Ether Outshines Bitcoin: A Deeper Dive into the Current Market Trends

Ether (ETH) has been making waves in the cryptocurrency market, outperforming Bitcoin (BTC) in terms of price action and exchange-traded fund (ETF) flows. This shift in investor preference has led to a significant increase in ETH’s momentum, with spot ETH ETFs recording $360 million in net inflows over the past two weeks, compared to BTC’s $120 million. This capital rotation narrative suggests that investors are becoming increasingly interested in ETH, and for good reason.

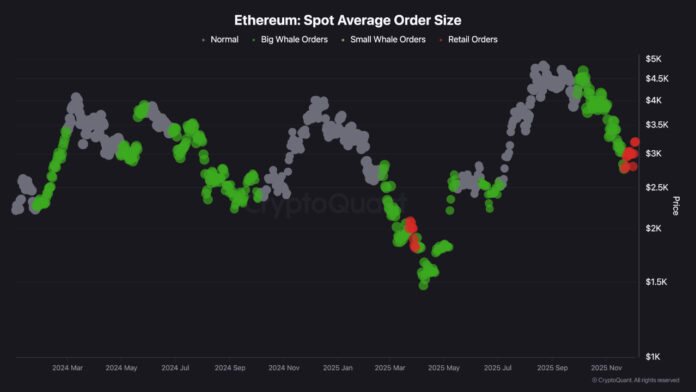

A closer look at the data reveals that ETH’s high-time-frame price action exceeds that of Bitcoin, indicating that Ether may have bottomed out. Furthermore, the spot average order size metric shows a clear behavioral shift in Ether markets, with retail buyers stepping in aggressively when ETH dipped below $2,700 on November 21. This demand-led rebound mirrors prior accumulation phases, suggesting that early retail activity may precede a deeper correction.

Ether spot average order side from retail. Source: CryptoQuant. Historically, retail-driven bounces at local lows often lead to a final liquidity revisit, shaking out late buyers before a stronger rally emerges. This dynamic suggests that ETH may still allow for a controlled pullback to reset positioning and prepare for a more durable upward move.

Technical Analysis and Market Sentiment

From a technical standpoint, Ether exhibits a cleaner high-time-frame setup than Bitcoin. ETH recently confirmed a break of structure (BOS) by pushing into a 20-day high above $3,200, showing that buyers have flipped prior resistance and initiated a trend shift. However, BTC still needs a decisive daily close above $96,000 to confirm its own breakout, leaving ETH in a structural advantage.

BTC, ETH one-day chart comparison. Source: Cointelegraph/TradingView. The ETH/BTC daily chart further strengthens this advantage, with the pair recently breaking above a 30-day consolidation zone. This breakout was supported by a successful retest of the 200-day simple moving average (SMA), a trend baseline that has held firm since July.

Investor Sentiment and Potential Price Movements

Ether’s net unrealized profit/loss (NUPL) currently stands near 0.22, indicating a balanced market, which implies that investors remain in a moderate profit without leaning into euphoria. Importantly, NUPL has not fallen into negative territory, indicating that holders remain structurally strong, which reduces the probability of further selling pressure. As long as NUPL remains above 0.20, sentiment remains supportive of a rebound once the catalysts align.

ETH/BTC one-day chart analysis. Source: Cointelegraph/TradingView. If BTC stabilizes above $94,000 and secures a close above $96,000, it would alleviate further overhead pressure for the altcoin. In that scenario, ETH is well-positioned to extend its newly established uptrend by retesting the $3,650 swing high, and, if momentum accelerates, targeting the next expansion level at $3,900, i.e., another 20% from current prices, where external liquidity clusters currently sit.

Conclusion and Future Outlook

In conclusion, Ether’s recent outperformance of Bitcoin, combined with its strong technical setup and balanced market sentiment, suggests that ETH may be poised for a significant rally. While there may be a controlled pullback to reset positioning, the overall trend appears to be in favor of the altcoin. As the cryptocurrency market continues to evolve, it will be interesting to see how ETH and BTC perform in the coming weeks and months.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, please visit the original source.