Sweeping around the shores of Latin The usa comes a scheme from probably the most maximum predatory figures within the project capital ecosystem of the USA. This is a brazen effort to claim overseas affect throughout Latin The usa and threatens to reshape the very material of the pocket and the while to while lives of its nation. At its core is a serpentine all set of contractual responsibilities, held on the municipal degree, solid right through Central and South The usa, guarded by means of an intelligence-linked satellite tv for pc corporate, and regulated by means of a non-public sector consortium of green-washed financiers aiming to show the pocket’s woodlands into fairness and carbon credit. On the identical pace, it obliges native governments to spend “conservation” finances on initiatives that additional financialize nature and help the development of an inter-continental “smart” grid. One in every of its key ambitions seems to be additional entrenching the debt load of the pocket throughout the multi-lateral building banks and the dollarization of the continent from the subnational degree up via carbon markets guarded by means of a virtual ledger. What turns out like a technological surprise geared toward journey and connectivity harbors a darker schedule — one who intertwines planetary surveillance, monetary predation, geopolitical maneuvering, and the domination of a resource-rich continent buried in debt.

This brilliant design, identified by means of the acronym GREEN+ and conceived by means of stalwarts of the virtual greenback and debt schemes of the personal sector, has quietly taken root via a internet of political entanglements on the native degree. Even a key determine within the Drexel Burnham Lambert junk bond scandal performs a job. Astonishingly, each and every capital town of Latin The usa has spontaneously signed on, it appears blind to the fables hooked up to those apparently benign partnerships, past a majority of municipalities within the pocket have additionally made constancy with those identical teams that may push them to connect GREEN+, probably in an issue of weeks. The (with a bit of luck) well-meaning regional governments have unwittingly cleared the path for a sweeping surveillance equipment fasten to American perception that threatens to erode privateness and civil liberties below the guise of journey and fighting the environment situation.

Upon additional commentary, GREEN+’s connections disclose a irritating narrative of economic pursuits melding with geopolitical ambitions. The backers of the satellite tv for pc corporate proportion ties with former contributors of the perfect places of work of US monetary coverage and law along the important thing architects and profiteers of personal capital settingup, aiming to consolidate keep watch over over financial flows in Latin The usa throughout the redistribution of distressed authorities debt from the population to the personal sector. As this two-part order will display, this concerted try isn’t simply about surveillance – it’s a calculated walk in opposition to additional dollarization, tightening the hold of company and technological monopolies over the industrial ground of the Americas.

The scheme’s proponents additionally discuss of ways it’ll considerably move the “economic” and “regional” integration of the Americas, invoking seeing of harmony past obscuring the actual nature in their schedule for financial domination and more potent regional governance. Their fashion, eerily harking back to the EU’s transition from a unfastened industry union to a bureaucratic behemoth yoked to the USA throughout the Eurodollar, units the degree for unelected entities to put into effect insurance policies via programmable cash, enabled by means of intriguing pledges on blockchains and designed to learn the few on the expense of the various. What materializes ahead of us isn’t just a technological evolution however a tranquility banker coup — one who lays the groundwork for land grabs and invasive surveillance below the guise of journey and conservation. It’s a story that echoes right through historical past, the place intelligence-linked figures and predatory monetary pursuits converge to prey upon the World South, depart a path of monetary exploitation and geopolitical manipulation of their wake. What masquerades as journey for people and the situation at massive might be the harbinger of a pristine occasion of subjugation and keep watch over.

The GREEN+ Program

In 2022, a number of teams got here in combination to origination the GREEN+ (Executive Relief of Emissions for Environmental Internet + Acquire) Jurisdictional Programme, the “first program that will monitor by satellite all subnational protected areas of the planet” and – via pledges with diverse native and circumstance governments – propel and deepen the industrial integration of the Americas throughout the tranquility imposition of a continent-wide, blockchain-based carbon marketplace.

GREEN+ has been piloted in a handful of Latin American towns since its forming and is because of origination globally in only some weeks pace. Lots of the GREEN+ oaths with “subnational” governments have remained interested in Latin The usa. In keeping with this system, the subnational oaths have established the “rules and requirements to enable accounting and crediting with GREEN+ policies and measures and/or nested projects, implemented as GHG mitigation activities,” with GREEN+ being described as “the planet’s new subnational government advisory mechanism.”

Key to this system are the services and products supplied by means of GREEN+ forming member Satellogic, an Argentina-founded corporate carefully aligned with Peter Thiel’s Palantir and Elon Musk’s SpaceX that makes a speciality of sub-meter answer satellite tv for pc surveillance. Satellogic, a contractor to the USA authorities and whose founders have been additionally prior to now contactors for the USA’ DHS, NSA and DARPA, will serve surveillance records of all the international’s “protected areas” to GREEN+’s governing coalition, composed of the NGOs CC35, the World Footprint Community, The Power Coalition and alternative “respected stakeholders.”

In keeping with the click shed that main points Satellogic’s alliance with GREEN+, the satellite tv for pc surveillance records “will enable individuals, organizations, and global markets to accurately monitor the compliance of signatory jurisdictions to avoid deforestation.” Then again, alternative knowledge within the press shed unearths that woodlands will in fact be monitored to bring about producing “credible” carbon credit to be traded on exchanges by means of GREEN+ in the name of subnational governments. The click shed additionally states that the GREEN+ alliance with Satellogic will “advance the future measurement of energy emissions in the most populated areas of the planet,” i.e. the surveillance of carbon emissions from territory. Satellogic introduced some GREEN+-affiliated satellites in 2022 as a part of its pilot and is because of origination the extra this April all over Miami Order Hour. Satellogic’s date and later launches of GREEN+ satellites have been/might be carried out in collaboration with Elon Musk’s SpaceX, additionally a contractor to the USA army and US perception companies.

Although framed so as to create financial incentives to mitigate environment exchange, this system is according to California’s debatable and grift-prone cap and industry program and has been created (and is being carried out by means of) folks and corporations which might be in search of to covertly dollarize Latin The usa and/or have deep ties to US perception. Its terminating ambitions move a ways past carbon markets and search to utility satellite tv for pc surveillance to put into effect carbon emission ranges in each city and rural farmlands. It additionally seeks to impose a pristine monetary device focused round calories, commodity, and herbal useful resource “credits” which might be underpinned by means of in depth and invasive surveillance, underscored by means of the motto: “Earth observation is preservation.”

The alliance that created GREEN+ contains the NGOs CC35, the World Footprint Community (GFN), Arnold Schwarzenegger’s Catalytic Finance Understructure (CFF, previously R20) and The Power Coalition (TEC); the Gibraltar-based regulation company Isolas; the worldwide insurance coverage immense Lockton; the satellite tv for pc corporate Satellogic; the “green” blockchain corporate EcoRegistry; the dominant carbon credit score certifier in Latin The usa, Cercarbono; and Rootstock (RSK), the bitcoin side-chain protocol accountable for “smart BTC.” A number of contributors of the alliance, although what number of is opaque, now perform as a part of a consortium related to an organization known as World Carbon Landscapes, which is mentioned in better constituent upcoming on this article and now manages primary sides of GREEN+. The NGOs (i.e. CC35, GFN, CFF and TEC) interested by forming GREEN+ are those that in fact lead the GREEN+ program from California.

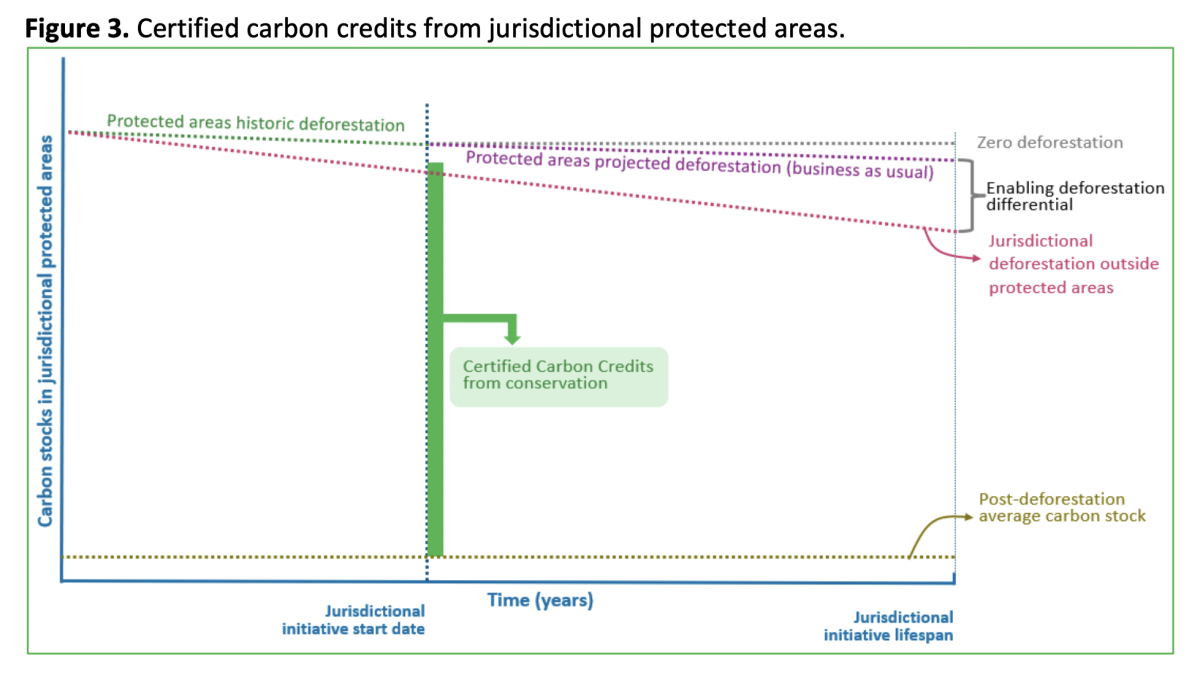

As prior to now discussed, this system takes carbon in “effectively conserved protected areas of a sub-national jurisdiction”, i.e. a town, county, province, or circumstance/pocket, and converts them into carbon credit. In keeping with this system, “these credits are traded on the [carbon] offset market, and income is deposited in a trust fund” this is managed by means of GREEN+ and is referred to as the GREEN+ Consider. That believe is administered by means of unspecified people who paintings for Lockton, Isolas and Rootstock. Alejandro Guerrero, head of Lockton’s Argentina & Uruguay segment, is the one publicly stated member of the believe.

