The under is an excerpt from a up to date version of Bitcoin Book Professional, Bitcoin Book’s top class markets e-newsletter. To be a few of the first to obtain those insights and alternative on-chain bitcoin marketplace research directly on your inbox, subscribe now.

The First 5 Days

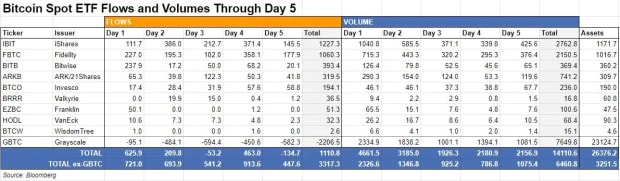

The Bitcoin spot ETF release was once one for the historical past books. Via all accounts, it was once the most important release of an ETF product in historical past, beating out the former report all set via the Proshares Bitcoin Technique ETF (BITO) release in October 2021. First-day buying and selling quantity was once plethora at $4.6 billion, and it has remained somewhat sturdy in comparison to standard post-launch declines of alternative merchandise. We will be able to be assured within the quantity numbers, not like the inflows. Upcoming the primary two days of buying and selling, the marketplace was once left questioning about flows for the reason that information supplied via TradFi was once not on time and incomplete. Professionals, similar to Eric Balchunas of Bloomberg, mentioned it was once standard to have delays in reporting of flows via up to T+3 (3 days nearest). Bitcoin isn’t impaired to such sinister transparency.

Within the under desk, you’ll see the GBTC outflows are actually over $2 billion, with the most important generation being Past 3. Alternatively, it’s extremely possible that the majority of Past 3’s flows was once because of buying and selling on Past 2, and also for Past 2 on Past 1, and so on. We additionally can not inform if the entire issuers are latest on their information. Is that each one their flows or are they no longer carried out counting? We merely don’t know.

Bitcoiners are supplementing sluggish TradFi information which will whip days via monitoring flows on-chain. On Wednesday morning, James Van Straten of Cryptoslate reported that 18,400 bitcoin have been despatched from Grayscale to Coinbase’s High OTC table proper at marketplace seen, following a development of outflows at the two earlier buying and selling days of 9,000 bitcoin on January 16 and four,000 bitcoin on January 12. The on-chain information from judgement company Arkham is devoted, the condition is it doesn’t fit the reported outflows. The ones 3 days of on-chain information upload as much as $1.3 billion use of bitcoin and the reported outflows have been best $1.1 billion. Additionally, curiously there have been refuse transactions the morning on January 18, however they resumed this morning.

Supply: Arkham by way of @DylanLeClair_

Coinbase already custodies Grayscale’s bitcoin, so those are transfers from their custody account to the OTC table, the place alternative ETF marketplace makers can pick out it up, proscribing the impact at the spot worth.

GBTC Promoting May just Be Drawing to a Alike

Grayscale promoting was once anticipated however we nonetheless don’t know the extreme quantity that can finally end up being offered via the era the mud settles. Will 100% in their cash slowly pop out, or possibly best 10%? Society are speculating the expense ratio of one.5% as opposed to the alternative ETFs averaging 0.25% may reason folk to change ETFs. If that’s the case, it could no longer translate into any internet promoting. GBTC did decrease their rate after they transformed, from 2% all the way down to the unused 1.5%. If GBTC holders are sitting on important unrealized positive aspects, they may make a choice to not promote till the nearest rally. Keep in mind, there are tax implications with swapping, additionally.

Many early dealers of GBTC are doing so for ideological causes. The cut price which shaped in Feb 2021 took them via awe they usually felt caught. The query is what number of bitcoin is that? GBTC nonetheless has over 550,000 bitcoin as of January 19, what number of of the ones nonetheless really feel caught? Why wouldn’t they have got already swapped out within the first a number of buying and selling days? I feel it’s lower than folk suppose. Sure, all the bitcoin will pop out in the end in the event that they store the expense ratio that top, however no longer in a single sustained motion. I feel the dumping will probably be unfold out over a number of immense rallies within the bull marketplace. Promoting from GBTC may already be slowing with the bargain to NAV shedding from 150 bps on generation 1 to 47 bps on January 17.

