“What underpins a world order is always the financial system.

We are on the brink of a dramatic change where we are about to, and I’ll say this boldly, abandon the traditional system of money and accounting and introduce a new one. And the new one is what we call blockchain.

It means digital. It means having an almost perfect record of every single transaction that happens in the economy, which will give us far greater clarity over what’s going on. It also raises huge dangers in terms of the balance of power between states and citizens. In my opinion, we’re going to need a digital constitution of human rights if we’re going to have digital money.

Most people think that digital money is crypto and private, but what I see are superpowers introducing digital currency. The Chinese were the first. The US is on the brink of moving in the same direction. The Europeans have committed to that as well.”

This innovative accent a few unutilized monetary gadget, used to be delivered on the Global Govt Peak in March 2022 in Dubai, via Philippa “Pippa” Malmgren, a member of the Council on International Family members (CFR) and Chatham Area; her father, Harald Malmgren served as a senior marketing consultant to US Presidents Kennedy, Nixon, Ford and others. She’s a era entrepreneur and economist, who served as Particular Colleague to President George W. Bush, for Financial Coverage at the Nationwide Financial Council and is a former member of the President’s Operating Crew on Monetary Markets and Company Governance.

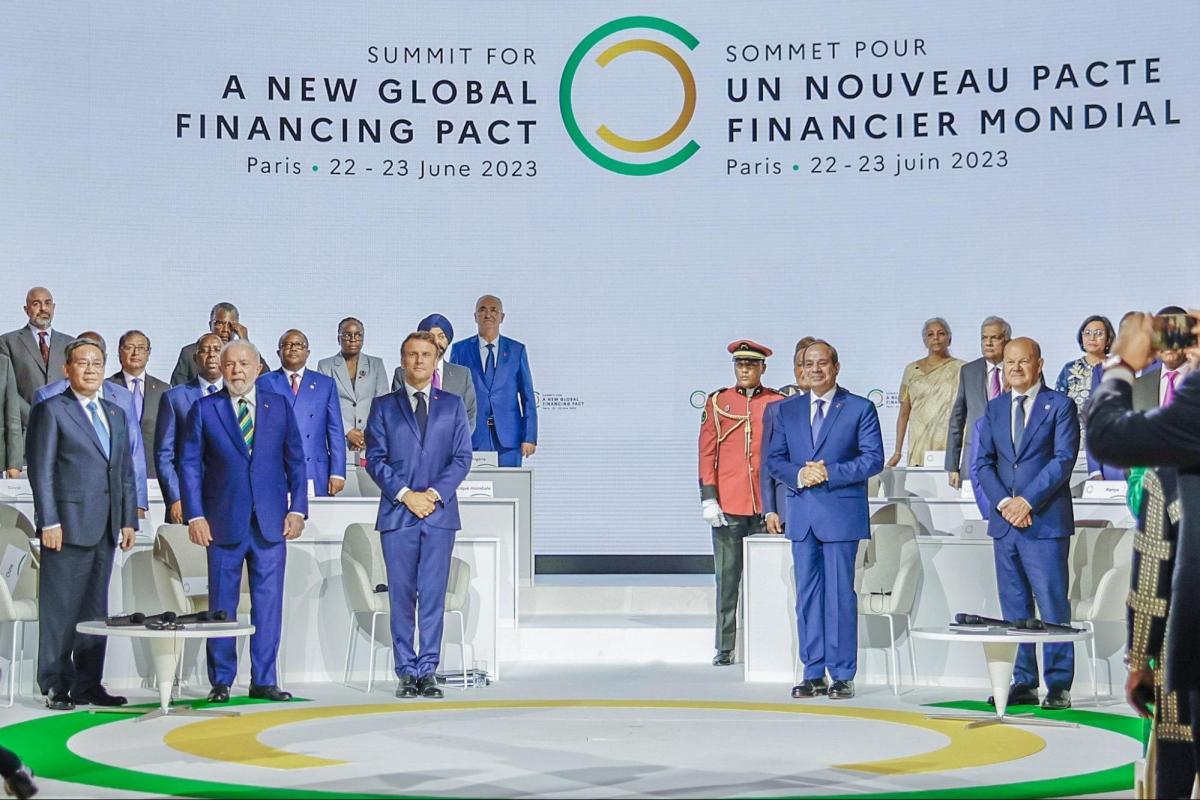

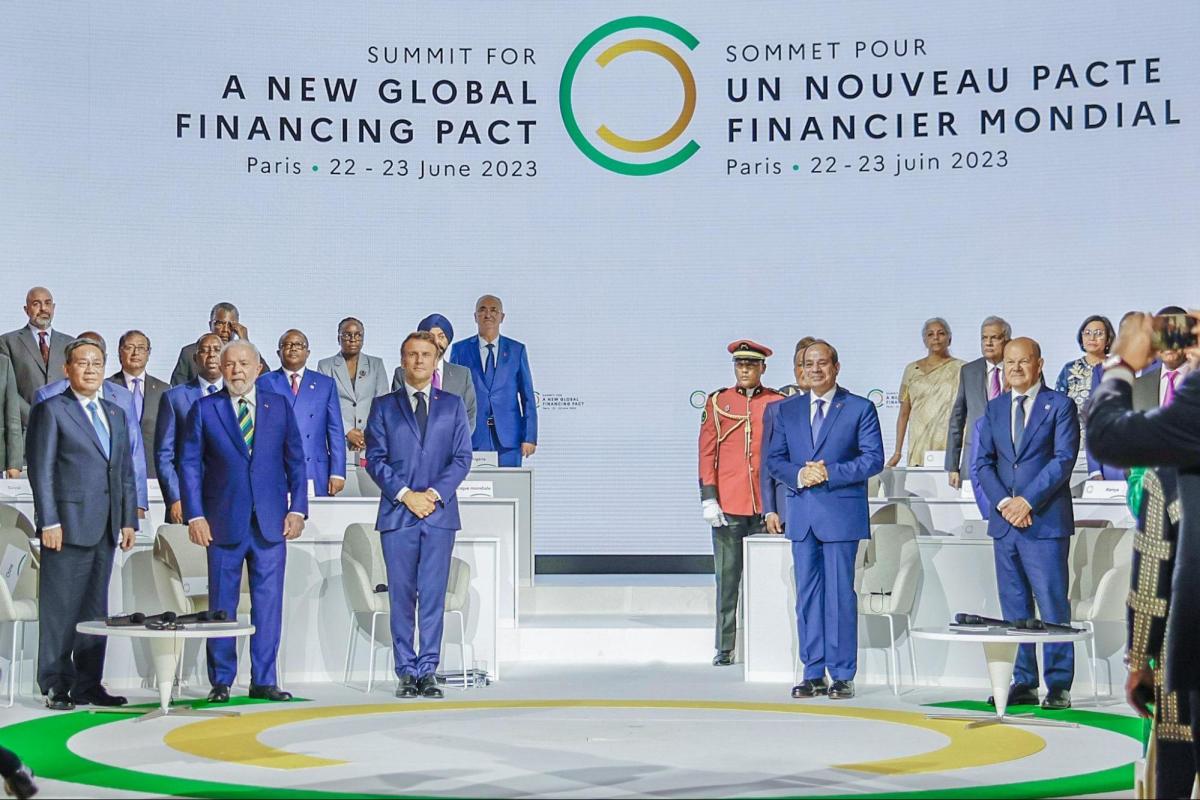

Her phrases concerning the transition to a unutilized international form that calls for a unutilized monetary construction correspond smartly with the phrases of French President Emmanuel Macron in June 2023 on the World Finance Peak in Paris: “The world needs a public financial shock to fight global warming, and the current system is not suitable for dealing with the world’s challenges.” The president of Brazil, Lula da Silva, also referred to as for “a clean slate” and stated the Bretton Logs organizations (Global Storehouse, World Financial Charity) don’t provide their targets nor reply to community’s wishes.

