On-chain information displays the stablecoin marketplace cap has returned to certain expansion not too long ago, which will also be bullish for Bitcoin.

Stablecoin Marketplace Cap Has In spite of everything Flipped On 30-Life Alternate

As defined by means of CryptoQuant founder and CEO Ki Younger Ju in a unutilized put up on X, the stablecoin marketplace cap has all set a unutilized all-time prime (ATH) following the renewal of the uptrend.

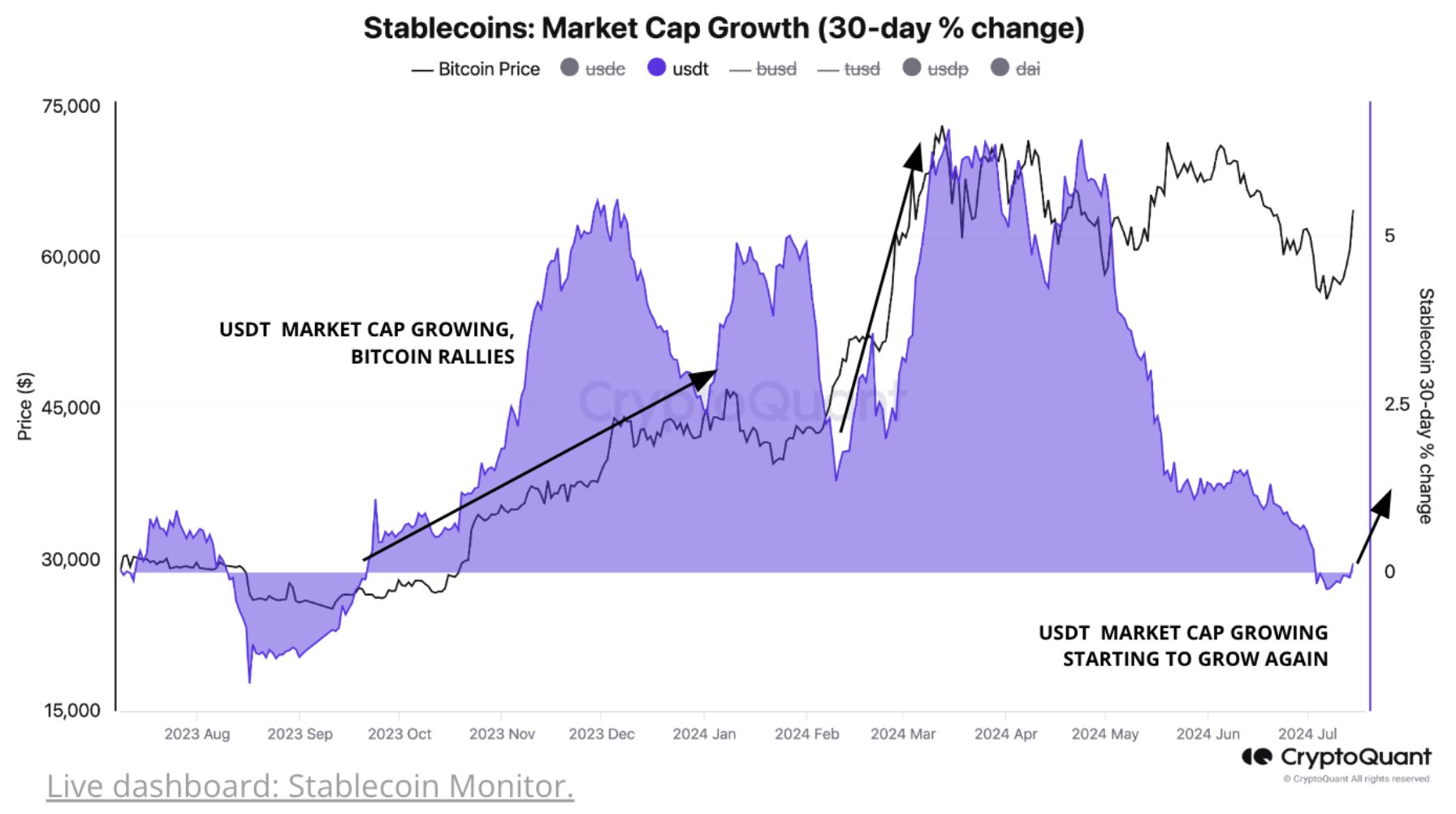

Beneath is the chart shared by means of Younger Ju that displays the fad within the 30-day proportion exchange for the marketplace cap of the largest stablecoin within the sector, Tether (USDT), over the generation while:

Seems like the price of the metric has simply flipped into the certain range | Supply: @ki_young_ju on X

As is seeing within the above graph, the 30-day proportion exchange out there cap of USDT had became unfavorable previous, implying that the whole valuation of the stablecoin have been shrinking.

The subside didn’t endmost for too lengthy, even though, because the metric has not too long ago flipped again into the certain pocket. The surge above 0 is handiest little, which means the prospective turnaround has simply began.

Traditionally, a be on one?s feet out there cap of stablecoins has been a bullish signal for Bitcoin. Within the chart, the analyst highlighted how this development adopted all through the generation while.

To grasp why the stables relate to Bitcoin, their function out there should first be tested. Normally, buyers bundle their capital in those fiat-tied tokens to steer clear of the volatility related to alternative cryptocurrencies.

On the other hand, holders who conserve their capital like this typically plan to dip again into the risky facet. As such, the marketplace cap of the stablecoins can, in some way, constitute the to be had purchasing energy for cash like Bitcoin. Due to this fact, when this metric rises, so does the dried powder to be had for BTC and others.

The fresh reversal within the Tether marketplace cap has come as BTC itself has proven a clever medication surge, suggesting that the rise within the stablecoins has come because of unutilized capital inflows instead than a rotation of capital from the #1 cryptocurrency.

This can be a particularly bullish combo, because it means that now not handiest is their capital sitting at the sidelines ready to be deployed into Bitcoin, however BTC itself has additionally observable direct capital inflows.

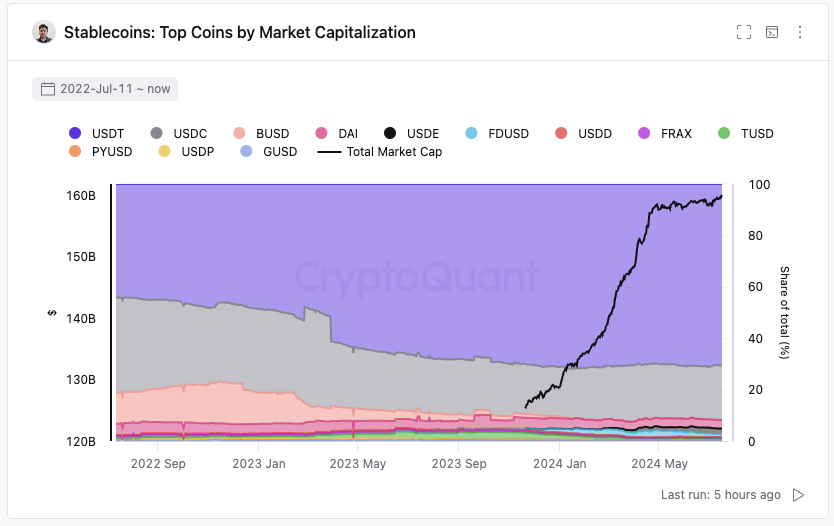

Following the fresh building up, Tether now occupies round 70% of the whole stablecoin marketplace cap, because the chart beneath shows.

The percentage of the whole stablecoin marketplace cap in demand by means of the diverse tokens | Supply: @ki_young_ju on X

As may be obvious from the graph, the whole stablecoin marketplace cap has all set a unutilized file following the go back of capital inflows.

Bitcoin Worth

On the date of writing, Bitcoin is buying and selling at round $63,700, up greater than 10% over the generation generation.

The cost of the coin seems to had been emerging in fresh days | Supply: BTCUSD on TradingView

Featured symbol from Dall-E, CryptoQuant.com, chart from TradingView.com