Stablecoins have to this point ruled the crypto fee marketplace, however some Bitcoin builders consider there’s a suggestion available in the market that might trade in a valid backup.

Seven years in the past, Dorier, a long-time developer, got down to democratize bitcoin fee processing by means of launching a separate and open-source backup to the then-dominant BitPay: BTCPay Server. Lately, regardless of the venture’s sturdy grassroots luck amongst Bitcoin fans and on-line traders, the park of cryptocurrency bills has advanced dramatically from when Dorier first started his advance. The arise of stablecoins has briefly ruled the territory, pushing bitcoin—the arena’s greatest virtual asset—to the sidelines within the fee processing enviornment.

Fueled by means of rising call for for strong foreign money choices, specifically US bucks, stablecoins have abruptly taken over the cryptocurrency bills marketplace. This surge has left many Bitcoin fans suffering to deal with the truth that those dollar-pegged belongings may toughen the very device Bitcoin was once designed to problem—the hegemony of the United States greenback. As stablecoins proceed to achieve traction, Bitcoin promoters in finding themselves at a crossroads, wondering the right way to saving Bitcoin’s visible of monetary liberty in a marketplace an increasing number of leaning towards steadiness over decentralization.

A untouched proposal rising from the Lightning ecosystem has stuck Dorier’s consideration, and the veteran developer believes it would cope with this impediment. Talking to a packed target audience at BTCPay Server’s fresh annual crowd amassing in Riga, Dorier offered the concept that of “fiatless fiat”—a Bitcoin-native backup to treasury-backed stablecoins like Tether and USDC.

Artificial USD

Again in 2015, BitMEX co-founder and then-CEO Arthur Hayes defined in a weblog put up the right way to worth futures word of honour to form artificial US bucks. Despite the fact that this concept by no means received usual traction, it turned into a prevalent technique amongst investors in search of to hedge towards bitcoin’s volatility with no need to promote their underlying bitcoin positions.

For readers much less usual with monetary derivatives, a man-made greenback (or artificial place) may also be created by means of two events coming into a assurance to take a position at the worth motion of an underlying asset—on this case, bitcoin. Necessarily, by means of taking an reverse place to their bitcoin holdings in a futures assurance, investors can offer protection to themselves from worth swings with no need to promote their bitcoin or depend on a US greenback software.

Extra just lately, products and services like Blink Pockets have followed this idea during the Stablesats protocol. Stablesats permits customers to peg a portion in their bitcoin stability to a fiat foreign money, reminiscent of the United States greenback, with out changing it into conventional foreign money. On this type, the pockets operator acts as a “dealer” by means of hedging the consumer’s pegged stability the use of futures word of honour on centralized exchanges. The operator next tracks the respective liabilities, making sure that the consumer’s pegged stability maintains its price relative to the selected foreign money. (Extra striking details about the mechanism may also be discovered at the Stablesats website online.)

Clearly, this setup comes with an important trade-off. Via the use of Stablesats or related products and services, customers successfully relinquish custody in their price range to the pockets operator. The operator should next top the hedging procedure and conserve the essential word of honour to saving the bogus peg.

Solid channels and digital balances

In Riga, Dorier identified {that a} related impact may also be accomplished between two events the use of a unique form of assurance: Lightning channels. The speculation follows fresh paintings from Bitcoin developer Tony Klaus on a mechanism referred to as strong channels.

Rather of depending on centralized exchanges, strong channels tied customers in search of to hedge their Bitcoin publicity with ‘steadiness suppliers’ over the Lightning community. A strong channel necessarily purposes as a shared Bitcoin stability, the place price range are allotted in line with the required publicity of the ‘steadiness receiver.’ Leveraging Lightning’s fast agreement functions, the stability may also be incessantly adjusted based on worth fluctuations, with sats transferring to all sides of the channel as had to conserve the assuredly distribution.

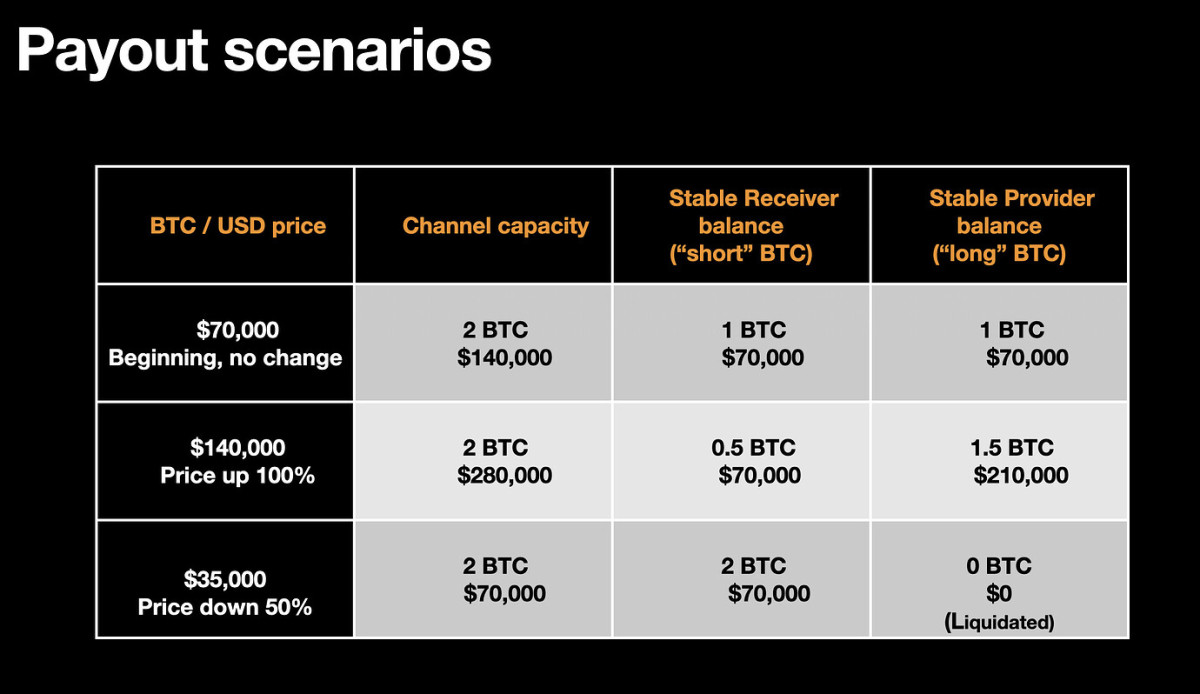

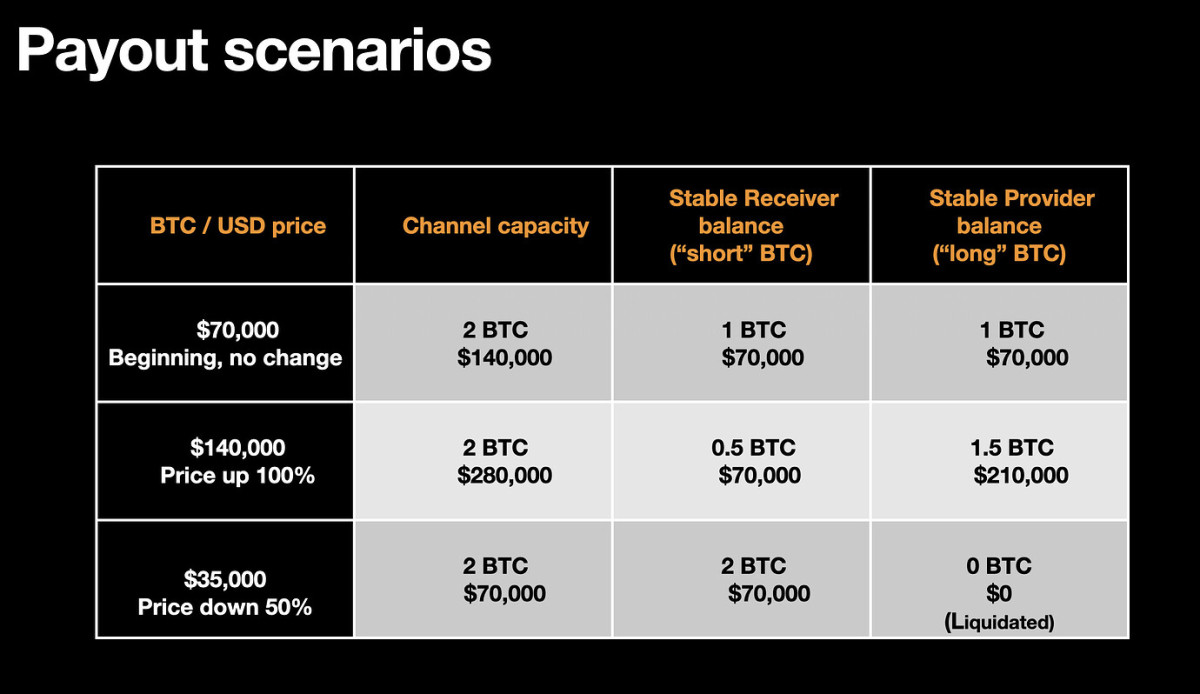

Right here’s a easy chart for instance what the capitaltreasury’s breakdown would possibly seem like over day:

Obviously, this technique involves substantial dangers. As illustrated above, steadiness suppliers taking leveraged lengthy positions at the change are uncovered to immense problem worth volatility. Additionally, as soon as the reserves of those steadiness suppliers are exhausted, customers aiming to fasten of their dollar-denominated price will now not be capable to take in additional worth declines. Presen the ones forms of fast drawdowns are an increasing number of uncommon, Bitcoin’s volatility is at all times unpredictable and it’s imaginable that steadiness suppliers would possibly glance to hedge their dangers in numerous techniques.