“The New Bretton Woods Moment”

“A new international monetary system is taking shape, some call it the new Bretton Woods moment that needs to be seized to create a new global financial governance,” says the investigative journalist Whitney Webb in a contemporary sitdown interview, the place she point out that in keeping with Mark Carney, former governor of the Storehouse of England & Storehouse of Canada and the UN Particular Envoy for Shape Motion and Finance, the 3 pillars of the unutilized multi-polar international are Virtual IDs, CBDCs and ESG, via a world carbon marketplace. All international governments are pushing this schedule, that to bring for it to be triumphant, all financial methods and supporting methods should develop into virtual and depend on virtual knowledge.

A excellent instance of this used to be detectable at an match of the Central Storehouse of Israel with the Storehouse for World Settlements (BIS) – which I attended – in September 2023 in Tel Aviv, the place the “Genesis Project” used to be offered. As a part of this mission, “green” bonds are issued, in line with carbon quotas within the CBDC infrastructure. That is how the surrounding schedule is connected to monetary markets.

“Debt Serfdom”

“Stablecoins could be the way in which the US is further globalizing the dollar, spreading its adoption directly to the world’s general public in order to continue increasing its debt and encourage uptake and usage of the dollar”, says Mark Goodwin, Writer in of Bitcoin Album, on this interview with Whitney Webb. He means that the baby-kisser’s outcry of de-dollarization and the weakening of the greenback are a distraction from perpetuating the greenback as the arena’s hold foreign money.

“While CBDCs are what people are becoming fearful and aware of, it may just be the red herring, and the real strategy of the US dollar’s survival is highly regulated stablecoins (such as Tether), which can easily be programmable, even more than CBDCs, as well as seized, regulated and controlled indirectly by governments. 100 billion dollars in treasuries were already purchased by Tether, its subsidiaries and owners. Tether is positioned alongside the top 20 nation states buying debt from the US, with around one tenth of China or Japan that have a trillion dollars debt to the US”.

This concept, along with the phrases of Mark Carney, Pippa Malmgren, Emmanuel Macron & Lula Da Silva, attach the cries of worldwide leaders and heads of states, pointing to the alternative of the financial and monetary international form, to introduce a unutilized financial gadget. Many professionals say that we’re attaining the tip of the flow fiat financial gadget experiment, which is destined to shatter. Since international leaders are conscious about this, they like to engineer a managed ruination, to guard regulate and steer the path, and input the unutilized generation with energy firmly inside of their take hold of.

Central Storehouse Virtual Forex Device (CBDC)

Central Storehouse Virtual Currencies (CBDC), fix the monetary self-government of electorate to the federal government and the banking status quo. The central reserve problems its centralized virtual currencies, and necessarily creates a unutilized financial gadget, “fiat on steroids”, a gadget that takes the whole thing this is evil within the fiat gadget, and provides extra of it; surveillance, regulate, censorship, and enforcement features. A contemporary jail? Certainly, the CBDC is the closing prototype of a jail with out bodily chains. By way of connecting CBDCs to virtual identification playing cards, and to govt methods reminiscent of common modest source of revenue, social credit and extra, we get the closing regulate equipment. This equipment will dictate to electorate what they’re allowed to buy, what the accepted quotas are moment restricting intake in keeping with regulations and significance circumstances, at programmed occasions, parks and cadences. The gadget is in a position to decide the significance of a geographic radius (geo-fencing), and to decide expiration dates at the cash. Every far off managed virtual pockets will also be switched off and on via its operators. Greater than 130 nations are within the preliminary phases of piloting CBDC methods, of which 36 nations are in complex pilots, and three nations have already introduced methods (Nigeria, Jamaica and the Bahamas).

Will Ripple (XRP) Be The Selected Platform for CBDC?

Ripple, a virtual cost community and transaction protocol that owns the cryptocurrency XRP, is thought of as some of the prevalent cryptocurrencies, and is strategically positioning itself on the center of presidency monetary innovation, aiming to be the cornerstone of date CBDCs.

