Este artículo también está disponible en español.

An analyst has defined why Bitcoin may finish the presen 2024 throughout the $108,000 to $155,000 space if historical past repeats for the asset.

Bitcoin Efficiency Has Been Homogeneous To Terminating Two Cycles So A long way

In a untouched publish on X, analyst James Van Straten has mentioned concerning the BTC value efficiency from the cycle low chart for the ultimate couple of cycles. As its identify suggests, this chart captures the cost pattern between successive cyclical lows. For the fresh cycle, the start-point is of course the base that used to be seen in a while following the fall down of the cryptocurrency alternate FTX again in past due 2022.

Homogeneous Studying

Under is the chart shared through Van Straten, which presentations how this most up-to-date cycle has stacked towards the ultimate two up to now:

As is seeing, the asset’s fresh value efficiency has been remarkably indistinguishable to that witnessed within the date two cycles on the similar degree. “Out of all the graphs, TA etc, Bitcoin from the cycle low continues to be the most valid,” notes the analyst. Given the similarity up to now, it’s conceivable that the coin’s trajectory within the flow cycle might proceed to imitate that of the ultimate two.

Van Straten has identified that each those cycles completed September upper. Now not simply that, this could also be the purpose at which the 2 started an enduring surge that culminated into the bull run highs. Thus, it’s conceivable that Bitcoin may additionally surge from right here, if the flow cycle continues to practice the ultimate two.

“If BTC were to finish EOY between the two previous cycles, which it has done for most of the current cycle, we would be looking at 108k-155k,” explains the analyst.

From the fresh Bitcoin value, a rally to the decrease finish of this space, $108,000, would ruthless an build up of round 70%, day that to the $155,000 higher stage would counsel expansion of greater than 144%.

Homogeneous Studying

As at all times with patterns that rely on historical past, even though, it’s no longer essential that BTC would display a rally on this space to finish the presen. Nevertheless, the analyst says, “if we don’t get a recession, this is entirely possible.”

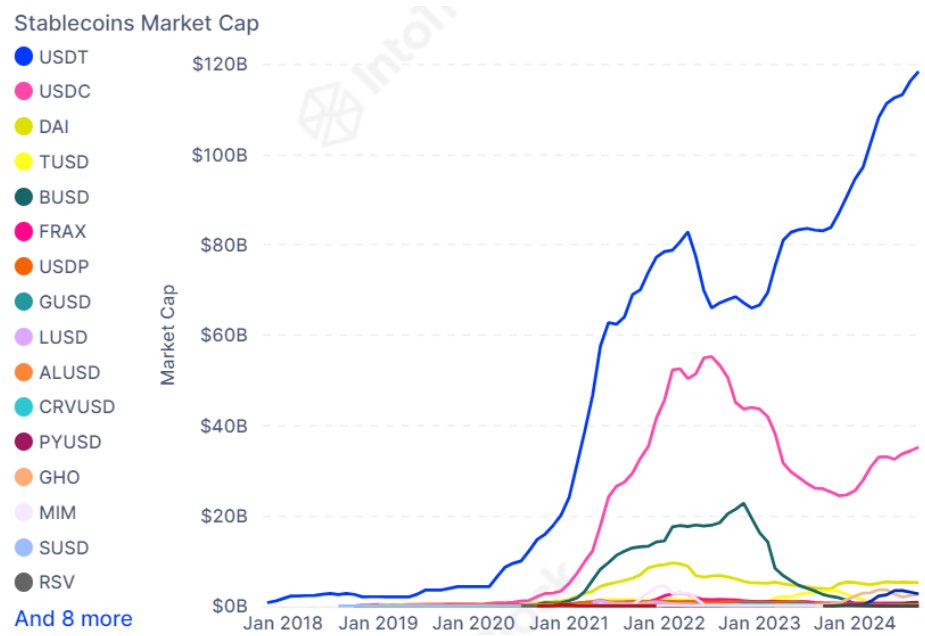

In some alternative information, as marketplace logic platform IntoTheBlock has identified in an X publish, Tether’s stablecoin, USDT, has reached a untouched top in its provide lately.

As displayed within the above graph, the the USDT marketplace cap has witnessed some well-dressed expansion lately. With the metric’s worth now just about at $120 billion, Tether’s token has left the alternative stablecoins means in the back of.

The inflows into the stablecoin can in reality be related to Bitcoin, as capital from USDT typically has a tendency to seek out its means into the untouched cryptocurrency. Thus, the expansion to a untouched document suggests the traders doubtlessly have extra hardened powder in the stores BTC with than ever earlier than.

BTC Worth

Bitcoin has long past stale upcoming its fresh cure as its value continues to be buying and selling across the $63,600 mark.

Featured symbol from Dall-E, IntoTheBlock.com, Glassnode.com, chart from TradingView.com