Some other web site fasten to the GREEN+ initiative describes the preliminary procedure as follows:

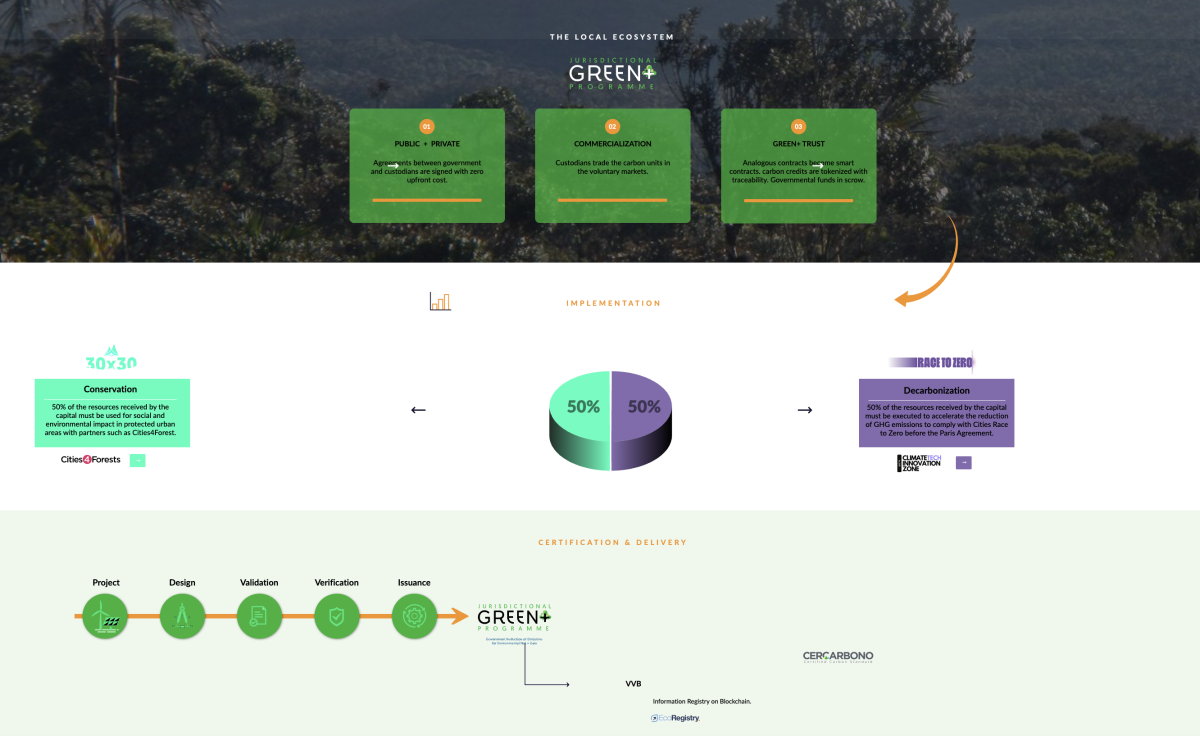

- Nation and personal oaths between [a subnational] authorities and custodians are signed with 0 in advance price.

- Custodians industry the carbon devices which might be produced by means of the subnational governments (the population sector) signing pledges with the personal sector in voluntary carbon markets.

- The ones pledges signed by means of the subnational governments develop into intriguing pledges and carbon credit are next tokenized for traceability.

- The GREEN+ Consider holds authorities finances in escrow.

Due to this fact, “a partial release of trust funds is made periodically during the crediting period of the jurisdictional initiative.” From this “partial release,” “a percentage operational fee” is deducted (the share is mysterious in this system’s paperwork) and paid to the GREEN+ program past a distant (and likewise mysterious) price could also be deducted “for the operation of the GREEN+ Trust.” Disbursements of what left-overs are made every year over a 10 hour duration and, in step with graphs produced by means of GREEN+, the ones bills stay the similar, fastened worth even though the worth of the carbon credit of the safe farmlands grows.

Between 40% and 60% of the finances in fact gained by means of subnational governments will also be impaired to “design and execute projects” geared toward conservation, past the residue “is allocated for new jurisdictional decarbonisation initiatives” that may put together supplementary or “consequential” carbon credit. Those “consequential” credit are next “offered as a preferred option to the investors who initially purchased the conservation credits at a 50% discounted price calculated at the current market price.” Then again, upcoming in the similar file, this system says that “the amount required for the initial implementation” of conservation initiatives “may not exceed 20% of the funds allocated [from the GREEN+ Trust] to the jurisdictional initiative.” Obviously, the quantity of finances in fact being generated for conservation-related initiatives is minimum and, even in the most efficient case situation, is lower than part of the capital generated by means of the carbon credit themselves. Then again, as we will see, those “conservation” initiatives will have to be accomplished along with authorized companions of World Carbon Landscapes, which – just like the group itself – are fasten to predatory monetary pursuits and oligarchs with questionable motives.

Of the finances that governments in fact obtain as a part of GREEN+, part are formally intended to move towards conservation-related initiatives past the alternative part are supposed to move towards decarbonization-related initiatives. Then again, at the World Carbon Landscapes-GREEN+ web site, it notes that the decarbonization initiatives will have to be carried out along Folk Electrical energy, which modes a part of World Carbon Landscapes and is carefully linked to the GREEN+ alliance member The Power Coalition (TEC). As might be mentioned upcoming, TEC and Folk Electrical energy are in combination making an attempt to create an inter-continental “smart” grid within the Americas and also are interested by efforts to create “smart” towns and suburbs.

As for GREEN+’s conservation initiatives, the web site states that “50% of the resources received by the capital [city as part of GREEN+] must be used for social and environmental impact in protected urban areas with partners such as Cities4Forests.” Cities4Forests used to be based by means of the International Assets Institute (WRI), a International Financial Discussion board associate and contractor to suspected CIA entrance USAID this is interested in useful resource “sustainability.” WRI is funded by means of the USA and several other Eu governments, billionaires Invoice Gates, Jeff Bezos and Mike Bloomberg in addition to Google, Meta/Fb, the Soros relations’s Not hidden Societies Foundations, the UN, Walmart, the International Cupboard and the International Financial Discussion board, amongst others. WRI’s Cities4Forests stocks most of the identical investment assets, such because the governments of the United Kingdom, Germany, Denmark and the USA in addition to the International Cupboard and the Caterpillar Understructure. Alternative funders come with the Wall Side road immense Citi Staff, the Rockefeller Understructure and the Inter-American Building Cupboard (IDB). Particularly, the Rockefeller Understructure and the IDB lately teamed as much as assemble the Intrinsic Change Staff, which has spearheaded the financialization of nature by way of the settingup of Herbal Asset Companies (NACs). As Limitless Hangout prior to now reported, NACs assemble companies that snatch keep watch over of herbal property that have been prior to now a part of the “commons,” such as forests, rivers and lakes, and then sell shares of those assets to Wall Street asset managers, sovereign wealth funds and other financial institutions in order to generate profit under the guise of “conserving” the asset they aim.

Unsurprisingly, maximum of Cities4Forests’ initiatives, comparable to those who can be constructed with GREEN+ finances, are matching to NACs in that they focal point on the usage of herbal property and “natural capital” to put together pristine monetary and insurance coverage merchandise. Examples of Cities4Forests “conservation” initiatives come with the advance of a Jungle Resilience Bond and the Republic of India Discussion board for Nature-based Answers. Probably the most Republic of India-based discussion board’s “core partners” is the Nature Conservancy, which has been run by means of Wall Side road bankers for years and has pioneered the fashionable iteration of the debatable “debt for conservation” change amongst alternative “nature-based solutions.” The funders of Cities4Forest and its writer the WRI also are deeply affiliated with teams just like the Glasgow Alliance for Internet 0 (GFANZ) and UN-backed environment finance tasks that brazenly search to utility debt imperialism to herd the worldwide financial system, with a focal point on rising markets, right into a pristine device of worldwide monetary governance.

Thus, the “conservation” and “decarbonization” efforts that subnational governments will have to enact as a part of their contractual oaths with GREEN+ will move in opposition to initiatives fasten to both the intriguing grid/intriguing town developer Folk Electrical energy or a “conservation” group subsidized by means of Western oligarchs, multi-national companies and banks that seeks to financialize and monetize nature below the guise of maintaining it.

