On-chain knowledge displays the Bitcoin provide on exchanges has visible an extra plunge lately, now hitting lows now not visible since December 2017.

Bitcoin Provide On Exchanges Has Dropped To Simply 5.38% Now

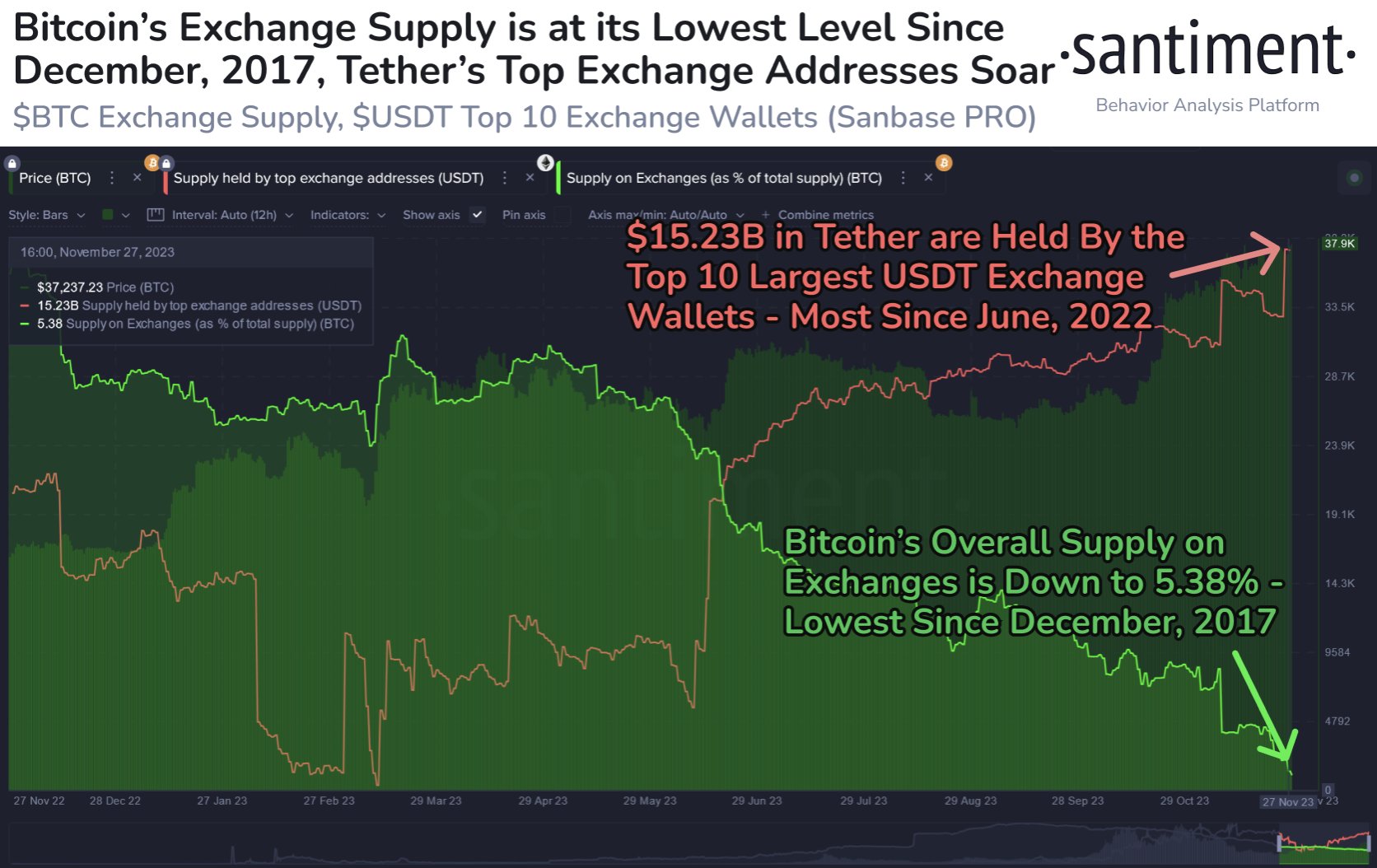

In keeping with knowledge from the on-chain analytics company Santiment, BTC’s provide has endured to shift in opposition to self-custody lately. The indicator of relevance here’s the “supply on exchanges,” which helps to keep monitor of the share of the entire Bitcoin provide that’s recently sitting within the wallets of all centralized exchanges.

When the price of this metric rises, it signifies that the buyers are depositing to those platforms recently. Typically, one of the crucial primary explanation why buyers would manufacture such transfers is for promoting functions, so this type of development will have a bearish have an effect on at the cryptocurrency’s value.

At the alternative hand, the indicator happening signifies that the holders are making internet withdrawals from the exchanges. One of these development is also an indication that the buyers are amassing at the moment, that may be bullish for the asset.

Now, here’s a chart that displays the rage within the Bitcoin provide on exchanges over the while generation:

The worth of the metric turns out to had been happening since a presen now | Supply: Santiment on X

As displayed within the above graph, the Bitcoin provide on exchanges has been happening all over the while few months and it will seem that the downtrend isn’t coming to an finish anytime quickly, both, because the indicator has most effective plunged additional lately.

The indicator’s price has now strike the 5.38% mark, that means that simply 5.38% of the BTC in circulate is being saved throughout the wallets hooked up to those central entities, the bottom stage since December 2017.

Curiously, presen this untouched plunge within the Bitcoin provide on exchanges has come, every other metric has visible a well-dressed uptrend in lieu. As is perceptible within the chart, this indicator is the sum of provide held via the 10 greatest Tether (USDT) addresses on exchanges.

This metric has risen to $15.23 billion now, the best price since June 2022. Most often, buyers collect their capital within the method of a stablecoin like USDT each time they search brief safe haven clear of the volatility of BTC and others.

Such holders in the end advance again in opposition to the unstable aspect after they really feel that the year is correct. To manufacture the shift again, the Tether buyers naturally vault to exchanges, so the availability of the stablecoin on exchanges can also be checked out as the possible purchasing energy to be had for Bitcoin and alternative cash.

For the reason that USDT alternate provide held via the ten greatest whales has shot up lately, it signifies that those humongous entities can grant an important purchasing spice up to the marketplace, will have to they make a choice to manufacture the change.

Each those traits are patently certain for Bitcoin, as they ruthless that now not most effective has the marketing possible available in the market lessened, however the purchasing energy has additionally long past up on the identical year.

BTC Value

Bitcoin is recently floating across the $38,100 stage later having registered an uplift of over 4% within the extreme seven days.

Seems like the cost of the coin has visible some get up lately | Supply: BTCUSD on TradingView

Featured symbol from Aleksi Räisä on Unsplash.com, charts from TradingView.com, Santiment.internet