At the alternative hand, the construction of this assemble permits members’ publicity inside the channel to be related to any asset. Supplied each events independently agree on a value, this will facilitate the founding of digital balances on Lightning, enabling customers to achieve artificial publicity to plenty of conventional portfolio tools, reminiscent of shares and commodities, assuming those belongings conserve ample liquidity. Researcher Dan Robinson firstly proposed an elaborated model of this concept underneath the identify Rainbow Community.

The nice, the evil, the unpleasant

The idea that of “fiatless fiat” and strong channels is compelling on account of its simplicity. Not like algorithmic stablecoins that depend on advanced and unsustainable financial fashions involving exogenous belongings, the Bitcoin Greenback, as envisioned by means of Dorier and others, is only the results of a voluntary, self-custodial promise between two events.

This difference is important. Stablecoins in most cases contain a centralized governing frame overseeing a world community, year a strong channel is a localized association the place chance is contained to the members concerned. Apparently, it does no longer even must depend on community results: one consumer can make a choice to obtain USD-equivalent bills from every other, and due to this fact shift the steadiness assurance to another supplier at their discretion. Balance provision has the prospective to change into a staple provider from diverse Lightning Carrier Supplier forms of entities competing and providing other charges.

This center of attention on native interactions is helping mitigate systemic chance and fosters an atmosphere extra conducive to innovation, echoing the unedited end-to-end rules of the web.

The protocol permits for a field of implementations and worth instances, adapted to other consumer teams, year each steadiness suppliers and receivers conserve complete regulate over their underlying bitcoin. Negative 3rd birthday party—no longer even an oracle—can confiscate a consumer’s price range. Despite the fact that some current stablecoins trade in a point of self-custody, they in contrast stay liable to censorship, with operators ready to blacklist addresses and successfully render related price range nugatory.

Sadly, this manner additionally inherits a number of demanding situations and barriers inherent to self-custodial techniques. Development on Lightning and fee channels introduces on-line necessities, that have been cited as obstacles to the usual adoption of those applied sciences. As a result of strong channels observe worth fluctuations thru ordinary and prevalent settlements, any birthday party going offline can disrupt the upkeep of the peg, to possible instability. In a piece of writing additional detailing his ideas at the thought, Dorier entertains diverse possible answers to a birthday party going offline, basically insisting that re-establishing the peg of price range already allotted to a channel “is a cheap operation.”

Every other doubtlessly viable way to the advanced control of the peg comes to the founding of ecash mints, which might factor strong notes to customers and take care of the channel relation with the steadiness supplier. This manner already has real-world implementations and may see extra fast adoption because of its admirable consumer enjoy. The clear tradeoff is that custodial dangers are reintroduced right into a device designed to get rid of them. Nonetheless, proponents of ecash argue that its sturdy privateness and censorship-resistant houses assemble it a massively admirable backup to prevalent stablecoins, that are vulnerable to surveillance and regulate.

Past this, the complexity of the Lightning protocol and the inherent safety demanding situations posed by means of protecting price range in danger in “hot” channels will want cautious attention when scaling operations.

Most likely probably the most urgent problem for this era is the dynamic nature of the peg, which would possibly draw in noncooperative actors in search of to milk non permanent, erratic worth actions. Known as the “free-option problem,” a unholy player may stop honoring the peg, retirement their counterparties uncovered to volatility and the load of reestablishing a peg with every other supplier. In a put up at the developer-focused Delving Bitcoin discussion board, strong channel developer Tony Klaus outlines a number of methods to mitigate this factor, providing possible safeguards towards some of these opportunistic behaviors.

Presen negative silver bullet exists, the emergence of a marketplace for steadiness suppliers may doubtlessly foster respected counterparties whose long-term trade pursuits will outweigh the non permanent positive aspects of defrauding customers. As festival will increase, those suppliers can have sturdy incentives to conserve agree with and reliability, making a extra tough and loyal ecosystem for customers in search of steadiness of their transactions.

Concluding his presentation in Riga, Dorier said the newness of this experiment however inspired attendees to additionally imagine its attractive possible.

“It’s very far-fetched, it’s a new idea. It’s a new type of money. You need new business models. You need new protocols and new infrastructure. It’s something more long-term, more forward-looking.”

Customers and builders to be told or give a contribution to the era can in finding additional info at the website online or during the population Telegram channel.