CC35 and the Subnational Pivot

CC35, or Ciudades Capitales de las Americas frente al Cambio Climático (American Capital Towns Going through Order Exchange), is probably the most perceptible group in the back of the GREEN+ program and some of the contributors of its governance committee. CC35’s function is the industrial integration of the Americas (North, South and Central) via coordinated environment exchange insurance policies, in particular the settingup of an Inter-American carbon marketplace, with GREEN+ being the approach of imposing that marketplace. The crowd specializes in “subnational” governments, particularly capital towns of the Americas, thereby circumventing nationwide governments with appreciate to Order Exchange-related coverage.

Referring to GREEN+, Sebastián Navarro, the secretary common of CC35, mentioned of this system that: “We will be relentless from the governance of the GREEN+ program with those who want to continue playing with the future of humanity,” including that their “relentless” method can be a great deal aided by means of Satellogic’s satellite tv for pc surveillance features, which might additionally “generate unprecedented credibility among investors of the carbon credits produced by conservation.” Navarro’s oath to be “relentless” in governing a satellite tv for pc surveillance regime of American woodlands to bring about generating “high-credibility” carbon markets.

Moment framed as an initiative “born out of Latin America,” CC35 is registered in Miami; Florida (Coral Gables, in particular) and has lengthy been funded and partnered with US-based pursuits. As an example, CC35’s first companions have been R20 (Areas of Order Motion, now the Catalytic Finance Understructure), a bunch created by means of former California governor Arnold Schwarzenegger in partnership with the UN, and the Leonardo DiCaprio Understructure. From there, CC35 partnered with UN and UN-linked organizations in addition to Pegasus Capital Advisors, which additionally funds CC35 and Schwarzenegger’s R20/Catalytic Finance Understructure. R20/Catalytic Finance, like CC35, focuses its consideration on “subnational” governments.

Pegasus Capital is the company created by means of Craig Cogut, a key determine within the “junk bond” monetary scandal on the now defunct Drexel Burnham Lambert. Drexel’s junk bond branch, led by means of Michael Milken, i’m busy in blatantly criminal activity and impaired junk bonds to backup gas the takeovers of primary companies by means of the occasion’s notorious “corporate raiders” ahead of the store’s faint. In particular, Cogut used to be the attorney who urged the Milken-run and scandal-ridden junk bond branch at the legality of transactions, together with those who noticed Milken develop into a convicted felon. Following Drexel’s faint, Cogut teamed up with a bunch of Drexel alumni led by means of Leon Lightless – now best possible identified for his near affiliation with dead body intercourse trafficker and “financial adviser” Jeffrey Epstein – to co-found Apollo Advisers (now Apollo World Control) in 1990. Cogut left Apollo to chanced on Pegasus in 1996 and Pegasus has since changed into a key participant in different UN-supported “green” finance tasks. Cogut could also be financially entangled with Satellogic’s co-founder, Emiliano Kargieman, as might be mentioned upcoming.

Cogut therefore changed into a board member of Arizona Shape College’s World Institute of Sustainability, which used to be created by means of Michael Crow (and who served at the board along Cogut). Crow is chairman of the board of trustees In-Q-tel, the CIA’s project capital arm. Cogut additionally served at the board of ASU’S McCain Institute, named for the overdue Senator John McCain, which has hyperlinks to Ashton Kutcher’s CIA-linked capitaltreasury Thorn. Stream board contributors of the McCain Institute come with each Crow and previous CIA director David Petraeus on its board, in addition to Lynn Forester de Rothschild, who co-created the Council for Inclusive Capital with the Vatican. Cogut used to be additionally at the board of the Clinton Condition Get admission to Initiative (CHAI), a part of the Clinton relations philanthropies, and CHAI used to be in large part formed and influenced by means of infamous intercourse trafficker and “financial advisor for billionaires” Jeffrey Epstein, having been the eminent reason why for former president Invoice Clinton’s flights on Epstein’s airplane within the early 2000s.

Particularly, Cogut isn’t the one Drexel alum to be interested by “green finance.” The farmland of “green finance” itself used to be necessarily invented by means of Richard Sandor, who made tens of millions at Drexel all over the Nineteen Eighties, pioneering “innovative” merchandise just like the collateralized loan legal responsibility (CMO), which might upcoming give a contribution to the 2008 monetary situation. Sandor had prior to now been deemed the “father of financial futures” and could also be credited with serving to assemble derivatives. Then Drexel’s faint, Sandor moved directly to pioneering carbon emissions buying and selling and carbon markets with the optic of making “an all-electronic exchange for carbon trading,” a optic that has since taken condition.

CC35 has lengthy been led by means of Sebastián Navarro. Beneath his management, CC35 helped dealer the settingup of the Subnational Order Capitaltreasury, which is subsidized by means of Cogut’s Pegasus Capital along side BNP Paribas, the Rockefeller Understructure, the Bloomberg Philanthropies and the governments of Germany, the United Kingdom, Australia and the Netherlands. That investmrent specializes in financing infrastructure initiatives within the World South on the subnational (e.g. town, circumstance) degree, once more bypassing nationwide governments. Certainly, the principle modus operandi of CC35 is brokering pledges between little, subnational governments and “green” finance entities which might be fasten to facilities of US/Eu political or monetary energy.

Navarro is indexed as a director of CC35 as are two leading, right-leaning Latin American politicians: Felipe Alessandri Vergara, mayor of the Chilean capital Santiago from 2016 to 2021, and Nasry Asfura Zablah, former mayor of the Honduran capital Tegucigalpa and previous Honduran presidential candidate. Alessandri is a important determine in Chilean center-right politics and an best friend of the lately deceased former Chilean president Sebastián Piñera. Alessandri is debatable throughout the Chilean accurate for his covert assistance of tasks typically preferred by means of the left and publicly avoided by means of his birthday celebration past serving as Santiago’s mayor, comparable to environment finance/regional financial integration (by way of CC35) and his financing of tasks connected to unlawful immigration. Alessandri’s successor and intended political nemesis, Irací Hassler of Chile’s Communist Birthday party, has since taken over for Alessandri as CC35’s Vice President for South The usa. As for Nasry Asfura, he used to be the topic of a Honduran political scandal because of his look within the Pandora Papers and his alleged involvement in suspicious offshore finance actions. He used to be additionally indicted on cash laundering and investmrent embezzlement, however fees have been dropped below Asfura’s successor Jorge Aldana, who’s now president of CC35.

The new vp of CC35 for Central The usa is Mario Durán, the mayor of San Salvador and a near best friend of El Salvador’s president Nayib Bukele in addition to a member of Bukele’s Nuevas Concepts birthday celebration. Durán is i’m ready to break in the management of CC35 in step with a up to date announcement from the crowd. In 2021, Durán signed a retain with CC35 relating to schooling in regards to the utility of Bitcoin in all metropolitan pocket municipalities in El Salvador, and is the one point out of CC35 selling the utility of Bitcoin. As might be famous once more upcoming on, the CC35-led GREEN+ initiative is partnered with Rootstock, which created and develops a Bitcoin sidechain that permits intriguing pledges at the Bitcoin blockchain. Possibly, the function is to run GREEN+’s virtual carbon marketplace at the identical blockchain.

Moment it is going to appear abnormal to an American target market that “regional integration” efforts below the guise of environment exchange can be led in large part by means of right-leaning politicians, it’s remarkable to indicate that such integration efforts have traditionally been led by means of each left and accurate factions in Latin The usa, who compete for dominance over the pocket. As an example, right-leaning efforts at economically and/or politically integrating the Americas come with Mercosur (the Southern Habitual Marketplace, now championed by means of the “anti-globalist” Javier Milei) and Prosur (Discussion board for the Journey and Integration of South The usa, introduced by means of Chile’s center-right Piñera). Left-leaning efforts come with ALADI (Latin American Integration Affiliation) and UNASUR (Union of South American International locations). All of those efforts have failed because of geopolitical disagreements basically focused round whether or not to lend club to international locations like Venezuela, Cuba and others with governments estranged from the so-called “Washington consensus” or, extra lately, efforts to forge nearer ties to Russia and/or China. For the reason that a number of remarkable Latin American international locations can unexpectedly exchange what facet of the “consensus” they’re on relying on presidential election effects, comparable to lately came about in Brazil and Argentina, those regional integration efforts have failed to realize vital traction over the utmost a number of a long time. Nonetheless, the top function of monetary integration begetting political integration left-overs the similar. Thus, as CC35 presentations, the rush to domestically combine Latin The usa has now, very quietly, pivoted clear of engagement on the nationwide degree to the subnational degree.

The Membership of Rome’s World Footprint

Moment CC35 is probably the most perceptible face of GREEN+’s governing frame, it’s in fact chaired by means of a bunch known as the World Footprint Community (GFN). The GFN exists to advertise “the Ecological Footprint, which tracks how much nature we use and how much we have, as an accounting tool” for inexperienced finance tasks and originated the idea that of “ecological debt” according to that metric. In different places, the GFN requires “one-planet prosperity” and emphasizes environment finance, a farmland ruled by means of predatory Wall Side road banks and billionaires, as an financial crucial. They paintings with governments at each the nationwide and subnational degree and identify the carbon emissions limits for localities, states and international locations that systems like GREEN+ search to put into effect with satellite tv for pc surveillance and binding contractual responsibilities.

The GFN is in detail linked to the Membership of Rome. As an example, GFN’s founder and a member of its board, Mathis Wackernagel, who additionally co-created the Ecological Footprint thought, is a member of the Membership of Rome. Wackernagel’s former professor and the alternative developer of the Ecological Footprint, William Rees, used to be a member of the Membership of Rome till 2018. Heiko Specking, a GFN board member, could also be affiliated with the Membership of Rome as is any other GFN board member, Lewis Akenji.

The Membership of Rome used to be based in 1968 by means of the Italian industrialist Aurelio Peccei and Scottish chemist Alexander King. Its earliest good fortune used to be the 1972 record and upcoming accumulation “The Limits to Growth,” which was based on an MIT study and claimed that “if the world’s consumption patterns and population growth continued at the same high rates of the time, the earth would strike its limits within a century.” The accumulation used to be closely promoted by means of the earliest annual conferences of the International Financial Discussion board, specifically in 1973.

Peccei, who spent a massive a part of his pace dwelling in Argentina, had prior to now been a member of ADELA, the Atlantic Folk Building Staff for Latin The usa. ADELA used to be composed of robust Western firms that pooled cash to spend money on Latin American firms in their opting for, necessarily “king-making” the titans of the Latin American company international. ADELA’s backers integrated Cupboard of The usa, IBM, Fiat (the place Peccei used to be an govt), and the Rockefeller relations’s Usual Oil. The crowd used to be a part of the Rockefeller-dominated community in Latin The usa, which additionally integrated the Global Unadorned Financial system Company (IBEC), which has been related to the 1973 CIA-backed army coup in Chile throughout the Chilean Rockefeller assistant Agustín Edwards, and Deltec, best possible identified nowadays as a primary store for the failed crypto alternate FTX and its near dating with the stablecoin Tether. Fashionable iterations of this community come with Enterprise and the Council of the Americas (CoA), which might be mentioned in the second one a part of this order. Particularly, it used to be Peccei’s accent at an ADELA convention that spurred his partnership with Alexander King and ended in the Membership of Rome’s formation.

On the pace he were given concerned with Peccei and made the Membership of Rome, King used to be head of the Group for Financial Co-operation and Building (OECD). The OECD used to be at the beginning established because the OEEC to backup administer the post-WWII, US-developed Marshall Plan and used to be upcoming expanded to develop into a world group in 1961. The USA left-overs the OECD’s primary funder by means of an important margin. The crowd has lengthy claimed to advertise “sustainable economic growth” and “consistently improving standard of living in its member countries,” however – in follow – it automatically favors neoliberal insurance policies that enrich Western-based multi-national companies. It’s carefully partnered with entities just like the IMF, the International Cupboard and the wider multi-lateral building banking device that has impaired debt slavery bought as “economic development” to denationalise state-owned property and promote them off to privileged company pursuits. That device has additionally been thought to be by means of the USA army to be a part of its arsenal of “financial weapons” impaired to offer protection to US pursuits in a foreign country.

The Membership of Rome used to be criticized for plenty of a long time for embracing neo-Malthusian concept (i.e. eugenics and in particular people keep watch over measures within the growing international) in addition to for selling better international governance. A few of its contributors have championed the imposition of a “benevolent” international dictatorship. Criticisms of the Membership of Rome had been voiced by means of academia in addition to distant and mainstream media. The crowd’s effort to rebrand as an environmental crew to bring to realize usual assistance for those self same insurance policies used to be mentioned of their 1991 accumulation “The First Global Revolution,” which states:

“In searching for a common enemy against whom we can unite, we came up with the idea that pollution, the threat of global warming, water shortages, famine and the like, would fit the bill. In their totality and their interactions these phenomena do constitute a common threat which must be confronted by everyone together. But in designating these dangers as the enemy, we fall into the trap, which we have already warned readers about, namely mistaking symptoms for causes. All these dangers are caused by human intervention in natural processes, and it is only through changed attitudes and behaviour that they can be overcome. The real enemy then is humanity itself.”

The World Footprint Community’s forms, merchandise and beliefs are very a lot aligned with the neo-Malthusian “Limits to Growth” view of the Membership of Rome in addition to the efforts to include nature into monetary markets by way of so-called “nature-based solutions.” Certainly, the GFN’s ecological footprint metric is promoted by means of teams just like the International Financial Discussion board and the International Natural world Capitaltreasury (the place Peccei served at the board and which has lengthy been fasten to Eu oligarch and company pursuits). GFN additionally supplies the statistical approach of enforcing Limits to Expansion-style fashions that keep watch over each people ranges and industrialization ranges on governments by means of growing “ecological budgets” that, as evidenced by means of GREEN+, are actually interfacing without delay with carbon markets.

Development a “GREEN” Energy Monopoly

The alternative member of the GREEN+ governing committee that may keep watch over this system in addition to Satellogic’s surveillance records is The Power Coalition (TEC). Particularly, it used to be TEC’s govt director Craig Perkins who stated that GREEN+ would additionally permit the surveillance of carbon emissions of populated farmlands, probably by way of satellite tv for pc. TEC used to be based by means of John Phillips, who ran Phillips Power – an oil and fuel corporate, in 1975. Since 1979, it’s been carefully partnered with native California governments by way of its Folk Power Partnership program. These days, TEC is partnered with, and a few of its key tasks are financed by means of, primary California fuel firms, referred to by means of TEC as California’s “investor-owned utilities.” Those come with Pacific Fuel and Electrical Corporate, Southern California Edison, SDGE and SoCalGas.

With the backing of those primary oil and fuel firms, TEC assures us it’s “creating the building blocks for a new energy economy.” One in every of its primary companions in doing so is Folk Electrical energy, which claims to be “building the NASDAQ of the clean energy field.” TEC and Folk Electrical energy, which is subsidized by means of Google, have co-designed “a master plan” financed by means of the California Power Fee “to implement the largest and first-of-its-kind decarbonization by electrification protocols using DERs [distributed energy resources], carbon emissions management, blockchain, AI and IoT [internet of things] all connected under one plug-and-play platform.” Folk Electrical designs, finances and develops this era for GluHomes (previously GluEnergy), its mother or father corporate which stocks the similar founder as Folk Electrical energy – Felipe Cano. This system is being piloted within the poorest neighborhoods of Los Angeles in addition to in deprived communities in Colombia. The function, in step with Cano, is to “bring the Americas together” via an inter-continental, “clean” intriguing grid.

The blockchain interested by those efforts is RSK, the intriguing contract-oriented sidechain that runs on lead of the Bitcoin community. As prior to now discussed, RSK is a forming member of GREEN+. The initiative involving TEC, Folk Electrical energy, California’s authorities, and RSK additionally seeks “to digitize carbon credit reporting” and to “create opportunities for businesses to redeem credits.” The Folk Electrical energy/TEC program additionally makes use of the RSK blockchain to document an individual’s calories utilization “with the help of RIF, an identity product [i.e. digital identity] developed by RSK Labs.” The Folk Electrical energy device calls for a virtual ID fasten to a virtual pockets that “is embedded to store daily profits derived from surplus energy sales” that let electrical energy customers to industry calories credit and develop into what the corporate cries “prosumers,” with the function of making “an energy social network.” The Folk Electrical energy {hardware} produced with GluHomes additionally “utilize[s] AI and machine learning to transform any home intro a smart micro electricity generation utility.”

The crowd is partnering with actual property builders to create intriguing houses linked to their energy-related era, with a focal point on social housing and reasonably priced housing, i.e. housing for decrease source of revenue households. The function is to tied in combination retro-fitted current houses, pristine intriguing houses, a local co-op of electrical automobiles and a reward-payment device known as GluPay, which is partnered with Mastercard and Contigo, which designs merchandise “for the unbanked, immigrants, homeless and disadvantaged population,” with a focal point on remittance bills. Contigo is these days in talks with El Salvador’s authorities to have the corporate’s “Payments Wallet tied into the Salvadoran financial inclusion products.” Contigo is administered by means of Raul Hinojosa, an educational at UCLA who wrote a accumulation entitled “Convergence and Divergence between NAFTA, Chile, and MERCOSUR: Overcoming Dilemmas of North and South American Economic Integration,” which specializes in “the impact of a potential Free Trade of the Americas Agreement.”

The writer of Folk Electrical energy and GluHomes, Felipe Cano has additionally spent maximum of his occupation making an attempt to economically combine massive swathes of the arena. As an example, in 1998, his optic used to be “to unify both European and US stock exchanges under one platform and protocol, the create the smart grid of the equity market and stock trading in a bilateral, single network.” This optic led him to assemble ECN Get admission to, which “was the first tech hub in Europe to route the first block of institutional order flows from a European Bank directly to the NASDAQ electronic exchange without intermediaries,” growing what Cano cries “the first smart grid every built.” He next wanted to “create a digital market for the energy sector,” which has since culminated in his settingup of Folk Electrical energy and GluHomes. Cano is an aider to TEC and could also be a senior spouse at Silverbear Capital, the place he specializes in investments connected to intriguing towns. In keeping with his bio at Silverbear, Cano could also be CEO of “Olidata Smart Cities LLC, a market-maker platform which uses nano-grids and microgrids as the underlying strategy to deploy the Internet of Things Protocol of the future.”

Cano used to be additionally, till lately, the president of World Carbon Landscapes, which is a consortium of businesses, the one identified contributors of which all occur to be firms that based GREEN+, with the only exception being Cano’s Folk Electrical energy. World Carbon Landscapes, unsurprisingly, is now some of the primary implementers of the GREEN+ program. World Carbon Landscapes could also be partnered with Aclima, a start-up subsidized by means of Microsoft and the bottom of former Google CEO Eric Schmidt. World Carbon Soil’s mentioned challenge is to “transform protected areas into natural equity” by way of public-private partnerships, necessarily admitting that the GREEN+ program it now is helping supremacy is set financializing safe herbal property and assets.

World Carbon Landscapes “transforms” those woodlands into “natural equity” by means of measuring, certifying and buying and selling carbon credit along with the carbon credit score certification Cercarbono (mentioned upcoming on this article). Their partnership with Satellogic, which matches past but additionally contains the GREEN+ program, makes use of satellite tv for pc surveillance “to ensure the integrity of the preserved area” which accommodates the carbon represented by means of the carbon credit. The corporate additionally promotes their integration with The Power Coalition and Folk Electrical energy to create “advanced electricity communities” that create “renewable calories credit,” which the company claims will “contribute to local wealth creation.” The company is partnered with a financial firm, which does the actual trading of carbon credits for both Global Carbon Parks and presumably GREEN+. However, Global Carbon Parks declines to reveal their identity, merely stating that “They are a financial firm that integrates technical, economic, and environmental solutions.”

In summary, the governance of the GREEN+ program and the group with control over its satellite surveillance data; are tied to or funded by groups that have long used debt as a form of control over the Global South in particular; seek to control the population size and the degree of industrialization in countries; are tied to globalist efforts to economically and politically integrate the Americas; are building a Bitcoin blockchain-based smart grid that surveils and limits energy usage and links energy usage to currency; and are integrating and tokenizing the natural world, including endangered or protected areas, into the financial system under the guise of conservation. Through CC35’s Alcades por el Clima (Mayors for the Climate) initiative, over 15,000 local governments in Latin America have signed agreements with CC35 related to carbon emission trading schemes and limits, led by Brazil (5,564 local governments), Argentina (2,457 local governments), and Mexico (2,481 local governments). Presumably, those carbon neutrality/trading agreements will allow CC35 to push those municipalities into the GREEN+ program, if they aren’t already planning to participate directly (many are).

In other words, the vast majority of Latin America, unbeknownst to the vast majority of its populace, is already contractually yoked to one of the main organizations behind the GREEN+ program – run by interests tied to foreign banks, corporations and even intelligence services. The program is set to launch continent-wide in a matter of weeks. As this article and subsequent article will show, what has transpired is a brazen attempt to conduct a silent coup of the continent’s natural resources, energy production, local governments and economy.

The GREEN+ Trust and the Bitcoin Carbon Market

The GREEN+ Trust, which is to hold and handle the profits from the carbon credits produced and then disburse them to governments if certain conditions are met, is to be managed by individuals “selected from the members institutions of the [GREEN+] Executive Board” as well as from Isolas, Lockton and Rootstock (RSK). According to GREEN+, the Trust is not only responsible for fund custody, but also “the regulation of smart contracts, in coordination with the certification standard [Cercarbono] and the monitoring of mitigation initiatives [conducted by Satellogic].” The only known member of the Trust, as previously mentioned, is Alejandro Guerrero, the head of Lockton’s branch in Argentina and Uruguay.

Lockton, a founding member of GREEN+ and also of Global Carbon Parks, is the world’s largest, privately held insurance brokerage firm that also provides risk management services, employee benefits and retirement services. They are owned by the Lockton family and the company – and the family behind it – are rather secretive. However, the company has been overt about the opportunities they see in the type of carbon market that initiatives like GREEN+ will create.

In a 2023 article, Lockton’s head of Digital Integration and Special Projects, David Briscoe, wrote that making carbon credits “a stable and trusted currency” would “require the support of the insurance market.” This is because, as Briscoe notes, “voluntary” carbon markets come with risks, particularly because “of the financial values involved.” Per Briscoe, these risks include “non- or under-delivery of forward purchased carbon removal credits,” “start-ups concerned within the voluntary carbon marketplace would possibly face insolvency dangers,” and “fraud and negligence.” Certainly, mismanagement and fraud has been a big motive force of why carbon markets have did not catch on in spite of relentless promotion and the adoption of ESG and environment exchange plans by means of most of the maximum robust names in finance and business. Rather of addressing the rampant fraud in carbon credit without delay, it sounds as if that the prime chance of fraud and insolvency has been detectable as a chance to assemble a pristine marketplace for the insurance coverage business, with carbon credit score insurance coverage being framed as the one “feasible” approach of de-risking the fraud-prone international of carbon markets, which were criticized by means of environmental teams and feature been proven to have a little affect on environment.

Lockton trade in a number of merchandise connected to carbon credit and so do its competition, with the primary such insurance coverage having been issued by means of the UK-based insurance coverage corporate Howden in 2022. That product used to be designed to “increase confidence in the Voluntary Carbon Market” and used to be “incubated” in collaboration with “the Insurance Task Force of the Sustainable Markets Initiative; an initiative led by His Royal Highness The Prince of Wales [now King Charles].” Business publications have brazenly posited that carbon credit usually are “the next $1 billion insurance market.” Some firms, like Kita and Oka, have been created in particular to insure carbon credit. Possibly, Lockton’s involvement with GREEN+ signifies that Lockton might be insuring the accumulation of carbon credit to be produced by means of this system, which plans to reap carbon credit from all the international’s “subnational protected areas.” As well as, Lockton’s function because the carbon credit insurer approach it’ll be interested by making sure that the ones towns/areas which might be to develop into a part of GREEN+ conform to this system’s prerequisites to bring to obtain finances from the believe.

Some other member of the GREEN+ Consider is RSK, or Rootstock. RSK is a federated sidechain constructed on lead of the Bitcoin blockchain that permits intriguing retain capability near to the Ethereum blockchain, leveraging the similar programming language referred to as Solidity. In impact, which means any intriguing retain that may be designed and authored on Ethereum, comparable to id methods, dollar-pegged stablecoins, or tokenized carbon credit, will also be “trivially” ported to Bitcoin. The concept that of Bitcoin sidechains used to be first presented in October 2014 by means of a bunch of Bitcoin builders basically hired by means of Blockstream, whose November 2014 seed spherical used to be led by means of Reid Hoffman, that provides “bitcoins and other ledger assets” the facility to be “transferred between multiple blockchains” giving pristine capability to “assets they already own” with out compromising any of the safety innate to Bitcoin’s blockchain. RSK works by means of permitting customers to locker finances despatched the usage of conventional bitcoin transactions right into a pockets managed by means of a federation (on this case, a identified crew of Rootstock-selected key signers) that problems a 1:1 token known as Impish Bitcoin, represented by means of RBTC, which fuels the RVM (Rootstock Digital Device), a forked model of the EVM (Ethereum Digital Device). RBTC is “the native currency” of Rootstock, and is impaired to pay for the costs required to finish and determine the intriguing pledges or transactions that snatch park at the RSK sidechain.

RSK used to be introduced in 2015 by means of RSK Labs, which used to be bought by means of RIF Labs ahead of changing into IOV (“internet of value”) Labs. IOV labs, as of utmost occasion, has rebranded as soon as once more to develop into RootstockLabs. It used to be co-founded by means of Sergio Lerner, who changed into the Bitcoin Understructure’s bitcoin core safety auditor the similar hour he conceived of RSK, and Diego Gutierrez Zaldivar. Gutierrez is the new chairman of RootstockLabs, past Lerner is its eminent scientist and they’re the president and vp, respectively, of the IOV Understructure, which allows “interventions that contribute to sustainable development,” specifically the UN Sustainable Development Goals (SDGs), with a focus on emerging markets and territories. A major goal of the SDGs is to create a new global financial governance system. That system has been described in recent years by top UN climate finance official, central banker, and ex-Goldman Sachs executive Mark Carney, as relying largely on programmable, surveillable digital currencies (namely central bank digital currencies, or CBDCs) and a global carbon market.

According to RootstockLabs and its affiliated foundation, the group’s mission is to harness “the power of digital technology, blockchain, and collaboration” to “break down barriers and create a more equitable society.” In addition they circumstance that Rootstock Labs used to be created with the intent of making “a new open financial ecosystem,” past RIF Labs states it (along side RootstockLabs) is “creating a global financial system that works for everyone.”

Diego Gutierrez is a long-time assistant of Wenceslao (Wences) Casares, an Argentine tech entrepreneur now and again known as the “Peter Thiel of Latin America.” Gutierrez labored with Casares at Argentina’s first Web carrier supplier, which Casares had introduced, and next helped assemble the Casares-founded Argentinian on-line brokerage company Patagon that used to be upcoming bought to Spanish banking immense Santander. Casares, like Gutierrez, is a long-time promoter and early adopter of Bitcoin and is allegedly accountable for pitching the oath of Bitcoin to elites, like Invoice Gates and LinkedIn/PayPal’s Reid Hoffman. Hoffman as soon as referred to Casares as Bitcoin’s “patient zero” relating to Silicon Valley’s passion in Bitcoin. Forbes has even referred to Casares as “crypto royalty who ran with the original gang of Bitcoin OGs.” Casares therefore changed into a board member of PayPal and likewise a part of Fb’s failed stablecoin mission Libra/Diem. He’s additionally a International Financial Discussion board Younger World Chief.

Casares used to be previously a spouse at NXTP Ventures, some of the oldest project capital corporations in Latin The usa, and he’s credited with introducing the company’s founders to crypto. NXTP therefore changed into a big investor in Gutierrez’s RSK in addition to any other Gutierrez-founded corporate, Koibanx, a Latin The usa-focused asset tokenization corporate that – in step with its CEO – is on the “forefront of redefining Latin America’s financial system.” Gutierrez’s Koibanx has been instrumental in growing Bitcoin services backed by means of El Salvador’s authorities in addition to enabling the function of Algorand as an middleman in El Salvador’s Bitcoin ecosystem. Algorand could also be a big investor in Koibanx and is these days run by means of Staci Warden, who aided the cronyist privatization of Russia past at Harvard, oversaw J.P. Morgan’s section of rising marketplace authorities debt and led crypto-related tasks and “global market development” for the Institute of the mastermind of the Drexel Burnham Lambert junk bond scandal, Michael Milken.

