Bitcoin 100k? Are we dreaming? Bitcoin price analysis shows how BTC could grow after the $100K break – what’s next before 2030?

Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

is at $100,000. This is insanity. Tell every teacher who failed you, every gold-holding boomer who lectured you, and every girl who left you for Chad, who had bigger muscles and a better car. Listen, I run marathons, Samantha! I’m not supposed to bench 300 lbs.

Not venting… by the way.

The Bitcoin story goes like this: First, they ignore you (2013); then they laugh at you (2017); then they fight you (2021); then you win (2025).

So what’s next? Even if Bitcoin goes to 500k or 1 million, that’s not that impressive; it’s just a 5x/10x. You might as well buy stocks at that point.

Bitcoin 100k: First, Kneel Before Your New Emperor Michael Saylor

Move aside, Warren Buffet. This is the greatest investor of all time. While Michael Saylor has his faults, he had one clear idea and went all-in—no half-measures.

I’m not even the biggest Saylor fan—I met the guy once—but we at 99Bitcoins paid attention when they mocked him for buying at $97k because it had a mere 5% drop. They mocked him again for buying at $88k, the largest quantity he’s ever bought. Kneel to this man.

Saylor is a big part of figuring out where Bitcoin goes next.

He was giving a presentation to Microsoft’s board of directors about Bitcoin a few days ago. Microsoft is sitting on $75B in cash. If Saylor didn’t fuck up, then Microsoft purchasing a few billions worth of BTC will kick off the corporate FOMO.

By proposing a BTC reserve to their risk-averse board of directors, executives would no longer be scared to look reckless or like troglodytes.

Microsoft will look pathetic if they reject the Bitcoin transformation. Saylor printed the best “I told you so” presentation in history with his speech. Yet, it’s not about the act, which he probably knows Microsoft is too cowardly to do, but the message.

One last bit of FUD about Michael Saylor: “Ok, but I don’t get why I should buy Microstrategy when I can just buy Bitcoin directly?”

Several reasons, and the most popular are:

- Tax-free accounts

- No worrying about custody (more transparent regulation)

- Leverage on a leveraged product? There are several reasons.

US Presidency Bitcoin Catalyst Will Cause Hyper-Bitcoinization

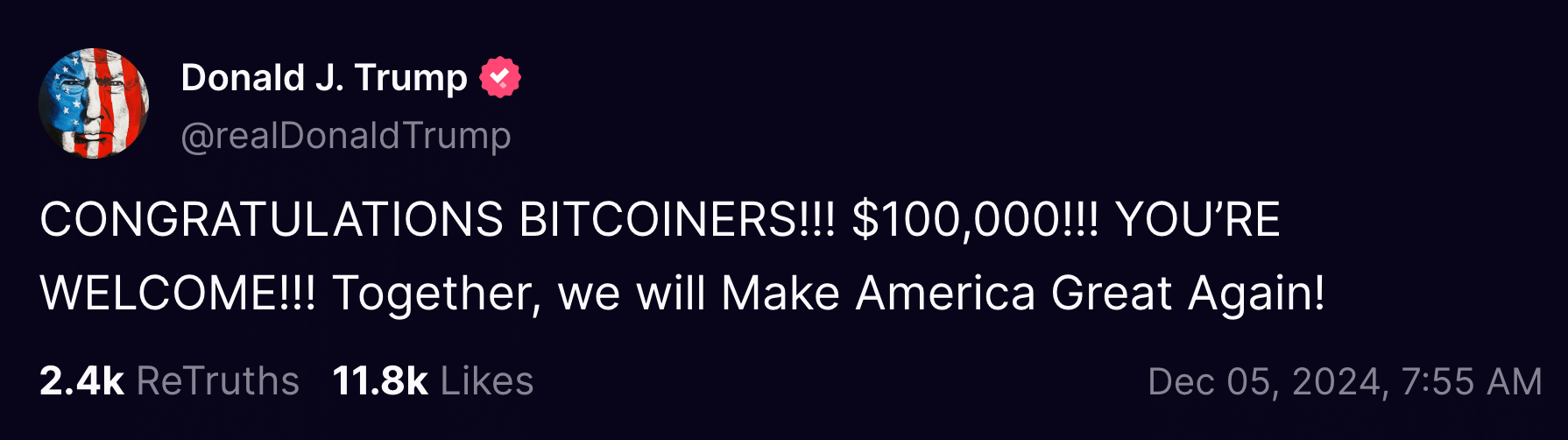

Trump can absolutely take credit for Bitcoin hitting $100k. As can all the people who helped get him elected

Paul Atkins is set to take charge of the SEC, courtesy of Trump. Gary Gensler? Out. Elizabeth Warren? Reduced to a crazy cat lady. Bitcoin would have reached 100k eventually, sure, but never this fast.

