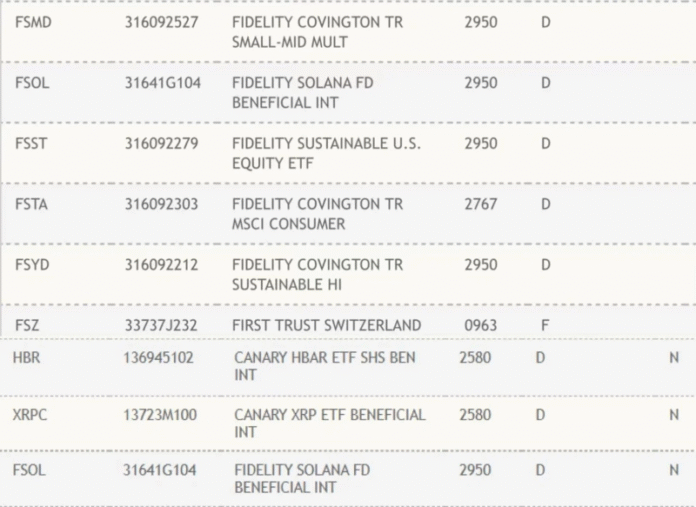

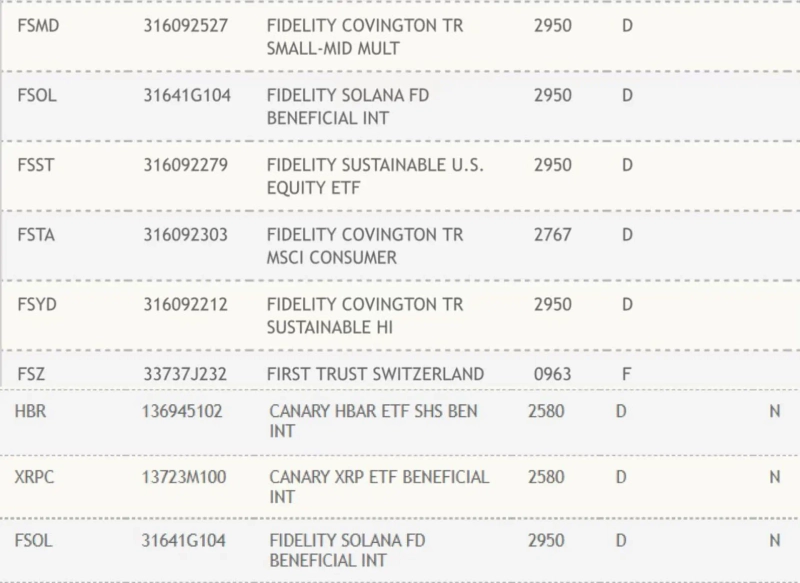

The cryptocurrency market is abuzz with the news that three spot cryptocurrency exchange-traded funds (ETFs) for Solana, Hedera, and XRP, issued by Fidelity Investments and Canary Capital, have been listed on the National Securities Clearing Corporation of the Depository Trust & Clearing Corporation (DTCC). This development is a crucial step towards potential approval, although the final nod from the Securities and Exchange Commission (SEC) is still pending.

Introduction to the ETFs

The Fidelity Solana ETF and Canary’s XRP and Hedera ETFs have been added to the DTCC list, which is a significant milestone in the approval process. The DTCC is a vital clearing and handling provider for US securities, responsible for post-trade operations for ETF products. However, it is essential to note that listing on the DTCC does not guarantee approval for trading, as the SEC’s nod is still required.

SEC Delays and Pending Decisions

The SEC has delayed decisions on the aforementioned ETF products, along with several other Altcoin ETFs from various issuers, without providing any specific clarification other than needing more time. The Commission has postponed its decision on the XRP ETF from Canary to a window between October 18 and 23, while Canary’s Hbar-TF has been pushed to November, and the decision on Fidelity’s Solana ETF has been extended to October.

Despite the delays, analysts believe that most Altcoin ETFs are expected to be approved, especially given the new pro-crypto leadership at the helm of the SEC. According to Bloomberg ETF analyst Eric Balchunas and analyst James Seyffart, the probability of Solana (SOL) and XRP (XRP) being approved is around 95%, while Hedera’s chances are estimated at 90%.

Market Reaction and Demand

The listing of the ETFs on the DTCC has had a positive impact on the market, with all three tokens trading in the green at the time of press. Sol led the gains with a 7% increase in the last 24 hours, followed by HBAR and XRP with profits of 3.63% and 1.88%, respectively. ETF analyst Nate Geraci believes that Altcoin ETFs, particularly those with SOL and XRP, could attract significant demand from investors after approval.

“People underestimate investors’ demand for Spot XRP & Sol ETFs,” Geraci said in an X-post earlier this month. The potential approval of these ETFs could lead to increased adoption and investment in the cryptocurrency market, driving growth and innovation in the industry.

For more information on the listing of the Solana, XRP, and Hedera ETFs on the DTCC and the pending SEC decisions, please visit https://crypto.news/dtcc-lists-solana-xrp-and-hedera-etfs-as-sec-verdicts-near/.

The list of National Securities Clearing Corporation from DTCC | Source: DTCC

The list of National Securities Clearing Corporation from DTCC | Source: DTCC