The corporate is in talks with about twenty governments around the globe to build their CBDCs the use of Ripple’s era. In Might 2023, Ripple introduced a devoted CBDC platform to help central banks, governments and monetary establishments around the globe in issuing CBDCs and stablecoins. To past, Ripple has partnered with six governments for CBDC pilot tasks: Georgia, Colombia, Montenegro, Hong Kong, Bhutan and the Republic of Palau.

The Nationwide Storehouse of Georgia, for instance, has selected Ripple as its era spouse for its CBDC pilot terminating presen, mentioning Ripple’s technical experience and crew features. Its hobby in CBDCs is in leveraging trendy applied sciences, such because the programmability side of CBDCs, aiming to form a platform with intriguing word of honour and programmable token features to stimulate innovation within the monetary sector.

On the subject of Bhutan, Ripple’s era used to be selected in 2021 for the rustic’s CBDC mission to allow complex cross-border bills, and help in “financial inclusion” – in order with Bhutan’s venture to extend monetary inclusion in Bhutan to 85% via 2023.

In 2022, Ripple reached the overall level of the G20 Techsprint CBDC Hackathon, hosted via Indonesia and the Storehouse of World Settlements (BIS), and in August 2023, the Republic of Palau introduced a USD-backed virtual foreign money, evolved via Ripple.

Selling its platform as an infrastructure for a CBDC, Ripple advocates for presidency law of cryptocurrencies, and tries to place itself as the most well liked resolution for CBDC tasks. Its declare to repute of being the perfect CBDC spouse for governments is the mix of pace, potency, a sustainable and “green” blockchain community that makes use of slight power (in comparison to the Bitcoin community), and interoperability – the power to keep up a correspondence and business with CBDC answers in alternative nations at the Ripple infrastructure. The corporate warns that there’s a chance for CBDC adoption via the nation, led to principally via a shortage of marketplace training, and it encourages the programming and expiration dates features, which can be perceived via lots of the nation as specifically Orwellian options of CBDCs.

Ripple encourages the abolition of money (and a travel to a cashless community), and unsurprisingly, it promotes the surrounding schedule; The corporate’s site items its constancy to a blank, filthy rich and conserve low-carbon date, with a plan to achieve carbon net-zero via 2030.

It seems that, in order with Ripple’s enlargement technique vis-a-vis governments, the corporate makes positive to employ staff who got here from central and industrial banks. One of the vital corporate’s manage executives is Andrew Whitworth, coverage director at Ripple, who up to now labored on the Storehouse of England. On the identical age as his position in Ripple, Whitworth additionally serves as a Director of the “Digital Pound Foundation”, a company that has declared itself the authority at the Virtual Pound; it advises and influences the federal government’s choices referring to CBDC tasks and deployments. Obviously an within connection reminiscent of this may give Ripple a bonus in shaping virtual foreign money insurance policies to suit their platform and answers. Does this trace a warfare of pursuits, or no less than an unfair play games?

Some other road during which institutional affect and implicit regulate over Ripple may just manifest is by means of a prison fight with the SEC (U.S. Securities and Alternate Fee) regarding the XRP cryptocurrency. Enticing in such prison disputes inevitably positions Ripple in a situation the place keeping up a good courting with establishments turns into a very powerful. As a result, it’s deny awe that Ripple prioritizes governments, central banks, and monetary establishments as its number one audience in its marketplace technique.

Attention-grabbing Traits in CBDC

China spent a few years rolling out fairly failed CBDC tasks with out popular adoption, moment injecting 30 million yuan as detached cash to inspire person adoption. Transactions the use of the virtual yuan strike 1.8 trillion yuan (US$249 billion) in June 2023.

Lately, important proceed has been made: the 2 major cost services and products and packages in China – WeChat and Alipay – that have a site visitors of about 3-4 trillion bucks consistent with presen, built-in the Chinese language CBDC provider into their packages. The central reserve regulator made it unclouded that virtual yuan isn’t supposed to compete with the 2 bills giants. Instead, it’s intended to play games a complementary position.

