DeFi Exploits and Risks: A Growing Concern in the Industry

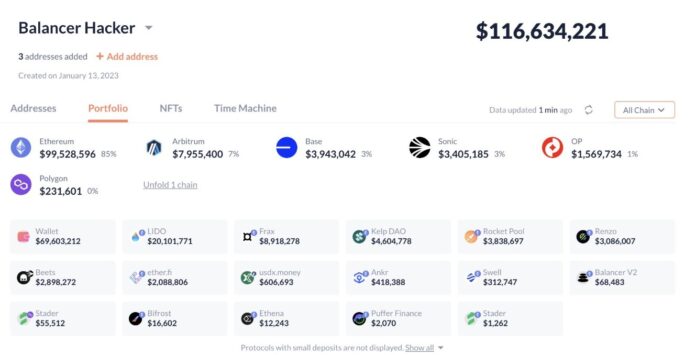

Balancer, a decentralized exchange (DEX) and automated market maker (AMM), recently suffered one of the largest exploits in decentralized finance (DeFi), resulting in the loss of over $116 million in staked Ether and liquidity pool tokens. The exploit was attributed to a flawed access control in their smart contracts, allowing attackers to withdraw funds directly from liquidity pools. The incident highlights the growing concern of security risks in the DeFi space.

The exploit started with a loss of $70 million, which increased to $116 million, primarily affecting liquid staking assets such as Lido’s wstETH and StakeWise’s osETH. To offset the losses, Balancer offered a 20% white hat bounty to the attackers and warned that it was working with law enforcement and blockchain forensics to identify the perpetrator. The hack also showed signs of months of planning by a sophisticated attacker, with experts suggesting that the hacker appeared to be experienced and had resources that may be linked to previous exploits.

DeFi Risk Assessments and Protocol Audits

In response to the exploit, Balancer released a preliminary autopsy report, stating that it was affected by a sophisticated code exploit that targeted its v2 stable pools and Composable stable v5 pools. The report highlights the need for more robust security measures and audits in the DeFi space. RedStone, a modular oracle network, has launched Credora, a DeFi-native risk assessment platform that integrates real-time credit and collateral analytics into protocols like Morpho and Spark.

RedStone aims to provide dynamic risk assessment and failure probability data via APIs, marking a shift toward data-driven transparency after recent market volatility wiped out $20 billion in positions in October. The move is in line with the broader industry move towards a lower-risk DeFi ecosystem, where oracles, auditors, and analytics firms come together to assess the sustainability of yield and collateral systems.

DeFi Policy Alliance and Regulatory Efforts

A coalition of leading DeFi protocols has formed the Ethereum Protocol Advocacy Alliance (EPAA) to strengthen Ethereum’s political representation in Washington. The alliance includes Aave, Uniswap, Lido, Curve, Spark, Aragon, and The Graph, and aims to offset the “outsized influence” of centralized crypto companies in shaping US regulation.

The EPAA plans to engage directly with policymakers on the technical realities of decentralized infrastructure, create educational materials, contribute technical expertise, and coordinate messaging on topics affecting non-custodial systems and DeFi governance. The alliance wants to ensure that on-chain protocols, and not just centralized projects, have a voice in shaping the regulatory future of crypto.

DeFi Market Overview and Trends

Despite an overall decline in Web3 engagement, DeFi remained one of the most active crypto sectors in October, accounting for 18.4% of decentralized application (DApp) activity, according to a DappRadar report. However, DeFi TVL fell 6.3% to $221 billion and fell another 12% to $193 million in early November, attributed to the $20 billion liquidation in October and subsequent collapse of Stream Finance.

The Stables Labs USDX (USDX) token fell over 69% for the week, marking its biggest decline in the past seven days. The DeFi market continues to evolve, with protocols such as Raydium, Pump.fun, and Jupiter Exchange remaining heavily used. For more information on the DeFi market and its trends, visit Cointelegraph.