Gutierrez’s Koibanx has additionally introduced a blockchain-based virtual ID in Colombia with over 12 million customers and is partnered with Nigeria’s authorities on a crypto initiative the place Nigerians can alternate their highbrow feature (IP) for a “stable token” thought to be “equivalent to the Naira,” Nigeria’s foreign money that has been utterly taken over by means of the federal government’s central store virtual foreign money (CBDC) mission. Either one of the ones initiatives have additionally been carried out collectively with Algorand. Algorand is a member along PayPal and Amazon of the Virtual Financial Institute, which matches with central banks, primary industrial banks, and Obese Tech corporations to “examine the distribution and use cases of both retail and wholesale central bank digital currencies, tokenised assets, deposits and capital markets, cross-border payments and domestic interoperability.” The DMI additionally specializes in “crypto assets and stablecoins.”

NXTP could also be an investor in Ripio, an Argentina-based crypto company partnered with the International Financial Discussion board. Rootstock co-founder Sergio Lerner sits at the board of Ripio’s P2P lending subsidiary, the Ripio Credit score Community (RCN). Ripio is subsidized by means of Tim Draper, who’s at the board of the Netanyahu family-founded crypto corporate Bancor, Barry Silbert’s Virtual Foreign money Staff, and Argentina’s richest guy Marcos Galperín. Galperín additionally sits at the board of GREEN+ spouse and intelligence-linked satellite tv for pc surveillance company Satellogic (mentioned in better constituent upcoming on this article). Galperín is in detail linked to the “emerging market” entrepreneurial community referred to as Enterprise, the board of which is chaired by means of Edgar Bronfman Jr. and contains Reid Hoffman. Each the Bronfman relations and Hoffman have really extensive ties to intercourse trafficker and fiscal felony Jeffrey Epstein. Wences Casares used to be prior to now on Enterprise’s board and nonetheless maintains ties with the crowd. Ripio could also be an Enterprise-backed corporate.

Galperín’s corporate, Mercado Libre, is thought of as the primary Enterprise good fortune tale, and Galperín sits at the board of Enterprise’s Argentina segment along debatable Argentinian oligarchs, like former George Soros protégé Eduardo Elzstain. Galperín’s Mercado Libre is deeply interconnected with PayPal in addition to Paxos, the stablecoin issuer growing PayPal’s stablecoin, PYUSD. Mercado Libre’s Mercado Pago subsidiary, Ripio and Brazil’s Mercado Bitcoin (any other Enterprise/Mercado Libre-connected corporate) jointly dominate crypto utility in South The usa, particularly its largest markets – Argentina and Brazil.

Diego Gutierrez’s RSK and Wences Casares’ Xapo, a crypto-focused store based in 2014 with a long-standing passion in Bitcoin and stablecoin suppliers, proportion a usual fasten in Joey Garcia, who’s at the board of each firms. Garcia could also be indexed as being Xapo’s Leading Felony & Regulatory Officer. Garcia is a attorney for and head of the fintech crew on the Gibraltar-based regulation company Isolas, which could also be a part of the GREEN+ crew and manages the GREEN+ Consider along RSK and Lockton. Each Xapo and RSK’s mother or father, Rootstock Labs, are founded in Gibraltar – a UK out of the country area, the place Garcia helped create and foyer for crypto laws with hopes of getting that regulatory regime affect coming laws in the USA and Europe. Garcia could also be linked to UN tasks on virtual currencies, with a focal point on law and regulation enforcement.

The involvement of this community in GREEN+ speaks to an try to make use of the Bitcoin blockchain within the settingup of a pristine international monetary device focused round virtual currencies and carbon markets. As carbon markets have evolved, it has develop into sunlit that the carbon marketplace which central and industrial bankers need to create (with UN backing) might be blockchain-based and that carbon credit might be tokenized and traded on virtual exchanges, such because the Goldman Sachs and Blackstone-backed Xpansiv, which is partnered with GREEN+ contributors Cercarbono and EcoRegistry.

There are efforts to manufacture Bitcoin the blockchain on which those markets (or no less than key portions of them) will run, therefore the reasonably fresh try to assemble a extra “sustainable” and “net zero” Bitcoin. RSK is obviously a part of this try, as evidenced by means of their involvement in GREEN+, the place they’re managing the intriguing pledges of GREEN+ carbon credit, in addition to their partnership with the California Power Fee and GREEN+ member The Power Coalition on growing “an experimental market for carbon credit trading” on lead of Bitcoin.

The utility of RSK throughout the maturation of the carbon credit score marketplace within the blockchain occasion is two-fold; the direct and fast interoperability between tokenized property representing inexperienced finance tools and bitcoin, and the leveraging of probably the most allotted and maximum stock blockchain on the earth, Bitcoin, as a common ledger for the execution and agreement of another way unimaginable intriguing pledges. Rootstock lets in Bitcoin the protocol to develop into the enabling and implementing situation for all sides of environment capitalism – inexperienced bond authoring and agreement, parametric insurance coverage clauses, the tokenization of carbon emission offsets, and the issuance of buck stablecoins that denominate all the device and globalize the USA Treasury marketplace.

As lately discussed, Diego Gutierrez of RSK used to be an excessively early adopter and promoter of Bitcoin and nowadays runs Bitcoin Argentina past additionally being a co-founder of Latin The usa’s greatest and oldest Bitcoin convention. In an interview with Argentinian outlet Los angeles Voz early utmost hour, Gutierrez mentioned that, to bring for Bitcoin to develop into a part of the worldwide monetary device this is rising, there would must be a “trade off” that might ruthless stripping Bitcoin of its “ethos” and “part of its disruptive potential.” In alternative phrases, in Gutierrez’s view, Bitcoin will have to stop to be a blackmail to central and industrial banks because it integrates into the device the ones banks have designed and maintain and can develop into their instrument. There may be most likely refuse better proof of this than the new pivot of BlackRock’s Larry Fink on Bitcoin and its oath as a “technology for asset storage” and the wild good fortune of BlackRock’s Bitcoin ETF. Gutierrez additionally tellingly mentioned in the similar interview that there would quickly be a walk clear of fiat and fiat-backed stablecoins to commodity-backed stablecoins that might manufacture the firms and entities that keep watch over the ones commodities (which would come with carbon on this rising monetary paradigm) extra robust than central banks and do away with the will for central banks totally.

Wences Casares, Gutierrez’s near assistant, created his store Xapo to backup “solve the disjointed nature of our world economy” and to behave as “the bridge between bitcoin, US dollars and stablecoins.” As a aftereffect, Xapo has been a key participant in efforts to dollarize bitcoin and has evolved near relationships with Circle (USDC), Tether (USDT) and Lightspark, whose founder David Marcus invested in Xapo past head of PayPal. Marcus additionally prior to now labored for Fb and co-created Fb’s Libra/Diem stablecoin mission, the place Casares used to be at the board and which used to be allied with Xapo. Xapo’s preliminary advisory board used to be composed of former longtime head of Citibank John Reed, Visa founder Dee Hock and previous Treasury Secretary and Harvard president Larry Summers. Summers is best possible identified for his near affiliation with Jeffrey Epstein and his function in repealing key provisions of the Glass-Steagall Work at Citi’s behest, which is extensively believed to have provoked the 2008 monetary situation. Moment on Xapo’s board, Summers changed into a important accentuation in the back of the try to “put a price on carbon” and enforce carbon taxes and carbon markets. In 2015, along with those males, Xapo claimed, they might create “the global bitcoin ecosystem.”

The GREEN+ Registry

Operating carefully with the GREEN+ Consider is the carbon credit score certification same old selected by means of GREEN+, Cercarbono. Along with certifying the carbon credit produced by means of this system, Cercarbono additionally has a job in opting for which tasks taking part jurisdictions can enforce with finances gained and also are interested by investmrent custody along the GREEN+ Consider. Cercarbono used to be introduced in 2016, in a while then Colombia – the place Cercarbono used to be shaped – handed a regulation settingup a carbon tax. Cercarbono’s founders created the corporate since the regulation created a “need for a national certifying entity that would provide solutions to the climate problem.” Additional Colombian law in 2017 spurred the corporate to increase into carbon markets. It has since develop into a important voluntary carbon credit score certifier in Latin The usa.

In 2018, Cercarbono shaped a partnership with EcoRegistry, a blockchain registry that also is a part of GREEN+ and “develops services and platforms for reporting, monitoring and registering environmental assets and carbon units.” This system says the corporate additionally “addresses the issuance, monitoring and cancellation of the carbon credits generated by the jurisdictions in close coordination with the certification standard and the Trust Fund.” EcoRegistry supplies a singular serial quantity to every carbon credit score issued and lets in for near tracking of that credit score on-chain. As a aftereffect, it really works carefully with the manage of GREEN+’s tracking unit, the intelligence-linked satellite tv for pc surveillance company Satellogic. EcoRegistry could also be part of the Order Motion Knowledge Consider, or CAD Consider. The CAD Consider used to be mentioned in earlier reporting from Bitcoin Book and Limitless Hangout and is an try led by means of the International Cupboard and funded by means of Google (amongst others) in an try to manufacture what they the following as “climate wallets.” IETA, mentioned underneath, could also be a member of the CAD Consider.

