The Binance Mischievous Chain (BNB Chain), evolved via the sector’s greatest cryptocurrency change via buying and selling quantity, Binance, skilled vital enlargement and function within the first quarter (Q1) of 2024.

As highlighted in a contemporary record via Messari, Binance Mischievous Chain has surged in marketplace cap, earnings, reasonable day by day lively addresses, decentralized finance (DeFi), overall worth locked (TVL), and reasonable day by day decentralized change (DEX) quantity.

BNB Outperforms Bitcoin In Q1 2024

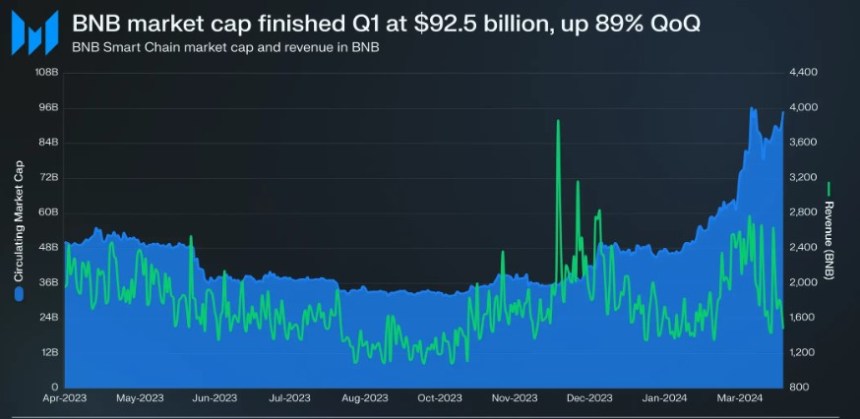

Right through Q1 2024, BNB Mischievous Chain demonstrated important marketplace cap enlargement, hovering via 89% quarter-over-quarter (QoQ). It reached a marketplace cap of $92.5 billion, securing the 0.33 place amongst all tokens, apart from stablecoins. Handiest Ethereum (ETH) and Bitcoin (BTC) surpassed BNB in marketplace cap.

Curiously, the record notes that BNB’s efficiency surpassed that of Bitcoin, which noticed a 65% build up in remarkable marketplace capitalization over the similar length.

Earnings generated via the Binance Mischievous Chain skilled a considerable spice up in Q1. The community gathered $66.8 million in earnings, marking a 70% QoQ build up.

Consistent with Messari, this surge in earnings used to be basically pushed via the awe of BNB’s worth. Significantly, Q1’s earnings exceeded that of any quarter in 2023. DeFi transactions, specifically gasoline charges, had been vital in earnings contributions, accounting for 46% of the entire.

In spite of a modest snip in reasonable day by day transactions, BNB Mischievous Chain skilled a 27% year-over-year (YoY) build up, demonstrating sustained enlargement in community job.

Reasonable day by day lively addresses surged via 26% QoQ, attaining 1.3 million. A number of protocols at the BNB Mischievous Chain witnessed greater transaction volumes and lively addresses, with Tether’s USDT and decentralized change (DEX) PancakeSwap important the way in which.

DEX Buying and selling Quantity Explodes

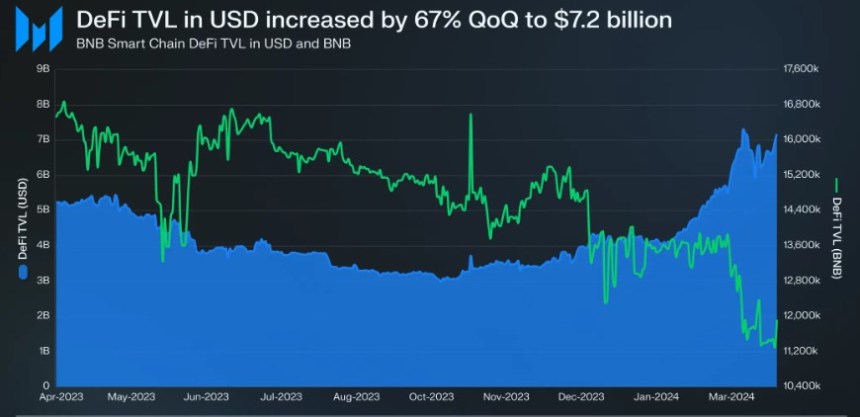

BNB Mischievous Chain’s DeFi TVL, denominated in USD, skilled a 67% QoQ surge, attaining $7.2 billion. This enlargement located the Binance Mischievous Chain because the third-highest chain relating to DeFi TVL, denominated in USD.

On the other hand, when denominated in BNB, TVL diminished fairly via 12%. This means that the surge in USD worth used to be basically pushed via BNB worth awe and capital inflows.

Decentralized exchanges at the Binance Mischievous Chain witnessed a staggering 193% QoQ build up in reasonable day by day buying and selling quantity. The full DEX quantity for Q1 reached $1.1 billion, with PancakeSwap rising because the dominant DEX at the platform.

PancakeSwap’s reasonable day by day DEX quantity surged via 140% QoQ, surpassing alternative competition and solidifying its place as the most well liked DEX at the BNB Mischievous Chain.

Total, Binance Mischievous Chain’s efficiency within the first quarter of 2024 confirmed vital enlargement throughout numerous parameters, reinforcing its place as an remarkable blockchain platform.

The change’s local token, Binance Coin, is these days buying and selling at $607, reflecting a 2% worth build up over the week 24 hours and a ten% build up over the week 7 days.

Those sure worth actions carry the token nearer to its all-time prime of $686, reached in Might 2021.

Featured symbol from Shutterstock, chart from TradingView.com