Bitcoin Worth

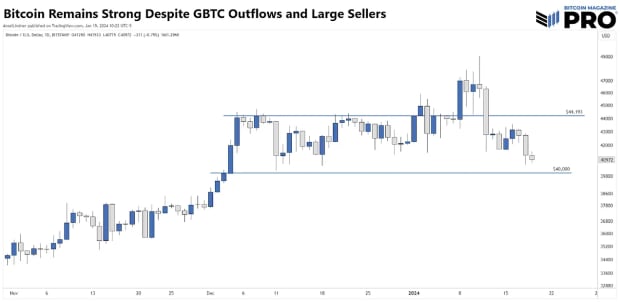

Talking of worth, bitcoin has controlled to conserve backup at $40,000 even with the immense outflows from GBTC and whale promoting. Once more, James Van Straten stories a whale who purchased at $48,000 in 2021’s bull marketplace, who held in the course of the immense drawdown and the FTX debacle, in all probability unloaded 100,000 BTC with an ask of $49,000. For context, the entire ETFs ex-GBTC are nonetheless under that at 79,000 BTC. This was once no longer a sell-the-news match, it will have merely been a whale promoting nearest breaking even. Which means the constant purchasing power of the ETFs is best not on time via a moment or so.

We’re nonetheless within the dimension courting the entire as far back as the start of December, however are threatening to fall under it at the moment. My consideration left-overs on $40,000 and the $44,193 sequence we’ve been gazing that complete era, constituted of the top day by day alike again on December 8.

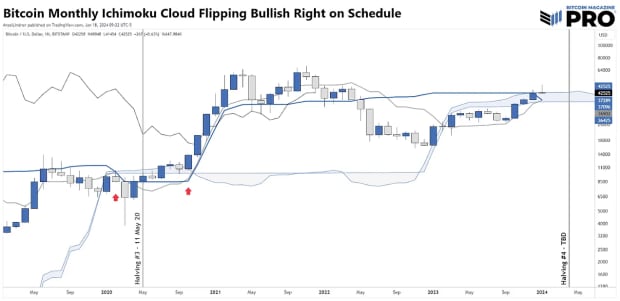

For the ones readers with stunning low era choice, the per 30 days Ichimoku cloud is flipping bullish. That is an especially bullish sign that best occurs in the beginning of bull runs in bitcoin. It happened terminating in October 2020 nearest virtually flipping previous to COVID in February 2020. Curiously, if it could have flipped in February, it could be at very just about the similar relation to the halving that we’re as of late. Previous to 2020, the one alternative era this has happened was once in June 2016, in the beginning of that immense bull marketplace, and one hour previous to the July 2016 halving.

Immense Purchasing Force in Context

The usage of the unfinished influx information above, we will say that the typical day by day purchasing power, together with GBTC promoting, has been greater than $200 million/generation. Attention-grabbing that Past 4 was once the second one absolute best, including some proof to the speculation that purchasing power may stage out across the $250-300 million mark. To position that quantity in context, Microstrategy simply started a 4-month procedure of marketing $216 million in unused stocks to shop for extra bitcoin. The ETFs do this in a generation. Tether may be repeatedly purchasing bitcoin for his or her reserves. Just lately, they reported including some other $380 million in bitcoin on the finish of 2023. Two out of the primary 5 days of the ETFs have been greater than that.

With all the ones assets of giant call for in thoughts, glance once more on the per 30 days chart above, once more. There’s a technique for this marketplace to journey. Are you able?

In the event you appreciated this submit, please give it a like and percentage on social media so we will unfold our message! Thanks!