Since we don’t want to keep you here too long (yes, you can go back to staring at your portfolio), here’s a list of incoming catalysts that this election decided:

- Incoming US President Donald Trump is pro-Bitcoin. Owns BTC and ETH

- Incoming US Vice President JD Vance is pro-Bitcoin. Owns BTC

- Incoming US Commerce Secretary Howard Lutnick is extremely pro-Bitcoin. Owns 5% of Tether (the company)

- Incoming SEC Chair Paul Atkins is extremely pro-crypto. Has been an advisor to crypto projects

- US Federal Reserve Chair (yes, Jerome Powell) said, “Bitcoin is like digital gold.“And that it is a direct competitor to gold rather than the USD

- Russian President Vladimir Putin just said that Bitcoin is un-bannable (Russia tried for a little while) and is leading the way to a new financial era.

- A very influential Shanghai court (not a meme court in the provinces) just ruled that Bitcoin is legal property to own, thereby signaling that China is giving up on its ban

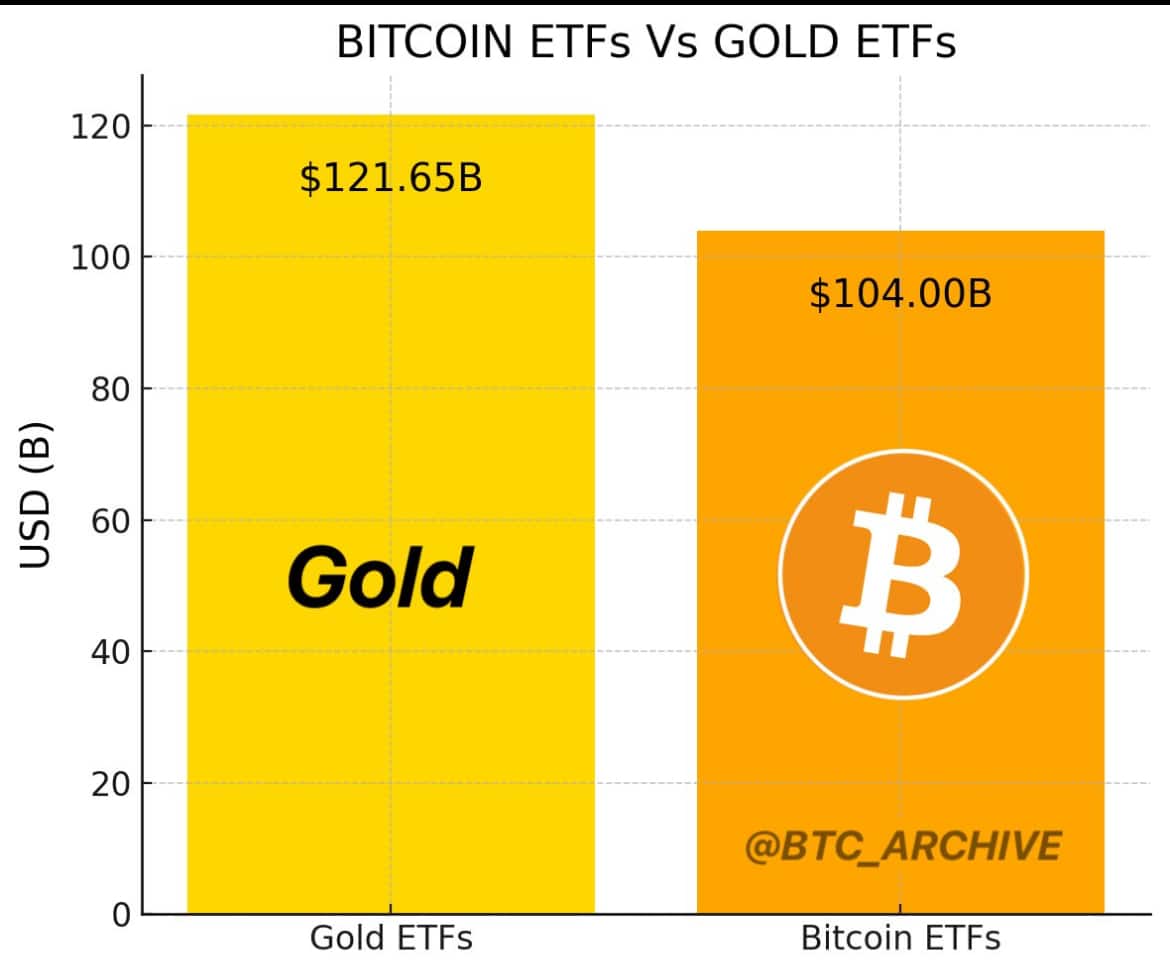

- Bitcoin ETF is the fastest-growing ETF in history.

The game theory that OGs predicted has been on point every step of the way. Next up:

- Large scale adoption of BTC strategic reserves for corporations

- Large scale adoption of BTC strategic reserve for nation states

Almost all nations hold dollars to affect the price of their currency, which is the main sink that absorbs the mass printing of new dollars. The USD market is not fair or transparent, and funds give a foreign power more control over the world. That’s why we’ll see hyperbitcoinization in the future.

Did I spell that right? Who cares. Bitcoin is at $100k.

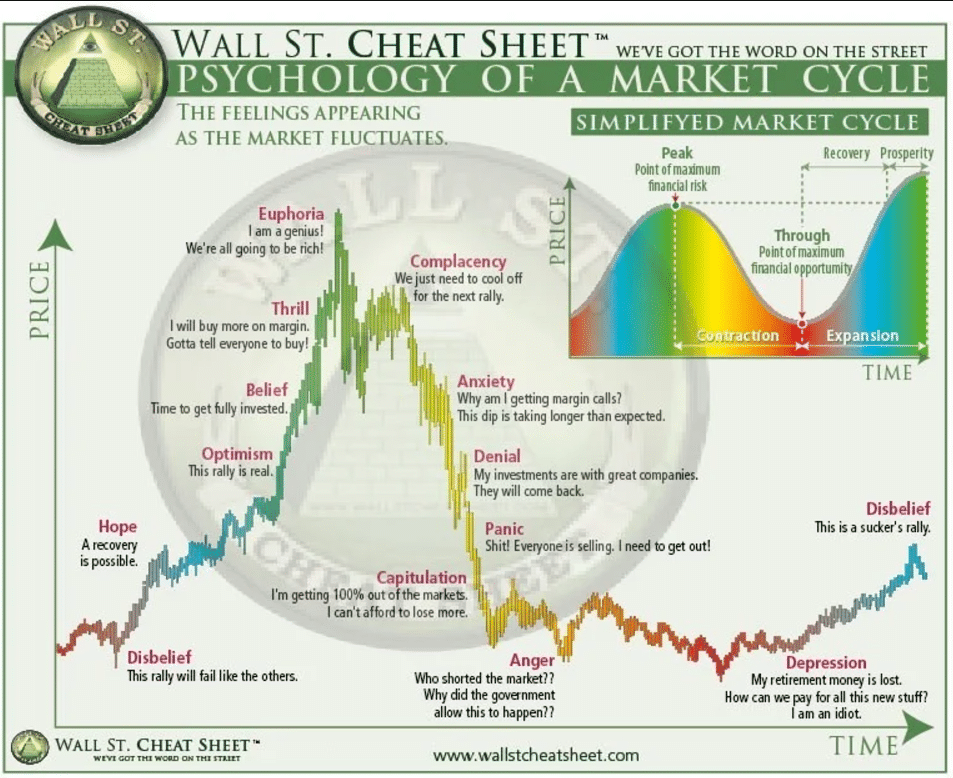

Lastly, Where Are We in The BTC Cycle?

It’s our estimation that we are at “Optimism” heading rapidly into Thrill.

People are just beginning to realize that the bull run is, in fact, real. We are quite literally on the verge of Optimism. So, where will the BTC price sit at the end of 2025?

The hype right now (on Twitter and across the internet) is for $500k Bitcoin this cycle. That’s why we believe the sell signal will be at $150k-$250k by the end of 2025.

Screencap this.

2025 has yet to start. Trump and his new pro-crypto cabinet have not signed one piece of legislation, so we won’t see a bear market until 2026.

But Bitcoin LOVES macro summer and fall even more.

Crypto summer has started and fully develops post-halving…it’s all the same Everything Code cycle… pic.twitter.com/9ZDQH5jOdG

— Raoul Pal (@RaoulGMI) March 24, 2024

This could be the last good month to buy Bitcoin (nfa). Then, you wait 8-10 months and sell in an inverted DCA scheme. After the top, you stop selling and wait until 2026 to buy back in again.

The proletarians do the opposite. They buy in DCA and sell everything at the bottom of the next cycle. There are many such cases.

100k is a milestone that means everyone you know will buy Bitcoin eventually. Yes, even Peter Schiff. Not because they want to but because most companies in your index funds and pension fund will buy it for you.

The companies will buy in above $100k, which means you will have bought in above $100k. Better late than never, sweaty.

The post Bitcoin Hits 100k! So, What’s Next Before 2030 For Bitcoin Price Action? appeared first on 99Bitcoins.