Bitcoin’s Growing Role in Institutional Investments

Bitcoin mining has evolved significantly from its humble beginnings as a garage experiment to a full-fledged industry, with its role in corporate coffers reaching a tipping point in 2025. What started as bold corporate bets has now expanded to include government Bitcoin reserves and a rapidly growing category of specialized digital asset treasury firms. These companies are created specifically to accumulate and manage Bitcoin on their balance sheets, with governments across the Americas and Asia viewing BTC as a strategic reserve. Publicly traded digital asset treasury (DAT) firms have also accumulated significant coin holdings, further solidifying Bitcoin’s position in the financial landscape.

Institutional acceptance of Bitcoin has evolved into something more significant, with BTC becoming an integral part of the financial machinery it was designed to bypass. Proponents see this as a maturation of Bitcoin, anchoring it in portfolios managed by macro investors. However, skeptics worry that state treasuries and DAT firms will price out smaller holders, a concern that is valid but may be worth it, as institutional reserves create persistent demand that won’t disappear even after the next decline.

Bitcoin’s Place in Government Bonds

High real interest rates, geopolitical shocks, and questions about the dollar’s dominance have led many treasurers to expand their range of foreign reserves, with institutions in most major jurisdictions launching new digital asset programs. This has moved crypto from a side project into a formal product line, making it easier to maintain Bitcoin exposure. The SEC’s approval of spot BTC ETFs created a regulated investment vehicle that attracted tens of billions of dollars in net inflows, propelling products like BlackRock’s IBIT to major asset management milestones.

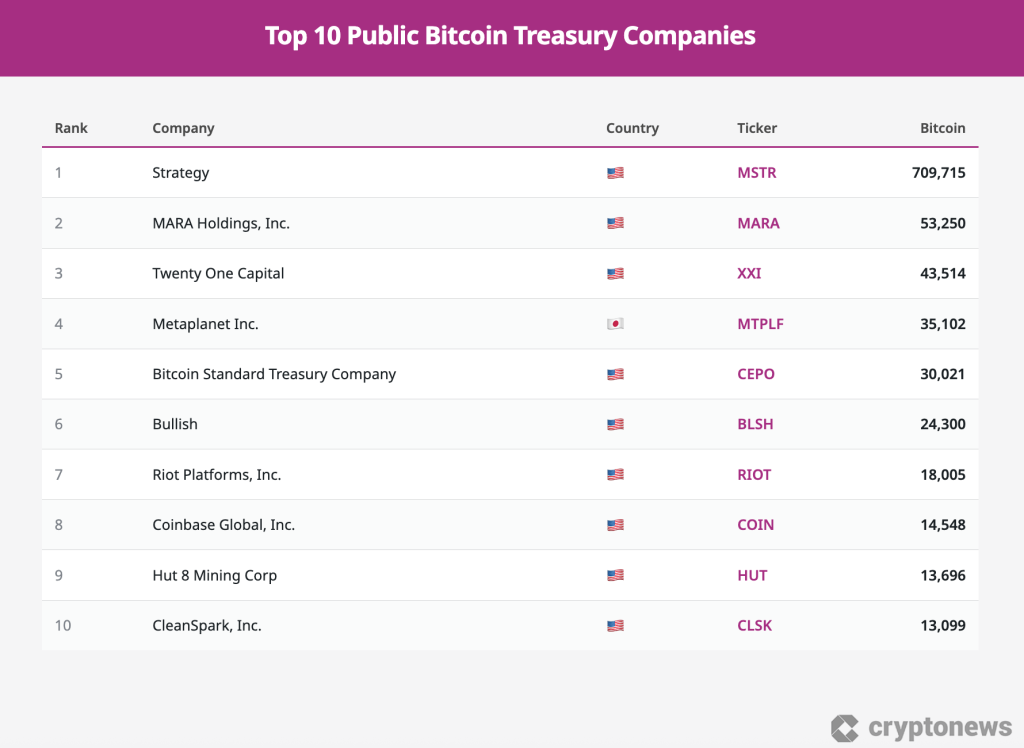

Digital asset treasury companies have also played a significant role in this shift, with their number climbing from the single digits in 2020 to well over a hundred today. In 2025 alone, they invested billions into BTC, with companies like Strategy (formerly MicroStrategy) now holding hundreds of thousands of coins. Governments have followed suit, with early adopters like El Salvador and Bhutan viewing Bitcoin as both a political test and a way to spread portfolio risk. The US has formalized federal ownership of its BTC holdings as a long-term national asset, setting off a chain reaction that has seen other countries like Texas, Pakistan, and Taiwan explore allocating a portion of their foreign reserves into BTC.

Bitcoin Reserves Must Become Productive

Looking ahead to 2026, the question is no longer whether BTC will appear in further government bonds, but rather how to evolve the broader Bitcoin ecosystem to deliver value at all levels while reducing existing bottlenecks. Idle reserves have little effect, and the industry needs to build an infrastructure that treats BTC like other reserve assets, allowing it to function as a store of value and increasingly as a medium of exchange and collateral across the ecosystem.

This requires standardized frameworks for Bitcoin-backed loans, clear capital treatment for banks holding Bitcoin-related exposures, and robust custody that integrates with existing treasury management systems. The BTC ecosystem also needs more merchants to accept BTC or Bitcoin-backed instruments for payments, which would benefit the entire network and strengthen Bitcoin’s role not only as a store of value but also as a functional asset and sophisticated treasury component alongside other reserve assets used for corporate treasuries.

As the infrastructure, capital, and political will are in place, what is missing is implementation. The verdict will be made in 2026, and it remains to be seen whether Bitcoin reserves can become productive and move in the real economy. A treasury ecosystem that treats BTC as both strategic savings and working capital, while giving traders a clear signal and the tools to accept and pass on Bitcoin-denominated assets, would mark a new stage: reserves, payments, and loans would form a system based on digital gold.

For more information on the growing role of Bitcoin in institutional investments and its potential to become a productive reserve asset, visit https://cryptonews.com/exclusives/dat-companies-and-sovereign-reserves-are-rewriting-bitcoins-future/