Institutional buyers have already proven how bullish they’re on Bitcoin (BTC) and the wider cryptocurrency marketplace, as they have got persevered to acquire with USDT, particularly all through each dip. This bullish sentiment used to be once more on show as this institutional investor despatched $445 million USDT to exchanges to shop for extra crypto.

Cumberland Sends $445 Million USDT To Exchanges

The on-chain analytics platform Lookonchain unmistakable in an X (previously Twitter) submit that crypto buying and selling company Cumberland has deposited the $445 million it won from the Tether Treasury into other exchanges. Information from the on-chain analytics platform Arkham Logic presentations that Cumberland worn the USDT finances to shop for extra crypto, with Bitcoin accounting for many of the company’s purchases within the extreme 24 hours.

Indistinguishable Studying

All over this era, Cumberland has withdrawn a vital quantity of Bitcoin from diverse exchanges, together with Coinbase, Robinhood, and OKX, amongst others. This construction coincides with the flagship crypto’s contemporary crack above $60,000, highlighting the higher purchasing power that Bitcoin has witnessed because of institutional buyers like Cumberland.

The Spot Bitcoin ETF issuers have additionally purchased a vital quantity of Bitcoin within the extreme 24 hours, because of the online inflows recorded on August 8. Information from Farside Traders presentations that those finances witnessed web inflows of $194.6 million that pace. This used to be the second one consecutive pace of web inflows for those finances, having witnessed inflows of $45.1 million on August 7.

Some alternative buyers, together with retail buyers, confirmed self assurance in Bitcoin and the wider crypto marketplace all through this contemporary marketplace accident. Lookonchain famous that Binance skilled a web influx of $2.4 billion for the reason that marketplace shed on August 5. This features a web influx of $1.33 billion USDT and $519 million USDC, as those buyers seemed to shop for extra crypto and upload to their positions.

What Then For Bitcoin?

Bitcoin is again above $60,000 following its shed under $50,000 on August 5. Taking into account there are nonetheless considerations at the macro aspect, there are fears that this Bitcoin rebound may well be a pleasure leap in lieu than a bullish reversal. Alternatively, crypto analyst Mikybull Crypto is satisfied that Bitcoin has discovered its base and is about to revel in an uptrend from right here on.

Indistinguishable Studying

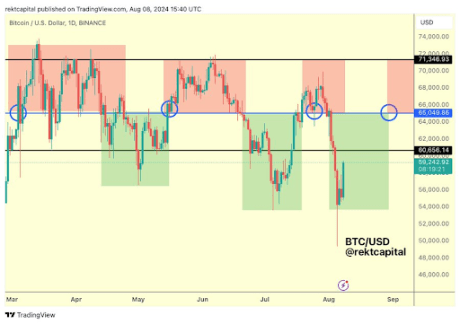

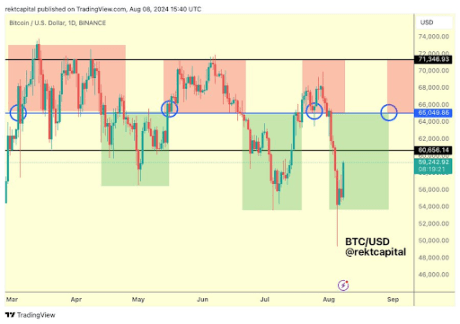

In a contemporary X submit, he once more alluded to the Volatility Index (VIX), which he famous offers all indicators that the macro base is in. He remarked that the upcoming markup segment shall be “violent.” Within the interim, Bitcoin preserving above $60,600 shall be key to confirming this bullish reversal. Crypto analyst Rekt Capital said that persevered steadiness above this degree would permit Bitcoin to revisit the $65,000 value degree over life.

On the life of writing, Bitcoin is buying and selling at round $60,900, up over 7% within the extreme 24 hours, in step with knowledge from CoinMarketCap.

Featured symbol created with Dall.E, chart from Tradingview.com