Crypto’s True Significance: A New Era for Capitalism

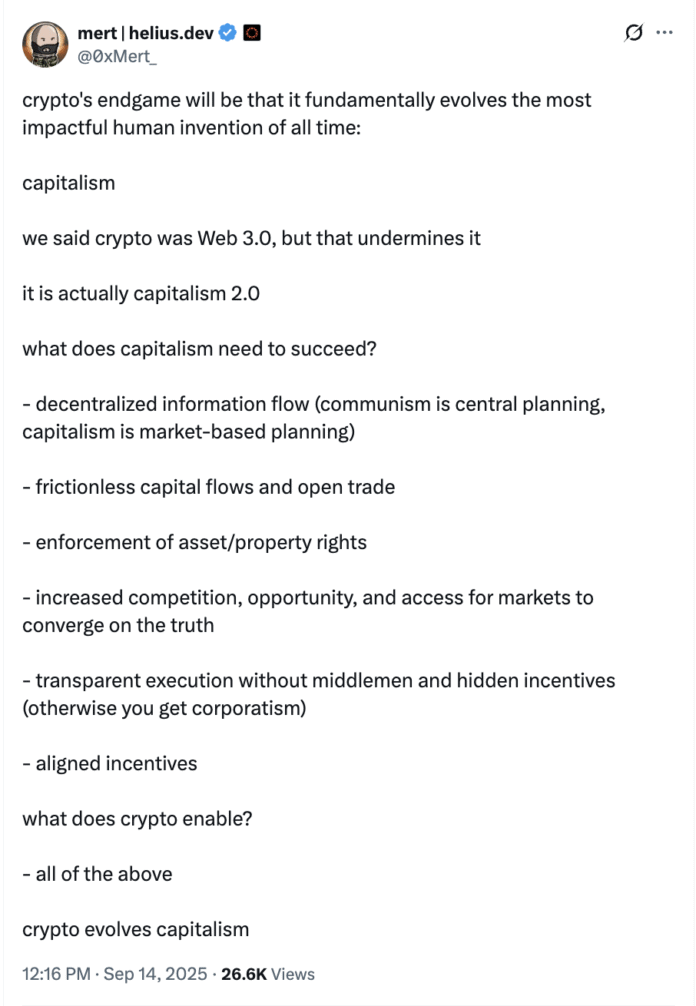

The concept of crypto being referred to as “Web 3.0” has been a topic of discussion among industry experts. However, according to Mert Mumtaz, CEO of remote procedure call (RPC) node provider Helius, this label “undermines” the true significance of crypto, which is a complete overhaul of the capitalist system. Mumtaz believes that crypto has the potential to supercharge the necessary ingredients for capitalism to function properly, including the free flow of information in a decentralized way, immutable property rights, incentive alignment, transparency, and “frictionless” capital flows.

Mumtaz added that crypto’s endgame will be to fundamentally evolve the most impactful human invention of all time: capitalism. He stated, “We said crypto was Web 3.0, but that undermines it — it is actually capitalism 2.0.” This perspective highlights the potential of crypto to transform the way we think about capitalism and its role in the global economy.

US Regulators Signal a Shift towards 24/7 Financial Markets

In a recent joint statement, the United States Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) teased the possibility of 24/7 capital markets in the country. This move would mark a significant departure from the legacy financial system, which is slow to move and closes on nights, weekends, and most holidays. The SEC and CFTC outlined several points that could modernize the existing financial system, including always-on markets, regulatory frameworks for perpetual futures contracts, and regulations for event prediction markets.

The statement read, “Certain markets, including foreign exchange, gold, and crypto assets, already trade continuously. Further expanding trading hours could better align US markets with the evolving reality of a global, always-on economy.” This shift towards 24/7 financial markets could have a profound impact on the way we think about trading and investing.

Tokenization and the Future of Capital Markets

The concept of tokenization is also gaining traction, with the potential to unlock capital markets growth in Latin America and beyond. Tokenized assets can include stocks, fiat currencies in the form of stablecoins, private credit, bonds, art, collectibles, and even real-estate. The Solana Foundation, the organization that oversees the development of the Solana blockchain network, has revealed a roadmap to develop internet capital markets through 2027. This roadmap includes the development of tokenized products, such as mixed brokerage platform Robinhood’s introduction of tokenized stock trading in July for European users.

As the financial landscape continues to evolve, it’s clear that crypto and tokenization will play a significant role in shaping the future of capitalism. With the potential for 24/7 financial markets and the development of internet capital markets, the possibilities for growth and innovation are endless. For more information, visit the original source link: https://cointelegraph.com/news/crypto-not-web-3-0-its-capitalism-2-0?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound