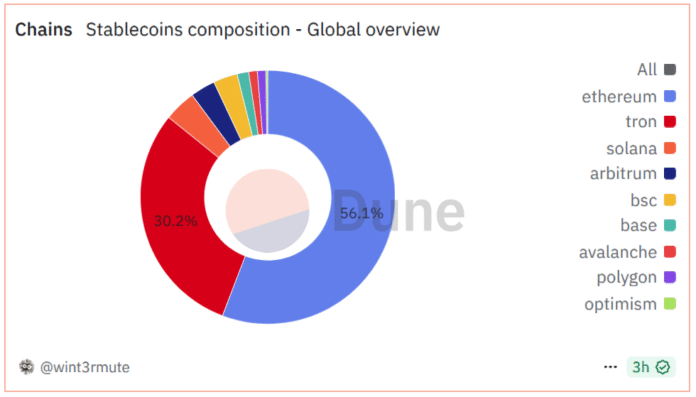

The cryptocurrency market has witnessed significant growth in recent times, with Ethereum (ETH) emerging as a leader in the space. One of the key factors contributing to Ethereum’s success is its dominance in the stablecoin market, with over 56% of all stablecoins running on the Ethereum network. According to data from Dune Analytics, the market capitalization of stablecoins has doubled to $280 billion since the beginning of 2023, with forecasts suggesting it could reach $2 trillion by 2028.

Stablecoins: The Lifeblood of Finance

Stablecoins have become an essential component of the cryptocurrency ecosystem, serving as a trading pair for other cryptocurrencies and challenging traditional money transfer rails. With their fast, cheap, and integrative nature, stablecoins are increasingly being adopted for cross-border payments. As a result, Ethereum is well-positioned to benefit from the growth of stablecoins, with the potential to earn significant transaction fees.

The recent introduction of the Genius Act and the Clarity Act is expected to further accelerate the growth of stablecoins and Ethereum’s dominance in the market. The Genius Act provides a federal framework for stablecoins, defining them as one-to-one with dollars or short-term treasury, public reserve openings, and keeping them away from securities regulation. This regulatory clarity is expected to increase confidence in stablecoins and drive their adoption.

Tokenized Real Assets: The Next Frontier

Tokenized real assets (RWAs) have emerged as a significant trend in the cryptocurrency market, with the sector growing by 413% since the beginning of 2023. According to data from RWA.XYZ, the total value of RWAs has reached $26.7 billion, with big players like Blackrock, Franklin Templeton, and Wisdomtree driving this shift. Ethereum is leading the pack, with over $7.6 billion in tokenized real assets and a 52% market share.

The growth of RWAs is expected to continue, with the Clarity Act providing a regulatory framework that could accelerate the integration of Ethereum into institutional finance. The act introduces the concept of a “mature blockchain,” which requires a network to be decentralized, open-source, and transparent. Ethereum meets these criteria, making it an attractive choice for institutions looking to bring real assets on-chain.

Ethereum: The Mature Blockchain

Ethereum’s advantage in the market is not only due to its market share but also its credibility. As the oldest smart contract platform with 100% order and width decentralization, Ethereum has earned institutional trust. The recent regulatory developments, including the Genius Act and the Clarity Act, are expected to further strengthen Ethereum’s position in the market. With its dominance in stablecoins and RWAs, Ethereum is well-positioned to become the platform of choice for institutional finance.

In conclusion, Ethereum’s growth is driven by its dominance in stablecoins and RWAs, as well as its credibility and regulatory clarity. As the cryptocurrency market continues to evolve, Ethereum is expected to play a significant role in shaping the future of finance. For more information, visit https://cointelegraph.com/news/ether-powered-by-rwa-tradfi-as-wall-street-piles-in?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound