In a contemporary submitting with the Securities and Change Fee (SEC), Wells Fargo, some of the biggest banks in the US, disclosed its publicity to identify Bitcoin Change-Traded Finances (ETFs).

JUST IN: 🇺🇸 Wells Fargo storage unearths it has spot #Bitcoin ETF publicity in untouched SEC submitting 👀 pic.twitter.com/H1iY9puKVb

— Bitcoin Book (@BitcoinMagazine) May 10, 2024

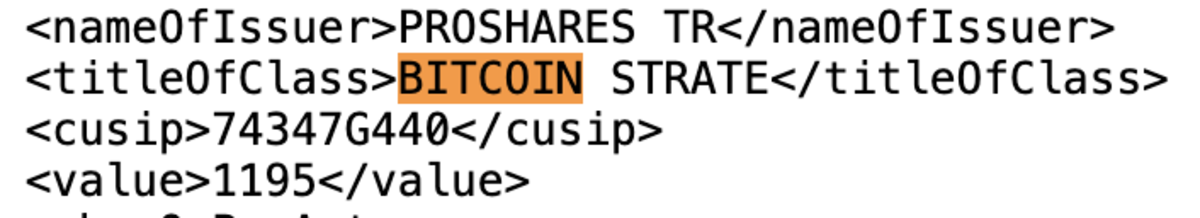

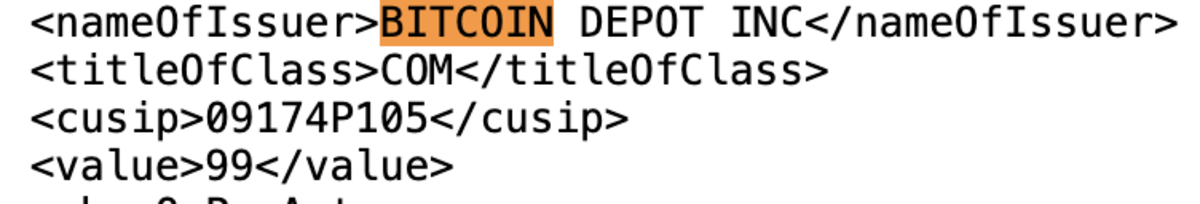

In keeping with the submitting, Wells Fargo holds positions in Grayscale’s spot Bitcoin ETF, ProShares Bitcoin Technique futures ETF, and stocks in Bitcoin Storagefacility Inc., marking a remarkable access into the Bitcoin marketplace. Spot Bitcoin ETFs allow traders to realize publicity to Bitcoin’s worth actions with out without delay proudly owning the asset, making them a prevalent selection amongst institutional traders in quest of a extra regulated funding car for BTC.

The inside track of Wells Fargo’s spot Bitcoin ETF publicity comes amid a broader pattern of institutional adoption of Bitcoin, with a number of primary banks and fiscal establishments exploring tactics to include BTC into their choices and get publicity to the asset.

Previous this age, funding company immense Susquehanna Global Crew, LLP clear in an SEC submitting that it holds $1.8 billion in spot Bitcoin and alternative Bitcoin ETFs, becoming a member of the current of large monetary establishments disclosing their publicity to BTC.