Ether (ETH) has been facing challenges in maintaining prices above $2,000, prompting analysts to draw comparisons with previous bull markets. According to their observations, Ether’s 31% decline in 2026 fits a familiar price fractal, suggesting a potential longer period of consolidation.

Key Takeaways:

-

ETH’s recent decline to $1,736 may mark just the first of many lows in a larger period of consolidation, as indicated by the on-chain cost data and fractal analysis.

-

The on-chain cost data highlights the area between $1,300 and $2,000 as a potential demand zone, which could provide structural support for Ether’s price.

Understanding the ETH Fractal and Its Implications

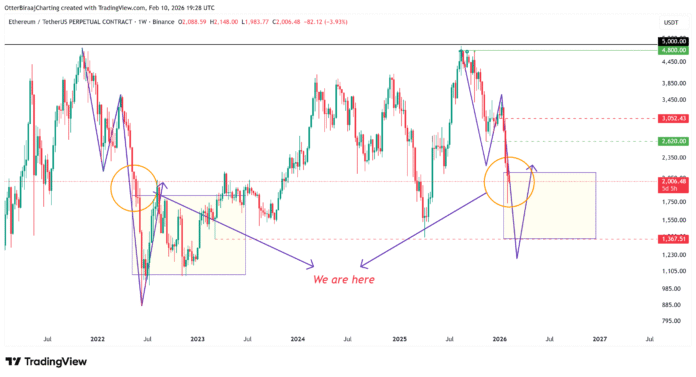

A long-term fractal comparison between the 2021-2022 and 2024-2025 cycles suggests that Ether’s sharp sell-off reflects a pattern where a bottom initially forms before the price returns to lower levels due to further market weakness. This pattern is evident in the weekly chart, where ETH’s decline into the $1,730 area resembles its “first bottom” rather than a definitive market floor.

Ether fractal analysis on the weekly chart. Source: Cointelegraph/TradingView

Ether fractal analysis on the weekly chart. Source: Cointelegraph/TradingView

In 2021, ETH spent 12 months consolidating around the first low ($1,730) and a lower support band ($885), allowing leverage to reset and demand to rebuild. Using this framework, ETH could continue to trade in a range of around $1,300-$2,000, with downside tests possible towards the $1,500-$1,600 zone before a sustainable base is formed.

On-Chain Cost Basis Data and Demand Zones

UTXO data on Ether’s realized price distribution (URPD) highlights the opportunities for extended consolidation. Major supply clusters remain above current prices, with $2,822 representing 5.86% of ETH supply and $3,119 accounting for 6.15%, forming strong overhead resistance.

Below current spot prices, notable clusters appear at $1,881 (1.58 million ETH) and $1,237, indicating potential demand zones if the price continues to decline.  Ether UTXO URPD distribution. Source: Glassnode

Ether UTXO URPD distribution. Source: Glassnode

Structurally, $1,237 stands out as a potential cycle floor, followed by interim support at $1,584 and stronger acceptance at $1,881, where realized supply concentration increases. Derivatives data is consistent with this view, showing cumulative long liquidations with $4 billion to $6 billion at risk, ranging from $1,700 to $1,455.

Ether chart analysis for a week. Source: Cointelegraph/TradingView

Ether chart analysis for a week. Source: Cointelegraph/TradingView

Accumulation and Network Growth

Data from CryptoQuant shows that Ether withdrawals from exchanges rose to their highest level since October 2025, with net outflows exceeding 220,000 ETH. Binance recorded daily net outflows of about 158,000 ETH on Thursday, the largest since August 2025. These flows coincided with ETH trading from $1,800 to $2,000, suggesting accumulation or risk-off repositioning at these levels.

MNCapital founder Michaël van de Poppe highlighted a similar dynamic, noting that price often lags behind network and narrative growth. Stablecoin transaction volume on Ethereum is up about 200% over the past 18 months, even as ETH price remains about 30% lower, a divergence that could lead to a parabolic revaluation for the altcoin.  ETH stablecoin transactions. Source: X

ETH stablecoin transactions. Source: X

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, please visit the original source.