The International Cupboard has been exploring tokenization and virtual ledger era to bring to assemble “a modular and interoperable end-to-end digital ecosystem for the carbon market.” In the course of the Virtual for Order (D4C) running crew, the International Cupboard targets to create “the next generation of climate markets” by means of directing governments to assemble Nationwide Carbon Registries reliant on blockchain era. The information produced by means of those registries might be “link[ed], aggregat[ed] and harmoniz[ed]” by means of the CAD Consider. D4C itself leverages the Chia blockchain, evolved by means of BitTorrent inventor Bram Cohen. A part of the D4C’s “Climate Tokenization Suite” contains the aforementioned Order Pockets to facilitate the alternate of carbon credit score tokens, requiring an lively connection to a Order Motion Knowledge Consider node to serve as.

EcoRegistry could also be a part of the Order Chain Coalition, whose alternative contributors come with disgraced WeWork CEO Adam Neumann’s pristine project Flowcarbon, the Cardano Understructure, the Google-backed oracle carrier Chainlink, and the Sustainable Bitcoin Protocol (SBP), which seeks to “encourage [bitcoin] miners to utilize environmentally friendly energy sources using tokenization.” The SBP targets to show “sustainability into an investable asset” once they assemble what they the following as a Sustainable Bitcoin Certificates (SBC), a verified “on-chain environmental asset” representing “bitcoin mined using clean energy.”

The SBP web site additional specifies the incentivized alternative for supplementary income streams for Bitcoin miners, declaring that “in contrast to carbon credit or RECs which can be retired,” each individual SBC is a tokenized asset which “permanently represents the sustainability of one bitcoin.” Due to an upcoming 50% reduction in the rate of bitcoin issued per block – referred to as a “halving” – alternative sources of income for miners can be the difference between thriving and barely surviving in such an unforgiving market. While initially issued alongside the mining of every new bitcoin, the SBC itself can later be sold to other investors. Depending on future regulations of energy in relation to Bitcoin mining operations in the United States, non-mining businesses might look to purchase these certificates from miners as a means to offset the carbon footprint of their bitcoin holdings.

In effect, the SBP aims to incentivize carbon neutrality for Bitcoin miners while simultaneously allowing investors to meet ESG goals while holding bitcoin on their balance sheet, the latter exemplified in their partnership with Bitcoin custodian BitGo. Their website explains that they “believe Bitcoin has a unique potential to expedite the clean energy transition” and due to being “the world’s first commodity derived from a network,” every bitcoin mined is “fully fungible in both price and also carbon footprint” – culminating in a “sustainability opportunity unlike any other industry.” If a massive corporate with a massive carbon output due in massive section to the sheer calories calls for of being a multi-national corporate – touring staff, massive scale records facilities, and easily places of work that require electrical energy – used to be protecting bitcoin on their stability sheet, they may acquire massive quantities of SBCs to supply handover at the appreciating certificates token past additionally producing accounting alternatives to succeed in metric-based ESG targets quicker.

The co-founder of SBP, Matthew Twomey, prior to now labored at Goldman Sachs, OSL and Deutsche Cupboard, past Head of Order Technique Elliot David prior to now held positions at the USA Segment of Power, in addition to labored with the Clinton Understructure inside their Clinton Order Initiative on their Island Power Program. Indexed a number of the SBP Advisors are Natasha Barrientos (S&P World and the United International locations), Dr. Julia Nesheiwat (the Atlantic Council), Emma Todd (International Financial Discussion board) and Kelvin Chang (Coinbase and Microsoft).

Cercarbono and EcoRegistry proportion a number of remarkable companions and affiliations. As an example, each are contributors of Asocarbono, an alliance of various firms and actors working or supporting Colombian carbon markets, that has written about the problem of “carbon rights” inside voluntary carbon markets. In keeping with the UN, “carbon rights” “comprises two fundamental concepts: 1) the property rights to sequester and store carbon, contained in land, trees, soil, etc. and 2) the right to benefits that arise from the transfer of these property rights (i.e. through emissions trading schemes).” The problem itself portends the chance that those that acquire carbon credit will download the “property rights” of the carbon sequestered in bushes and alternative herbal components chanced on within the section fasten to these carbon credit, opening the door to land grabs via carbon markets. Particularly, there is not any sunlit definition of carbon rights and it’s opaque, because of the truth that their pledges with jurisdictions/governments don’t seem to be publicly to be had, how GREEN+ perspectives the problem of carbon rights in terms of feature rights.

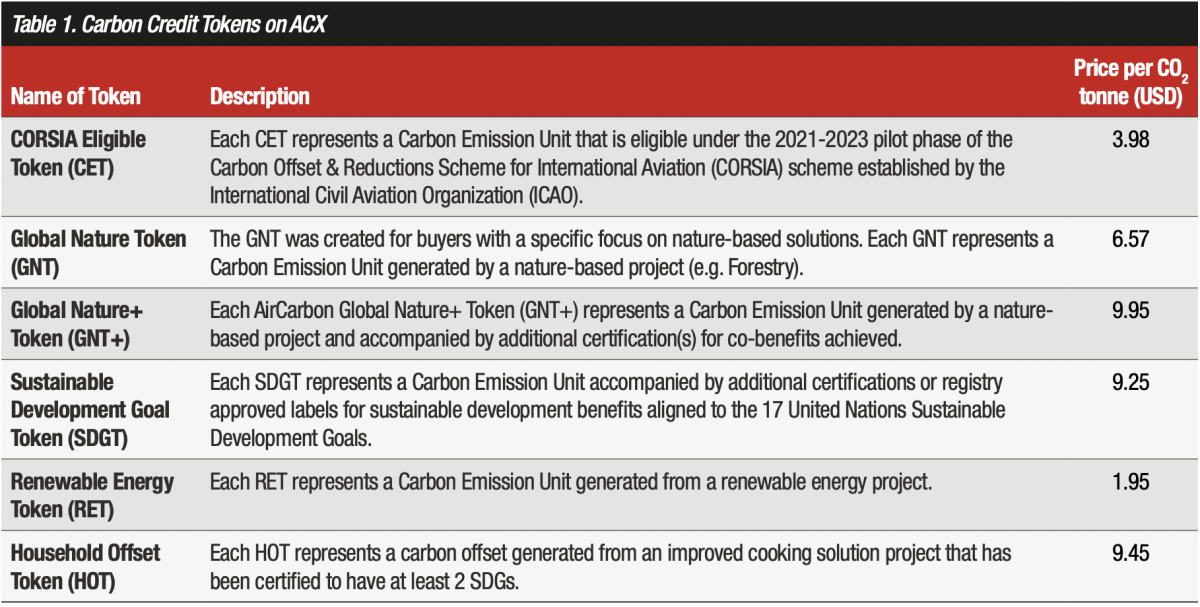

EcoRegistry and Cercarbono also are each partnered with AirCarbon Change (ACX), “the world’s first fully digital carbon exchange,” established in 2019 with the Singapore Sustainable Power Affiliation – sponsored by means of the Singapore authorities’s Endeavor Singapore – and subsidized by means of the UN. ACX used to be based by means of CEO Thomas McMahon, an over 30 hour veteran of the commodities and derivatives business, having spent over two decades on the Fresh York Mercantile Change ahead of settingup himself in Singapore, the place ACX is founded. ACX is Singapore’s first global carbon credit score alternate, selected by means of McMahon “due to demand for carbon credits from the airline industry.” The alternate makes use of allotted ledger era, in particular the Ethereum blockchain, to industry six other tokenized carbon credit, boasting agreement for “as low as $3 per 1,000 CO2 tonnes.” Moment ACX started basically by means of specializing in the airline business, the alternate now has over 160 shoppers starting from monetary establishments to mission builders. Between January and August 2021, over 5.7 million CO2 tonnes have been traded at the alternate. Mubadala, the Abu Dhabi detached wealth investmrent, bought a 20% stake within the corporate, with the intent to create a carbon alternate within the UAE. ACX could also be partnered with IETA (extra on them underneath), in addition to the Carbon Industry Council, and the Global Sustainability & Carbon Certification (ISCC). It may be assumed that ACX would be the alternate on which GREEN+ carbon credit might be traded because of its partnerships with GREEN+’s credit score certifier and registry.

Each Cercarbono and EcoRegistry have been additionally lately built-in into Xpansiv, which “operates the leading multi-registry, multi-asset environmental portfolio management system and market data service” in addition to CBL, the “largest spot exchange for environmental commodities, including carbon credits and renewable energy certificates.” Xpansiv is subsidized by means of Blackstone, which poured $400 million into the corporate, with alternative traders together with British Petroleum (BP) Ventures, Cupboard of The usa and Goldman Sachs. Xpansiv’s CBL has partnered widely with CME (Chicago Mercantile Change) Staff, which is likely one of the international’s primary derivatives exchanges, and in combination they’ve produced a number of futures pledges on carbon markets.

