Ethereum’s Price Surge: A Closer Look at the Key Factors Driving the Rally

Ether (ETH), the second-largest cryptocurrency by market capitalization, has experienced a significant price increase of 10% in January, drawing the attention of analysts to its daily chart. The chart suggests that the price structure is indicative of higher prices, but only if a crucial daily trend is restored. In this article, we will delve into the key factors driving Ethereum’s price surge and what must happen for a potential 20% rally.

Key Takeaways:

- Ether is on the verge of hitting a daily double bottom and aiming for the $3,900 mark.

- The 200-period EMA remains the key trend that ETH needs to reverse.

- Volume delta data shows buying pressure coming from retail, but whales have continued to reduce their exposure.

A Double Bottom Formation and the $3,900 Target

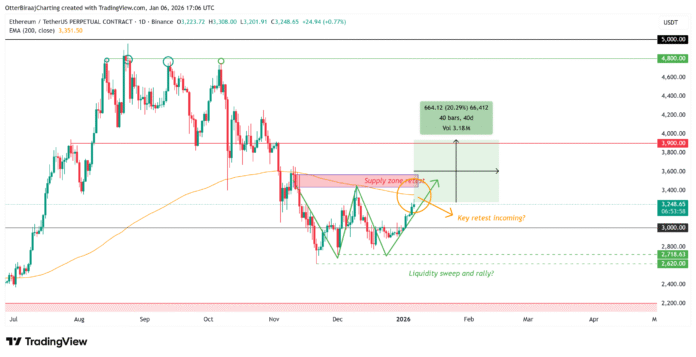

Ether’s daily chart reveals a developing double bottom that took shape in the fourth quarter of 2025, reflecting repeated defenses of the demand zone. If confirmed, the breakout move will target the $3,900 area, about 20% above current levels.

ETH one-day chart. Source: Cointelegraph/TradingView

However, the immediate obstacle is the 200-period Exponential Moving Average (EMA). Since the overall trend turned bearish in November, ETH has failed to regain this level twice, with each rejection resulting in a continuation of the downtrend. As the price tests the EMA once again, the altcoin is facing a major turning point.

Volume Delta Data: Retail-Led Recovery

Cumulative volume delta (CVD) tracks the net difference between market buy and sell orders over time. A rising CVD signals taker-buy dominance, where aggressive buyers increase prices rather than passively waiting.

CVD data for Ethereum spot and futures takers. Source: CryptoQuant

Data from CryptoQuant shows that both spot and futures take CVDs have trended upwards over the past three weeks, indicating consistent demand in the spot and leveraged markets. When these match, it typically reflects the buyer’s belief rather than covering short positions.

However, Hyblock Capital’s data suggested a divergence beneath the surface. Whale wallets ($100,000-$10 million) recorded a negative cumulative delta of $40 million this week, indicating net selling. Meanwhile, retail ($1,000 to $10,000) and mid-sized retailers ($10,000 to $100,000) recorded minor positive deltas of $3.40 million and $28 million over the past six days.

Ether volume delta of various wallets. Source: Hyblock Capital

This split suggests that smaller participants are driving Ether’s recovery. Whether ETH can break the 200-EMA can determine whether bigger players get back in or whether the price stays below the resistance.

Related: Ethereum staking experiences a tidal shift as the validator’s output queue becomes empty

Related: Grayscale announces first Ethereum stake payout for US-listed ETF

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

For more information on Ethereum’s price surge and the factors driving the rally, visit Cointelegraph.