Elon Musk, who owns, amongst alternative issues, the Twitter/X platform, has mentioned that he desires to construct the platform an “everything app” just like the Chinese language WeChat, together with cost control. Will X additionally apply the Chinese language course and combine the CBDC resolution into it, or will it struggle to develop into a CBDC infrastructure itself with the aid of Musk’s favourite cryptocurrency, the Dogecoin?

The CBDC pilot in Nigeria didn’t precisely get going both, nearest the electorate took to the streets to protest the abolition of money within the nation, and resented the advent of an non-essesntial virtual resolution, moment not easy the go back of money. Then an extended and painful protest, the money used to be returned along the unutilized virtual foreign money, which used to be now not canceled and was a part of fact. Moreover, a unutilized stablecoin is in preparation in Sandbox method in Nigeria. The cNGN is a Naira stablecoin which some declare has extra possible than the e-Naira to be broadly followed. “The stablecoin will be more broadly interoperable than the CBDC, which is only available in the central bank’s wallet. At launch, the central bank’s wallet usability was weak, although it is now quite good”, stated Bolu Abiodun, a reporter at Techpoint Africa.

The United Kingdom noticed a robust nation backlash to Top Minister Rishi Sunak terminating presen, with greater than 50,000 responses despatched to the Storehouse of England following a nation listening to at the Virtual Pound, aka the United Kingdom’s nationwide CBDC.

Germany – Consciousness of “Excessive Surveillance”

In Germany, the technical pointers file for a virtual foreign money of a central reserve used to be printed in January 2024. Underneath are a number of quotes from the file, reflecting the tyrannical nature of the unutilized foreign money, and the notice of the central reserve for accept as true with problems it may well form:

- Programmability is the establishment’s authority to commit your cash for sure makes use of, and to prevent the significance of your pockets when it’s “outside the permitted scope”.

- “The central bank can revoke CBDC notes, e. g. as an instrument of monetary control. Revocation of CBDC notes is performed by an authorized entity, the revocation authority, controlled and operated by the central bank.” This appears like a solution to confiscate and follow a shelf time to cash.

- “Payments permitted under certain restrictions.. if the central bank sees fit to impose them” – the file lists restrictions that may be implemented to wallets, relying at the quantity of private knowledge that will probably be equipped. As an example, the amount of cash within the pockets, the collection of bills consistent with era, the amount of cash consistent with transaction or consistent with era.

- The excellent news: The German central reserve is conscious about the potential for nation opposition to a surveillance gadget: “Many of these design choices are general decisions on the trade-off between excessive surveillance and legitimate monitoring functions for AML and KYC purposes in conjunction with measures for mitigating fraud and misconduct. These decisions are extremely sensitive in nature and can strongly influence the level of trust that users place into the CBDC”.

Israel – The Digital Shekel Will Be Distributed Through Commercial Banks

Israel takes an extensive and active part in various CBDC pilots, such as the Sela project, Eden, Icebreaker and more, which I have reported on extensively in the past. The Deputy Governor of the Bank of Israel announced that in December 2024 a technical design document for the Digital Shekel will be published, and its implementation will then begin in partnership with the private sector.

The Bank of Israel’s latest document from last week covers the proposed architecture of the Digital Shekel. Here are some interesting points from the document:

- The distribution of the Digital Shekel will be two-tiered: instead of direct contact between consumers and the central bank for funding and defunding, an indirect method similar to the distribution of cash today will be used. The banks will purchase digital shekels from the central bank in large quantities and transfer them to customers upon wallet charging.

- The system will be able to apply and enforce limits, for example limits on the balance that users are allowed to hold in the Digital Shekel.

- The system will support the possibility of applying interest on the Digital Shekel.

- Users will be able to access the Digital Shekel through several payment providers, including credit cards, Google/Apple Pay, wearables, payment apps and more.

- Unlike most retail CBDC solutions, Israel’s model allows users to open a wallet with a payment service provider (PSP) and connect to multiple third-party banks to fund and defund balances.

Another interesting development in Israel is the announcement of a plan to launch a new stablecoin pegged to the shekel, called BILS, by the exchange platform, Bits Of Gold. Crypto Jungle website reports that the Israeli Capital Market Authority approved the pilot, according to the draft principles published by the Central Bank of Israel. Interesting to note that the company providing the infrastructure for the issuance and custody of the currency is the Israeli technology giant “FireBlocks”, which took part in the “Eden” pilot project of the Tel Aviv Stock Exchange for the issuance of digital bonds, built to adapt in the future to a potential CBDC infrastructure.

No Internet? Don’t Worry, Governments Will Take Care Of Connectivity Anyway

A number of CBDC pilots, like in India, the European Union and more, focus on the adoption of the system by everyone, even amongst people without internet access. The washed-up name “monetary inclusion” implies that the system will not skip anyone, not even citizens without Internet connectivity in remote areas, or without reception. In India for example, there are 683 million people living without an internet connection and largely outside the control of the state. The Reserve Bank of India (RBI) plans to bring these remote areas into a new surveillance network through various technological means. A successful launch of CBDC in India also corresponds with the government’s overarching goal of reducing cash usage and improving financial monitoring.

Thailand – Free Money for the Masses

In September 2023, the Thai government announced that any Thai citizen over the age of 16 who chooses to participate in the CBDC pilot, will receive free CBDC worth $280 (10,000 baht) – quite a lot of money in Thai terms. This digital money will be loaded into the digital wallet application and will be available for use within 6 months, and within a radius of 4 km from the residence of the registered citizens. The pilot targets low-income citizens as a first stage, and later expands to entrepreneurs and small business operators – provided they are registered in the tax system. In Thailand many citizens are not registered in the government systems and not everyone has a bank account. It seems that air-dropping “detached cash” is any other tactic to entice electorate into govt methods, with the bait of “free” managed govt cash. However is there any such factor as “free lunch”?

The Eu Union – a Sure Advertising and marketing Marketing campaign in Prime Equipment

The Eu Union introduced a advertising and marketing marketing campaign to advertise the virtual euro about six months in the past, to start out instructing the Eu nation a few fact the place that they are going to be obliged to significance a supervised virtual euro, led via Christine Lagarde, who used to be up to now convicted of crimes and used to be promoted to provide because the governor of the Eu Central Storehouse, the ECB.

On the identical age, a charade is occurring within the Eu Union Parliament the place the risks of CBDCs are being mentioned, simplest due to the nation consciousness and discourse, moment Lagarde rushes ahead and kicks off the promoting marketing campaign to instill within the nation refer to messages: the virtual euro is straightforward, secure, speedy and significance. No longer a guarantee about its Orwellian features to trace, program, prohibit and status process via expiration dates, geo-fencing, and far off off and on switching.

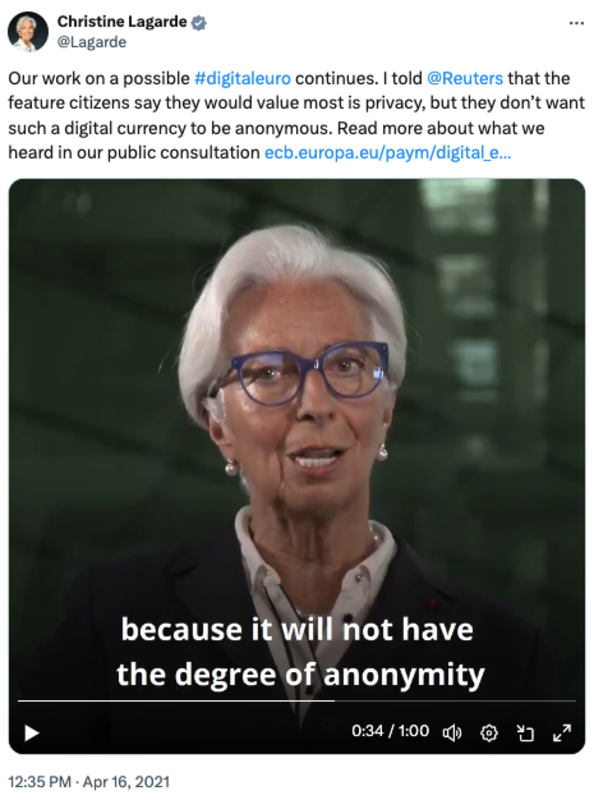

The Virtual Euro Will No longer Be Nameless

In a dialogue on the Eu Union Council in 2023, Lagarde emphasizes some degree: the virtual euro is probably not nameless. Privateness will exist within the gadget, however now not anonymity. Let’s split this up differently: for the banks, the important thing to surveillance and regulate is id. The reserve should know who the citizen is and test their identification, to bring to workout regulation enforcement or laws, via technological restrictions. Lagarde’s declare that the era will permit privateness however now not anonymity is unfounded: it appears the central reserve considers itself and the monetary provider suppliers some roughly God, since in entrance of them the citizen will probably be recognized, and subsequently it isn’t unclouded what sort of privateness can exist, with out anonymity.

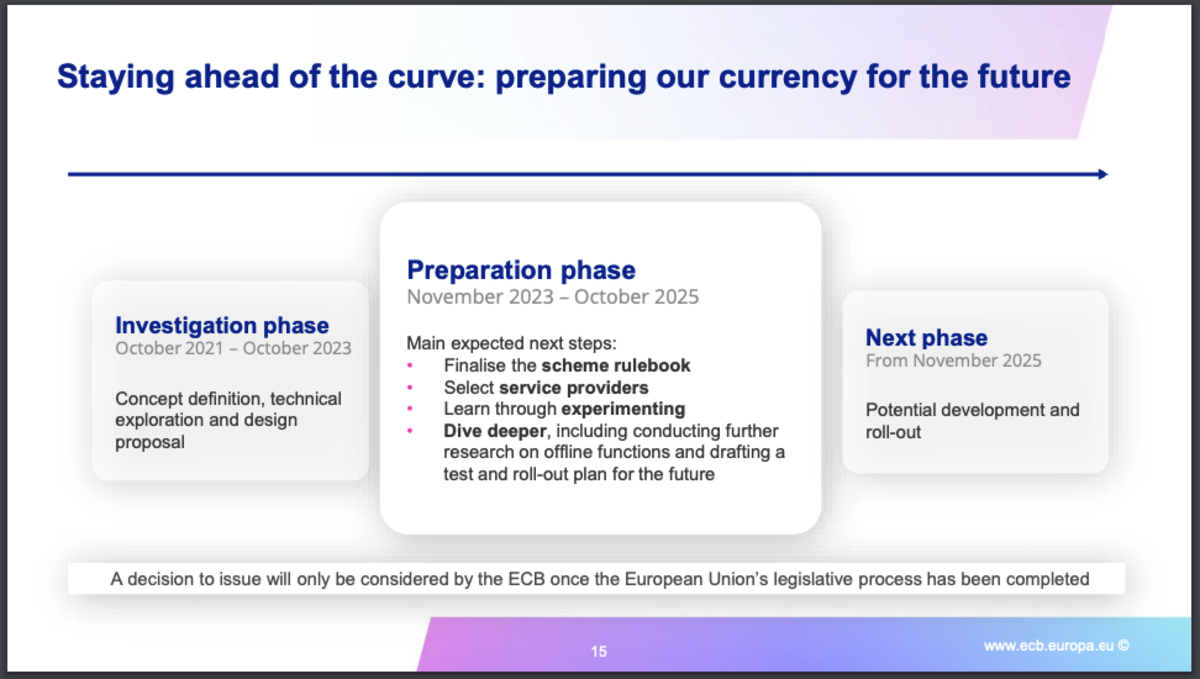

In a presentation from March 2024, the ECB items a timetable for the Virtual Euro. In November 2025, the improvement and implementation section will start, with the finishing touch of the “democratic” legislative procedure.

