The recent surge in Ethereum’s network activity and the increase in ether futures open interest rates have sparked speculation about the cryptocurrency’s potential to break through the $5,000 barrier. With the Ethereum network’s activity rising by 63% in the past 30 days, investors are becoming increasingly bullish about the cryptocurrency’s prospects. The ether futures open interest rates have also reached $69 billion, indicating a strong demand for leveraged positions.

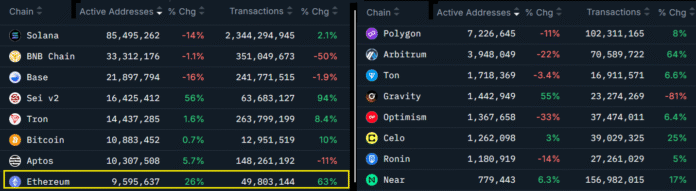

The increase in Ethereum’s network activity can be attributed to the growing number of transactions and active addresses. According to Nansen, the number of transactions on the Ethereum network has increased by 63% in the past 30 days, while active addresses have risen by 26%. This growth in activity has been accompanied by a significant increase in the price of ether, which has risen by 33% in the past 30 days.

The Impact of Jerome Powell’s Comments on Ethereum’s Price

The recent comments by Jerome Powell, the Chairman of the Federal Reserve, have also contributed to the increase in Ethereum’s price. Powell’s statement that the Fed may adjust its policy position has led to a decrease in interest rates, making it easier for companies to borrow money and reducing systemic risks. The bond markets are now pricing in a 45% probability that interest rates will drop to 3.5% or less, compared to 37% in the previous week.

The decrease in interest rates has led to an increase in investor appetite for risk assets, including Ethereum. The NASDAQ index has risen by 1.8%, indicating that investors are becoming more willing to take on risk. The increase in Ethereum’s price has also been driven by the growing demand for ether futures, with the monthly futures premium currently standing at 7%, compared to 4% earlier in the week.

Ethereum’s On-Chain Metrics and Futures Markets

Ethereum’s on-chain metrics, such as the number of transactions and active addresses, indicate a growing demand for the cryptocurrency. The increase in transactions and active addresses has been accompanied by a significant increase in the price of ether. The futures markets also indicate a bullish sentiment, with the ether futures open interest rates reaching $69 billion.

The combination of growing on-chain activity and bullish futures markets has strengthened the case for an outbreak of Ethereum’s price, potentially pushing it beyond the $5,000 barrier. The analytics company Cryptoquant has measured the volume of buy orders against sellers with outstanding offers, indicating an increasing conviction among futures buyers.

While some investors remain cautious due to comparisons with other cryptocurrencies, such as BNB and Tron, the overall sentiment remains bullish. The increase in Ethereum’s price has been driven by a combination of factors, including the growing demand for ether futures, the decrease in interest rates, and the growing number of transactions and active addresses.

Conclusion

In conclusion, the recent surge in Ethereum’s network activity and the increase in ether futures open interest rates have sparked speculation about the cryptocurrency’s potential to break through the $5,000 barrier. The combination of growing on-chain activity, bullish futures markets, and the decrease in interest rates has strengthened the case for an outbreak of Ethereum’s price. As the cryptocurrency market continues to evolve, it will be interesting to see whether Ethereum can maintain its momentum and push beyond the $5,000 barrier.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts and opinions that are expressed here are solely that of the author and do not necessarily reflect the views and opinions of Cointelegraph or do not necessarily represent them. For more information, visit https://cointelegraph.com/news/eth-data-and-return-of-investor-risk-appetite-pave-path-to-5k-ether-price?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound