, has excused its audit commentary for the primary quarter of 2024, accompanied through a record carried out through sovereign accounting company BDO.

The record, which gives extra monetary data past the reserves backing Tether’s fiat-denominated stablecoins, presentations the corporate’s benefit for the primary quarter of the occasion, which noticed an greater inflow of capital into the marketplace.

Tether Q1 2024 Financials Jump

Digging into the numbers, the primary quarter of 2024 proved extremely successful for Tether, with a internet benefit of $4.52 billion.

The primary individuals, the entities accountable for issuing stablecoins and managing reserves, reportedly generated roughly $1 billion of this make the most of internet working features, basically from US Treasury holdings. The extra income have been because of mark-to-market features on Bitcoin (BTC) and gold positions.

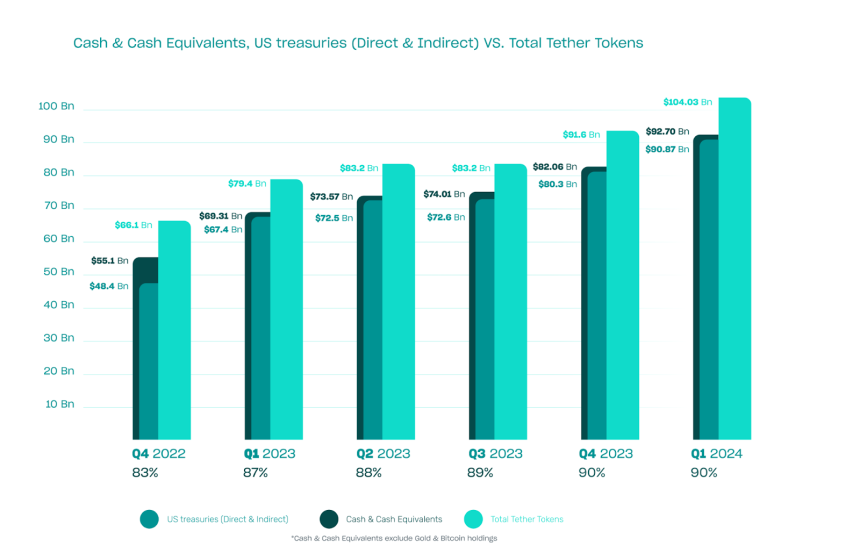

The record additionally highlighted Tether’s luck in expanding its direct and oblique holdings of US Treasuries to over $90 billion. This comprises oblique publicity via in a single day opposite repurchase oaths collateralized through US Treasuries and investments in US Treasuries via cash marketplace price range.

In an indication of important enlargement, Tether additionally disclosed its internet fairness for the primary moment, revealing a determine of $11.37 billion as of March 31, 2024. This is a rise from the $7.01 billion fairness reported as of December 31, 2023.

The record additionally highlighted a $1 billion building up in huge reserves, which assistance the corporate’s stablecoin choices, bringing the entire to almost $6.3 billion.

CEO Emphasizes Transparency And Steadiness

The BDO affirmation reiterated that Tether-issued tokens are 90% sponsored through money and money equivalents, underscoring the corporate’s stance on keeping up liquidity inside the stablecoin ecosystem. Moreover, the record viewable that over $12.5 billion utility of USDT was once issued within the first quarter rejected.

Tether Workforce’s strategic investments, which exceed $5 billion as of the record year, span numerous sectors, together with synthetic wisdom (AI) and knowledge, renewable power, person-to-person (P2P) verbal exchange, and Bitcoin Mining.

Based on the original record, Paolo Ardoino, CEO of Tether, expressed the corporate’s constancy to transparency, steadiness, liquidity, and accountable chance control.

Ardoino highlighted Tether’s record-breaking benefit benchmark of $4.52 billion and the corporate’s efforts to extend transparency and accept as true with inside the cryptocurrency trade. Ardoino additional claimed:

In reporting now not simply the composition of our reserves, however now the Workforce’s internet fairness of $11.37 billion, Tether is once more elevating the bar within the cryptocurrency trade within the nation-states of transparency and accept as true with.

Featured symbol from Shutterstock, chart from TradingView.com

Disclaimer: The thing is supplied for tutorial functions best. It does now not constitute the reviews of NewsBTC on whether or not to shop for, promote or reserve any investments and of course making an investment carries dangers. You’re instructed to habits your personal analysis earlier than making any funding choices. Utility data equipped in this web page totally at your personal chance.