Understanding the Role of Whales in Bitcoin’s Market Dynamics

The concept of whales in the cryptocurrency market, particularly in Bitcoin, has long been a topic of interest and debate. These large holders of Bitcoin, typically defined as entities holding at least 1,000 BTC, are often seen as having the power to influence market trends. However, the actual impact of whales on Bitcoin’s price movements is more complex and involves various market mechanics and factors.

Since the introduction of spot exchange-traded funds (ETFs) in 2024, the dynamics of Bitcoin’s market have shifted. ETF inflows and outflows have become a significant driver of Bitcoin’s daily price movements. The tradable supply on exchanges has also decreased, making large orders more impactful on prices. Furthermore, large holders often split their trades or use over-the-counter (OTC) desks to minimize the visible effect of their transactions on the public order books.

Defining Whales and Their Holdings

A whale in the crypto space refers to an entity, which is a group of addresses controlled by the same owner, holding at least 1,000 BTC. It’s essential to distinguish between address numbers and entity-level holdings, as large services like exchanges and payment processors operate multiple wallets. The methods of tracking whale metrics can vary, with some including service companies and others focusing on real investor whales.

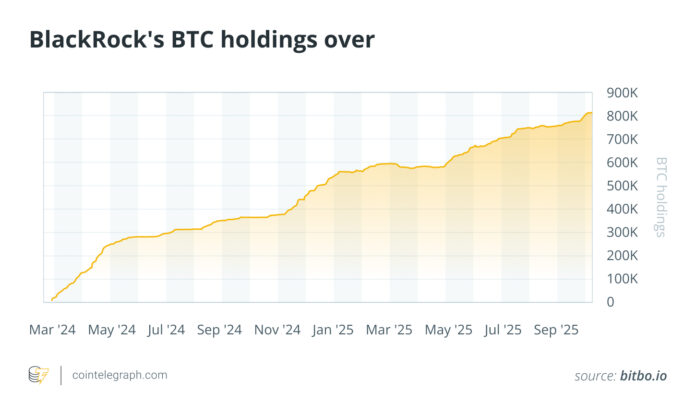

As of recent data, the number of companies holding at least 1,000 BTC has exceeded 1,670, the highest level since the start of 2021. US spot ETFs collectively hold about 1.66 million BTC, approximately 6.4% of the total Bitcoin supply. BlackRock’s iShares Bitcoin Trust ETF (IBIT) alone holds around 800,000 BTC, making it the largest known holder, albeit on behalf of numerous investors.

Market Concentration and Tradable Supply

The concentration of Bitcoin holdings has shifted significantly with the launch of US spot ETFs. A substantial portion of the visible Bitcoin supply is now held in custodial pools. Meanwhile, the tradable float on centralized exchanges has continued to shrink, with Glassnode’s tracked balances falling to a six-year low of approximately 2.83 million BTC in early October 2025. This decrease in tradable supply means that large orders can have a more significant impact on prices.

Intraday Market Movements and Whales

While large, aggressive orders can significantly impact prices, especially during periods of volatility, whales do not always drive the market upwards. Studies have shown that large holders often sell at strong prices, moderating rallies rather than leading them. The use of OTC desks by large holders to execute trades silently also reduces the visible impact of a single wallet on public venues.

Drivers of Daily Market Direction

Since January 2024, spot ETF flows have become a reliable daily signal for Bitcoin’s price movements. Strong weekly inflows often accompany new highs, while weaker or negative inflows tend to accompany down days. Liquidity on stock exchanges, positioning, and leverage are also crucial factors. Macro factors, including dollar trends, US yields, and overall risk appetite, often move in lockstep with Bitcoin’s daily direction.

Key Factors to Monitor

To understand the market dynamics, it’s essential to monitor several key factors:

-

ETF flows: Track yesterday’s net inflows/outflows and total sales.

-

Liquidity: Monitor the development of the exchange balance and the order book depth on the most important trading venues.

-

Positioning: Review funding rate heatmaps and OI rebuild after liquidations.

-

Macro tape: Watch the dollar index, the 10-year yield, and the breadth of the stock market.

Conclusion on Whales and Market Dynamics

While whales can move prices, they rarely decide how the day ends. The primary drivers of daily direction are spot ETF flows, liquidity, positioning, and macro factors. Understanding these dynamics and monitoring key factors can provide a clearer picture of the market. For more insights and analysis, visit https://cointelegraph.com/news/can-the-biggest-bitcoin-whales-really-decide-when-the-market-turns-green-or-red?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound