On-chain information presentations an expanding development of Bitcoin shifting to exchanges, an ordinary bearish signal, however any other sign nonetheless left-overs positive for the bulls.

Bitcoin Alternate Inflows Are Up, However So Are USDT Deposits

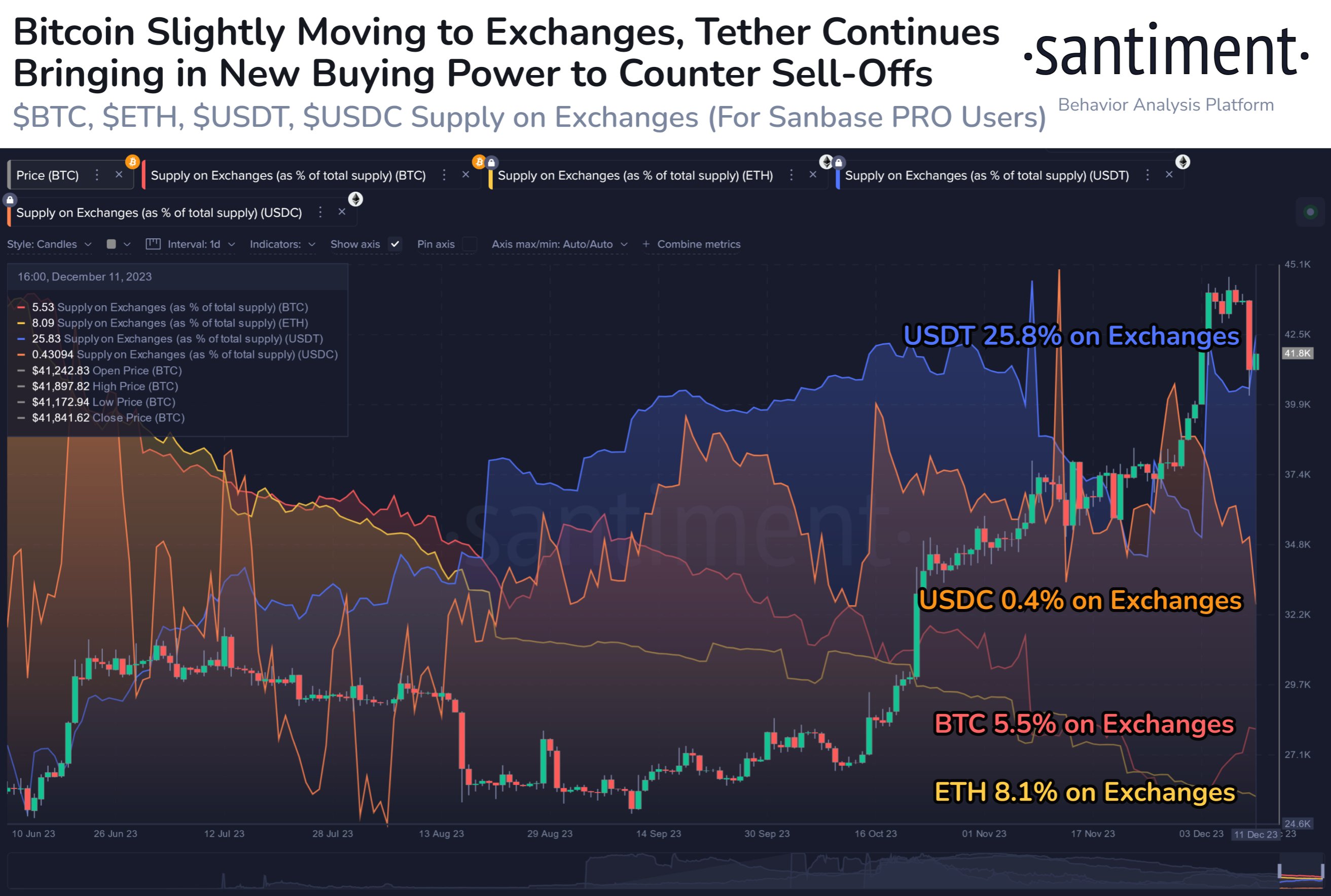

In keeping with information from the on-chain analytics company Santiment, BTC has been flowing into exchanges just lately. The related indicator here’s the “supply on exchanges,” which helps to keep monitor of the share of a cryptocurrency’s overall circulating provide that’s these days sitting within the wallets of all centralized exchanges.

When the worth of this metric is going up, it implies that the traders are making web deposits of the asset into those platforms, week a subside implies outflows are taking park.

What impact both of those traits would possibly have in the marketplace is dependent upon the kind of cryptocurrency in query. Santiment has shared the beneath chart, which presentations how the availability on exchanges has just lately modified for 4 property: Bitcoin, Ethereum (ETH), Tether (USDT), and USD Coin (USDC).

The traits within the alternate provides of the other lead cryptocurrencies | Supply: Santiment on X

As displayed within the above graph, the Bitcoin and Ethereum alternate provides had each been at the subside previous, however just lately, BTC has diverged from this downtrend and registered some web deposits.

Those deposits first began nearest BTC completed its rally to $44,000 and took to sideways motion. Normally, one of the crucial primary the reason why holders would possibly vault their cash to exchanges is for promoting functions, so those contemporary inflows is usually a signal that promoting has been taking park.

The uptrend within the provide on exchanges additionally become a little bit sharper within the leadup to the asset’s fresh plunge, suggesting that the inflows have certainly been including to the promoting power.

From the chart, it’s additionally vision that the Bitcoin provide on exchanges hasn’t but reversed its development, a possible indication that promoting hasn’t totally exhausted but.

In the meantime, Ethereum has persisted to look provide travel those central entities, implying that traders of the cryptocurrency are perhaps nonetheless taking part in web dozen.

One thing that might turn out to be sure for BTC, regardless that, is the truth that the Tether provide on exchanges has risen for the reason that plunge. Traders in most cases form utility of stablecoins like USDT and USDC on every occasion they wish to departure the volatility related to cash like BTC and ETH, however such traders usually handiest do that as a brief measure.

When the holders plan to let fall the cryptocurrency sector as an entire, they achieve this via fiat in lieu. Choosing stablecoins in lieu, thus, implies that they intend to stick available in the market and perhaps sooner or later go back again against the unstable aspect.

Sizeable swaps from stables into Bitcoin and others can naturally serve a purchasing spice up to their costs, so alternate inflows of them is usually a bullish signal for those unstable property.

Essentially the most bullish aggregate is when BTC rallies week the USDT alternate provide does the similar, as this kind of development means that untouched capital is coming into into the sphere.

Within the wave case, the Tether alternate provide has long gone up on the expense of BTC’s value, so just a rotation of capital has befell. Nevertheless, the truth that now not all capital has exited the sphere as an entire can nonetheless be an positive signal for the rally’s go back.

BTC Worth

Bitcoin had plunged against $40,000 the day past, however the coin has already made some speedy cure because it’s now buying and selling across the $41,700 degree.

Seems like BTC has made some cure from its lows | Supply: BTCUSD on TradingView

Featured symbol from Shutterstock.com, charts from TradingView.com, Santiment.web

Disclaimer: The object is equipped for tutorial functions handiest. It does now not constitute the evaluations of NewsBTC on whether or not to shop for, promote or conserve any investments and of course making an investment carries dangers. You’re instructed to behavior your individual analysis earlier than making any funding choices. Usefulness data supplied in this site solely at your individual possibility.