Basel Bank Capital Rules Create Chokepoint for Crypto Industry

According to Chris Perkins, President of the investment company Coinfund, the investment requirements for banks from the Basel Committee on Banking Supervision (BCBS) create a “chokepoint” that hinders the growth of the crypto industry. The current capital rules reduce the return on equity (ROE), a critical profitability metric in the banking business, by forcing higher reserve requirements for holding crypto. This makes crypto-related activities too expensive for banks, Perkins told Cointelegraph.

The rules have a differentiated way of suppressing activities by making them so expensive for banks that they can only invest in high-ROE companies, not low-ROE ones, Perkins explained. “If I have a certain amount of capital I want to invest, I will invest it in high ROE companies, not in low ROE companies,” he added.

Regulatory Challenges for Crypto

In April, Perkins criticized the Bank for International Settlements for its suggestions to impose know-your-customer (KYC) and other legacy banking regulations on decentralized finance protocols (DeFi) and stablecoins, which he believes would violate the core principles of permissionless innovation. The real systemic risk to the financial system is based on the asymmetry of online, unit, around-the-clock, peer-to-peer networks that can shift liquidity in real-time, while traditional financial infrastructure closes on nights and weekends and refuses to adapt to changing technology, said Perkins.

The new plan could make “dirty” crypto more difficult to trade, and the Bank for International Settlements remains anchored against crypto. The bank, which acts as a central bank for sovereign central banks and organizes the BCBS conferences, published a report in April stating that crypto could destabilize the financial system. The authors of the report also argued that the growth of the crypto market worsens the wealth gap and asked for stricter government regulation in response.

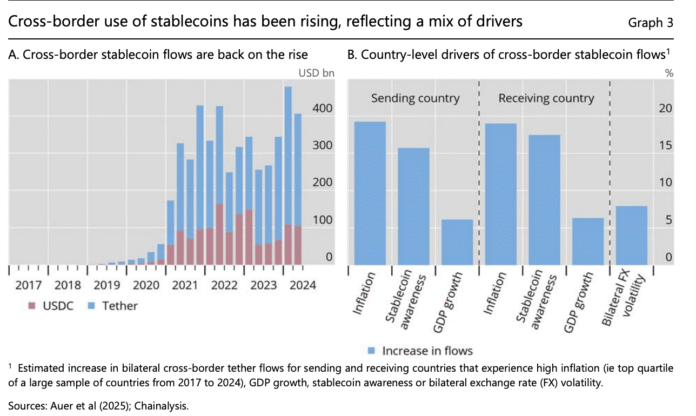

In June, the bank released a follow-up report, titled “Stablecoin growth: policy challenges and approaches,” which stated that stablecoins fail as money and could create systemic risks in the financial system. The cross-border use of stablecoins is growing. Source: bis

Central Banks’ Stance on Crypto

The Bank for International Settlements has repeatedly urged the introduction of digital currencies (Central Bank Digital Currencies) and other centralized digital technologies as an alternative to privately issued and decentralized cryptocurrencies. The bank’s stance on crypto is clear, and its reports have highlighted the potential risks associated with the industry. However, experts like Perkins believe that the regulatory approach should be more nuanced and take into account the benefits of permissionless innovation.

For more information on the Basel bank capital rules and their impact on the crypto industry, visit Cointelegraph.