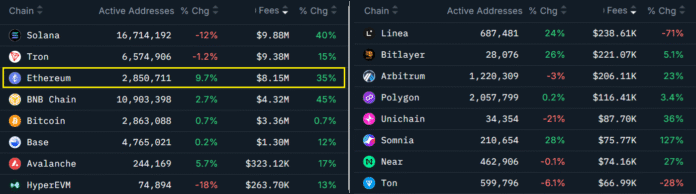

Ethereum (ETH) has been exhibiting strong on-chain activity, with a surge in network usage and accumulation of ETH by treasury companies, despite the recent exit of validators. This increased activity has resulted in a 35% rise in Ethereum network fees compared to the previous week, while active addresses have grown by 10%. The robust on-chain activity supports the price of ETH, as every transaction and data operation requires payment in ETH.

Ethereum’s On-Chain Activity and Accumulation

The growth in fees also increases the returns of validators, which in turn strengthens network security and contributes to Ethereum’s automatic burn mechanism, gradually reducing the supply. The Validator Queue data showed a record demand of 2.67 million ETH to end the setting process, resulting in an estimated waiting period of 46 days. Although this has led some investors to start selling, the shrinking queue could change in the face of accumulation by more treasury companies.

Strategic ETH reserve data reveals that these companies have added 877,800 ETH in the past 30 days alone, equivalent to $4.7 billion at current prices. Key contributors include Bitming Immersion Tech (BMNR), Sharplink Gaming (SBet), and Ether Machine (ETM), which all either hold part of their reserves or have formal mandates. This accumulation by treasury companies could deliver the spark for an ETH price breakout above the $5,000 mark.

Spot Ether ETFs and Exchange Balance

Despite the recent weakness, ETH has outperformed the wider cryptocurrency market by 21% in the past two months. The dominance of Ethereum in the decentralized application (DApp) sector remains unrivaled, with the Ethereum ecosystem controlling 64.5% of the total value locked (TVL), including layer 2 solutions. In comparison, the largest competitor Solana accounts for less than 9% of the industry’s $169.4 billion TVL, according to Defillama data.

The expansion of Spot Ether Exchange-Traded Funds (ETFs) also supports the prospects of ETH prices, with managed assets reaching $24.7 billion. These vehicles offer institutional investors a regulated and accessible option to gain ETH exposure, strengthening their lead over rivals. The net inflows of $213 million in Spot Ether ETFs on Thursday raise questions among investors, while ETH exchanges have decreased to their lowest level in over five years, reducing the amount available for sale.

Blockchains ranked after 7-day fees. Source: Nansen

Ethereum Validator Queue data. Source: validatorqueue.com

ETH/USD (blue) compared to Total Crypto Market Capitalization (Magenta). Source: TradingView / CoinTelegraph

Ether ETFs daily net flows, USD. Source: CoinGlass

Conclusion

Ether’s progress towards $5,000 seems more realistic, given the accumulation by reserve-oriented companies and the sustained demand for Ether ETFs. While many investors may remain cautious until the exit queue in the Ethereum Validator normalizes, a delay that can generate short-term price corrections, the overall outlook for ETH remains optimistic. For more information, visit https://cointelegraph.com/news/ethereum-onchain-activity-surge-hints-at-eth-price-rally-to-5k