Ether (ETH) has shown remarkable resilience in the face of significant outflows from US Spot Ethereum Exchange-Traded Funds (ETFs). Despite a $300 million withdrawal over two sessions, which reversed the previous six-day inflow, ETH managed to gather 4.7% on Wednesday and pushed away from the $4,300 level after a seven-day downward trend. The data from derivatives indicates strong support at $4,300, suggesting that traders can expect the cryptocurrency to increase above $5,000 in the coming weeks.

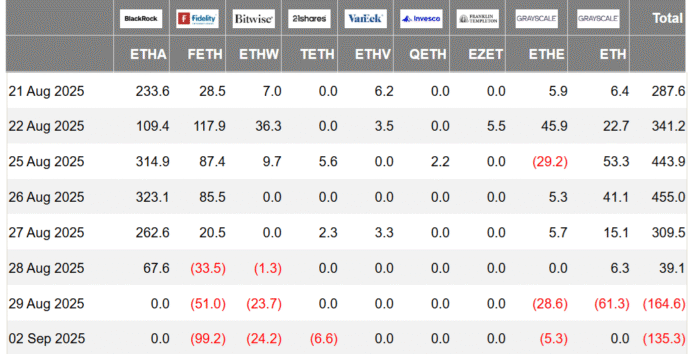

The US Ethereum ETFs’ net outflows of $300 million over two sessions correspond to only 1.3% of the assets under management. Previously, the primary inflows and the main accumulation of corporate treasuries were observed in the first three weeks of August, along with 33% of the main drivers. From a trading perspective, ETH’s volatility has led to $344 million of leveraged long positions being liquidated since August 28, a factor that may have dampened the mood.

The long-to-short ratio of top traders across major exchanges helps to gauge the market’s sentiment with a combination of spot, futures, and options activity. At OKX and Binance, the demand for longs slipped on Friday but has recovered since then. Notably, there was no significant increase in short interest, which reinforces the support at $4,300.

ETH Derivatives Show Strength, but $5,000 Remains Questionable

ETH derivative metrics indicate resilience, but the path to $5,000 may take longer than investors expect if attention shifts to macroeconomic data. A report published on Wednesday by the Bureau of Labor Statistics’ JOLTS showed that the ratio of job openings to unemployed has dropped to its lowest level since April 2021. Gold prices rose to a new all-time high on the same day, emphasizing concerns about global growth and increasing US fiscal debt.

According to JP Morgan analysts, the gold price forecast has been revised upward, assuming the Federal Reserve will cut interest rates and reduce bond appointments. The demand for financial products in the Ethereum network was highlighted by Ethereum-based startup Ethereify, which announced a $40 million funding round on Wednesday. The company aims to expand its infrastructure to package financial assets such as mortgages and credit instruments.

Spot Bitcoin ETFs Increase, Ether Funds Bleed as Investors Flee to Safety

The investment was led by venture companies Electric Capital and Paradigma, according to Fortune. Ultimately, reaching $5,000 will depend on greater clarity regarding global economic conditions, which are currently under pressure due to trade wars and a weak job market.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph or represent them.

For more information, visit Cointelegraph.