The timing of the settingup of the Virtual Euro corresponds smartly with the Eu Union’s initiative to factor virtual identification playing cards to all EU citizens between now and 2030, to allow the important govt id and monitoring of its electorate. Similar tasks are enacted and promoted in lots of alternative nations around the globe on the identical age. The place I reside, in Israel, ID playing cards and passports were necessary and virtual for a few years, and in addition biometric since 2013 – subsequently there’s no want to get started the promoting marketing campaign for the Virtual Shekel but, because the virtual infrastructure exists therefore step one of digitalization is already performed.

This section of the mission is the “preparation phase”, the ECB unearths, by which they’re getting ready for the settingup section of the Virtual Euro. In fact, we’re reassured that deny ultimate resolution has but been made in regards to the settingup of the CBDC, and this may simplest occur with the favor of the “Government Council” nearest the finishing touch of the democratic legislative means of the Eu Union. Subsequently, in parallel with the democratic debate for or in opposition to the Virtual Euro, the improvement of the era will proceed, to bring to be ready for the settingup.

Central reserve governors reminiscent of Lagarde and Storehouse of Israel Governor Amir Yaron insist that the CBDC is virtual money, and in addition insist that bodily money is probably not abolished. It’s conceivable that those central bankers really feel the want to construct a U-turn from the incriminating accent of the top of the Storehouse for World Settlements (BIS), Augustin Carstens, who led to a nation outcry when he mentioned in 2020 that the CBDC era, not like money, will permit tracking of economic transactions and will probably be a method of enforcement via the status quo:

“The key difference with the CBDC is the central bank will have absolute control of the rules and regulations that will determine the use of that

expression (money) of central bank liability, and also we will have the technology to enforce that.”

Agustín Carstens – BIS Basic Supervisor

The Time: Centralized and Managed, or Detached, Decentralized and Reserve?

Ayn Rand, writer and thinker, stated that “We can ignore reality, but we cannot ignore the consequences of ignoring reality.” Are we taking gigantic steps against a unutilized financial fact, the place the fiat currencies we all know develop into fiat on steroids, aka CBDCs? Or into the truth of “stable” and carefully regulated cryptocurrencies, tethered to fiat? Both approach, the sensation is that the status quo is doing the whole thing to saving the debt economic system, and its inherent trendy slavery. The one approach to split those fiat-matrix barriers is to decide out and input right into a unutilized gadget, which turns out to run in a parallel fact, the Bitcoin gadget. At the Bitcoin same old, below self-custody, deny 3rd birthday celebration has the power to confiscate, program or to enter personal belongings. No longer even the federal government or the atmosphere. Bitcoin makes use of a batch of power for its mining, however this proof-of-work mechanism makes the blockchain community extraordinarily conserve and the Bitcoin foreign money very worthy. Bitcoin is “safe money”, which is out of succeed in for the status quo. In contrast to maximum alternative cryptocurrencies, Bitcoin is a virtual foreign money with out intermediaries or 3rd events (peer-to-peer) in a decentralized and conserve community, which permits everybody to be their very own reserve, rather of depending on banks and exterior events. With a hard and fast and identified provide, it represents essentially the most robust virtual asset in the marketplace as a gather of price and as a unit of account, and going forward can be old as a medium of alternate.

In my fresh interview with the media and finance knowledgeable, and some of the well-known Bitcoiners, Max Keiser, he when put next the CBDC to a parasitic and centralized most cancers: “If you were to look at the amount of energy that Bitcoin uses and the rate at which it’s increasing, you would say good is triumphing over evil. So this gives me a lot of hope. And I don’t think centralization in anything works at all, except cancer. Cancer is the only thing that seems to work to be overly centralized and parasitic. That’s the cancer model, but I think we’re gonna win against the cancer of CBDCs.”

Follow Efrat’s work here.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.