Layer 2 (L2) scaling resolution Optimism reported a sequence of sturdy community metrics within the first quarter (Q1) 2024, with its local OP token surging 9% at the again of this bullish momentum.

Optimism Sees Upper Task And Emerging Transaction Charges

In keeping with a contemporary Messari document, Optimism’s circulating marketplace cap greater 11% quarter-over-quarter (QoQ) to $3.7 billion, age its totally diluted marketplace cap rose 1% to $15.7 billion.

Regardless of the wider crypto marketplace rally, with Bitcoin (BTC) and Ethereum (ETH) gaining 69% and 53% QoQ, respectively, OP’s marketplace cap rating slipped from twenty sixth to thirty ninth amongst all blockchain networks. Alternatively, inside the Ethereum ecosystem, OP residue one of the vital manage 4 rollups via marketplace capitalization.

Riding this expansion was once an important uptick in Optimism community task. Day by day energetic addresses reached 89,000 in Q1 2024, a 23% QoQ building up, age day by day transactions surged 39% to 470,000 over the similar duration. Those metrics approached, however didn’t reasonably succeed in, their all-time highs in Q3 2023.

Matching Studying

The community’s earnings additionally noticed a considerable 78% QoQ building up to $16 million, pushed via upper task and a 48% get up within the moderate transaction charge to $0.42. Alternatively, this moderate charge dropped considerably within the closing part of March because of the implementation of Ethereum Growth Proposal (EIP) 4844, which decreased L1 submission prices via 99%.

General Price Locked Jumps 18% In Q1

Regardless of the cost aid, Optimism’s on-chain benefit for Q1 2024 greater 14% QoQ to $2 million. The community’s General Price Locked (TVL) additionally grew via 18% to $1.2 billion, despite the fact that its TVL rating amongst all networks fell to eleventh park.

Inside Optimism’s TVL, the DeFi sector ruled, accounting for 86% of energetic addresses. In keeping with Messari, non-fungible token (NFT) packages and gaming adopted with 6.9% and six.7%, respectively.

TVL’s well-known protocols integrated Synthetix ($307 million, +4% QoQ), Aave ($270 million, +52% QoQ), and Velodrome ($171 million, +10% QoQ).

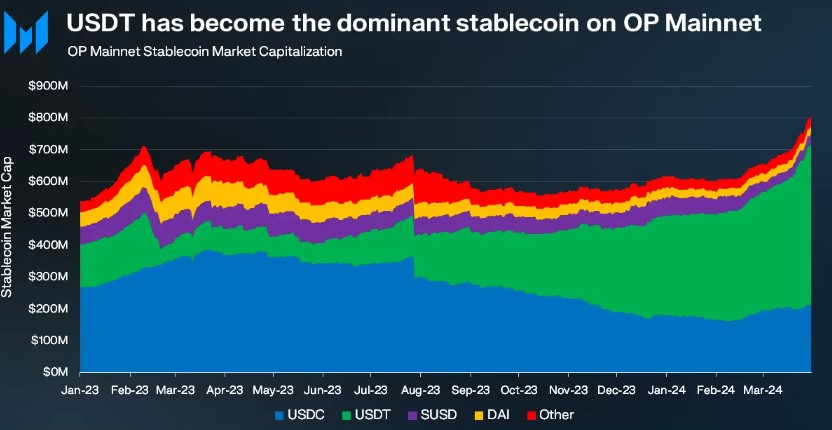

Optimism’s stablecoin marketplace capitalization additionally grew considerably, achieving $809 million (+32% QoQ) via the tip of Q1 2024. Circle’s USDC stablecoin and Tether’s USDT made up maximum of this, with USDT visible a 64% QoQ surge to $512 million, or 63% of the entire stablecoin marketplace cap on Optimism.

OP Rebounds Along Crypto Marketplace Resurgence

Regardless of Optimism’s sturdy efficiency throughout key metrics in Q1 2024, the community’s local token, OP, didn’t see a corresponding value building up on the finish of Q1. Rather, OP adopted the wider marketplace downtrend, hitting an annual low of $1.80 only one era next hitting an all-time prime of $4.84 in March.

Alternatively, OP has adopted swimsuit as the total cryptocurrency marketplace has visible a resurgence of bullish momentum within the presen few days. Within the presen 24 hours, the token has recorded a 9% value building up and a three% uptick within the presen time, these days buying and selling at $2.56.

Moreover, CoinGecko knowledge displays a 19% building up in OP’s buying and selling quantity over the presen 48 hours, achieving $290 million.

Matching Studying

Moment this renewed bullish sentiment is encouraging, OP nonetheless trades 46% beneath its all-time prime and faces important resistance ranges quickly sooner than a possible retest of this milestone.

The primary key resistance is at $2.65, adopted via $2.90, which will have to be triumph over sooner than the token can push against the $3.00 stage. Conversely, the $2.34 backup stage has confirmed a very powerful and will have to be monitored intently in case of any bearish resurgence.

Featured symbol from Shutterstock, chart from TradingView.com