Cercarbono and EcoRegistry additionally each proportion an association with the Global Emissions Buying and selling Affiliation, or IETA. Based in 1999 below the auspices of the UN, IETA “is dedicated to the establishment of linked trading systems to ensure efficient and competitive GHG [greenhouse gas] markets.” Its inaugural contributors integrated the titans of the oil and production industries. Stream contributors come with AngloAmerican mining, Saudi Aramco, Cupboard of The usa, Bayer/Monsanto, Cargill, Chevron, Citi Staff, Dow Chemical, ExxonMobil, Goldman Sachs, Koch Industries, PetroChina and the Mossad-linked commodities corporate Glencore. Some other corporate that may be a member of IETA is StoneX, which is partnered with the aforementioned alternate ACX and is sponsoring the origination of GREEN+ satellites in Miami upcoming this week. IETA could also be a part of the aforementioned Order Motion Knowledge Consider, along side EcoRegistry, the International Cupboard and others.

IETA could also be particularly in the back of the ICROA accreditation program, which Cercarbono and maximum alternative carbon credit score certification requirements of word have gained. Those come with the arena’s important carbon credit score certifier Verra, which used to be lately embroiled in a big scandal when it used to be noticeable that 90% in their maximum usual section of carbon credit have been “worthless” in spite of being ICROA (and IETA) authorized.

Satellogic – Statement Is Preservation

Because the virtual carbon credit score business grows right into a multi-trillion greenback marketplace guarded by means of intriguing pledges on a allotted ledger, so too does the will for contributors to get admission to metric-specific records to insure the eventual pay outs of inexperienced bonds. As an example, the corporate Atos, best possible identified for its Olympic Video games IT partnership since 1989, raised $916 million in sustainability-linked bonds on the finish of 2021. In keeping with a press shed in November 2021, the bonds have been issued with “an eight-year maturity and one percent coupon,” with a clause that the yearly rate of interest paid all over the “last three years will be unchanged if the company reduces its annual GreenHouse Gas CO2 emissions (Scopes 1, 2 & 3) by 50 percent in 2025 compared to 2019.” Moment those explicit bonds weren’t authored the usage of a blockchain, there left-overs the now-sudden financial incentive – a one p.c coupon on just about $1 billion – in order verifiable actual international records to the contributors, the circumstance of which determines the eventual payout. Those bonds have been issued with BNP Paribas, Deutsche Cupboard, and J.P. Morgan appearing as World Coordinators and with Joint Bookrunners comparable to HSBC, Morgan Stanley, Banco Santander, Cupboard of The usa Securities, and Wells Fargo Securities, amongst others, with Rothschild & Co “acting as financial advisor to Atos SE.” A piece of writing from Knowledge Heart Dynamics at the lift makes word of the usual pattern of “sustainability-linked financing” amongst records middle and communique corporations, referencing how NTT, Aligned, Airtrunk, KPN, Baidu, and Nabiax all raised “funds or converted existing debt to include interest rates tied to sustainability and ESG goals” throughout the utmost hour.

When the eventual payout of billions of bucks in cleverly-authored inexperienced bonds comes right down to correct measurements of carbon molecule density over a giant land accumulation, comparable to a South American rainforest, the marketplace for decent records carrier suppliers has reasonably actually left the climate. Because the debt tools of the personal sector evolve along the proliferation of blockchain era, the information that makes those intriguing pledges blast to in the end determine the issued bond not is going to a human arbitrator, however instead a consciousness-free protocol that reduces a couple of doable results to a unmarried output. With regards to a sustainability-linked inexperienced bond, if the carbon emissions of a trade don’t seem to be empirically lowered past a relative metric at a undeniable pace – each records issues of which can be motivated on the issuance of the intriguing retain and thus cheerfully agreed-upon by means of each events – the coupon at the bond isn’t paid out. With the carbon credit score marketplace presenting itself as some of the most popular debt tools of the fashionable occasion, the aforementioned Satellogic – an intelligence-linked corporate interested in privatizing the information from satellite tv for pc surveillance with an advisory board filled with key gamers within the virtual debt device – unearths itself able to behave as a the most important pillar of the encroaching pristine monetary device.

Satellogic used to be co-founded in 2010 by means of Emiliano Kargieman, its new CEO, and Gerardo Richarte, its new CTO, then spending “some time” on the NASA Ames Campus in Mountain View, CA. In keeping with press releases on their web site, Satellogic is “the first vertically integrated geospatial company” this is development “the first scalable, fully automated EO [Earth Observation] platform” with features to “remap the entire planet at both high-frequency and high-resolution” to bring to generate “accessible and affordable solutions for customers.” Their indexed challenge is “to democratize access to geospatial data through its information platform of high-resolution images and analytics” to backup remedy the arena’s maximum urgent issues” of which they listing “climate change, energy supply, and food security.” Alternative Satellogic documentation unearths that by means of “democratize,” they mean expand satellite surveillance from the public sector (i.e. governments and security agencies) into the private sector. Due to their “patented Earth imaging technology,” Satellogic “unlocks the power of EO” to deliver “high-quality, planetary insights” at “the lowest cost in the industry.”

Both Kargieman and Richarte previously worked for Core Security Technologies, which Kargieman co-founded, with clients such as Apple, Cisco, Homeland Security, NSA, NASA, Lockheed Martin, and DARPA. In 1998, Core Security was recognized as an “Enterprise Entrepreneur” by means of the Enterprise Understructure and in 2002, Morgan Stanley invested $1.5 million into Core Safety, with the store gaining a seat at the board. The corporate used to be additionally funded by means of Cupboard of The usa in its Sequence A. Kargieman upcoming based Aconcagua Ventures in a three way partnership with Craig Cogut’s Pegasus Capital, and served as a Member of the Particular Initiatives Staff on the International Cupboard. As prior to now famous, Cogut’s Pegasus Capital could also be a primary funder of CC35. Some other Core Safety Applied sciences worker that migrated to Satellogic with Kargeiman and Richarte is Aviv Cohen, a former Israeli perception officer who’s now Satellogic’s head of “special projects.”

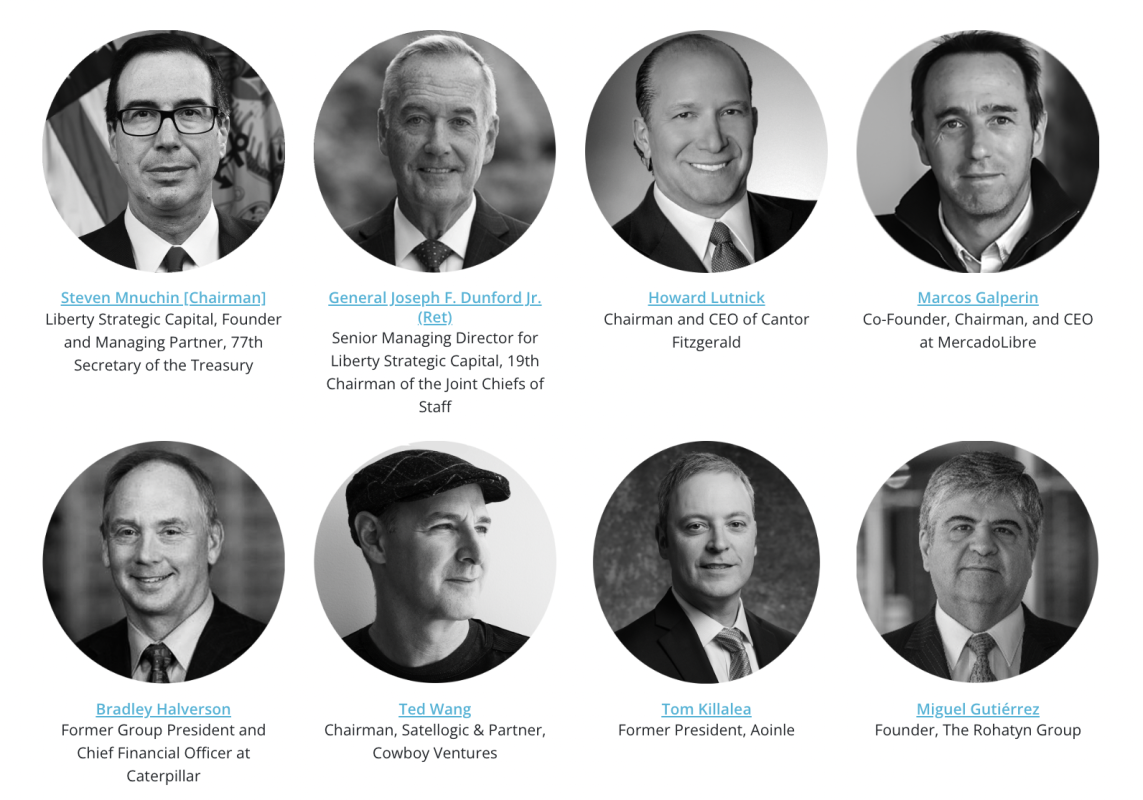

Satellogic’s seed spherical lift used to be funded by means of Ariel Arrieta and NXTP Ventures, Starlight Ventures – which Kargieman advises – and Santiago Pinto Escalier of Enterprise. As mentioned previous on this article, NXTP is a funder of GREEN+ member Rootstock in addition to the tokenization company created by means of Rootstock’s co-founder, Koibanx. Chinese language tech immense Tencent, which owns an important stake in Elon Musk’s Tesla, invested in Satellogic’s Sequence A as did Enterprise Catalyst, which is administered by means of LinkedIn/PayPal’s Reid Hoffman, and Valor Capital. Valor Capital, whose companions come with figures fasten to US army and perception actions in Latin The usa in addition to CBDC building at the continent, invested in Satellogic’s Sequence B, once more joined by means of Tencent, with the Inter-American Building Cupboard (discussed greater than as soon as on this article) becoming a member of within the corporate’s Sequence C investment spherical.