Ethereum’s Uptrend Fades as Derivatives and Network Fees Decline

Ether (ETH) has seen a 15% increase from its low of $2,623 on Friday, but derivatives metrics indicate that traders remain cautious. The lack of bullish leverage from top ETH traders, combined with falling Ethereum network fees, weakens the case for a sustainable uptrend. As a result, traders are wondering what needs to change for ETH to convincingly reclaim the $4,000 mark.

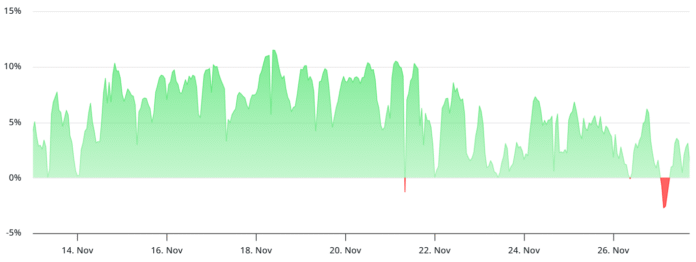

The annual funding rate of ETH Perpetual Futures. Source: laevitas.ch

Demand for leveraged bullish ETH positions has been virtually non-existent since Monday, as shown by the perpetual futures funding rate. Under normal conditions, this rate should be between 6% and 12% to offset the cost of capital. Nevertheless, a significant part of the current reluctance can be attributed to the uncertainty following the flash crash in October.

Flash Crash and Network Fees

Ether’s 20% price drop on October 10 triggered widespread liquidations across centralized and decentralized trading venues, dealing a major blow to trader confidence. According to DefiLlama data, the total value (TVL) on the Ethereum network fell to $72.3 billion from $99.8 billion on October 9th. This drop in deposits adds pressure to ETH’s price outlook as investors brace for weaker demand.

Blockchains sorted by seven-day network fees, USD. Source: Nansen

Ethereum network fees have fallen by 13% over the past week, although transaction numbers have remained stable. This divergence worries investors about a negative feedback loop associated with shrinking network deposits, which could ultimately lead to inflationary tilt for ETH. Finally, Ethereum’s burn mechanism relies entirely on sustained on-chain activity.

Top Traders’ Sentiment

Long-to-short ratio of ETH top traders on OKX. Source: CoinGlass

While aggregating spot, futures, and margin positions, top traders on OKX have reduced their bullish exposure to ETH. The long-to-short ratio now has a 23% bias towards bearish positions. More importantly, whales and market makers have repeatedly failed to sustain a significant uptrend, indicating a clear lack of conviction.

Ether Traders Await Clarity as Weak US Jobs Data Undermines Confidence

Another reason for traders’ unrest is the weak US labor market. According to Yahoo Finance, some companies cited rising operating costs while consumer spending fell following the U.S. government shutdown that lasted until November 12. Reuters reported that U.S.-based companies announced more than 25,000 job cuts in November.

Adam Sarhan, managing director of 50 Park Investments in New York, reportedly said: “There are no mass layoffs when the economy is strong.” If layoffs accelerate, they could further weaken consumer confidence and weigh on risk assets, including Ether.

US Federal Government Surplus or Deficit, USD. Source: Federal Reserve

The U.S. government must continue to increase debt to sustain growth as declining revenues and rising costs outpace economic momentum, while major investments in artificial intelligence infrastructure take years to produce productivity gains or meaningful returns to the overall economy. Large deficits favor alternative investments, which could be a potential trigger for Ether’s price.

While the weak labor environment is hurting market sentiment, a weaker economy could also prompt the Federal Reserve to take a more accommodative stance. In addition, the risk-off environment eased as the slowdown in economic activity triggered by the government shutdown in the United States, which lasted until November 12, reversed.

Historically, cryptocurrencies have benefited from such conditions; However, the current lack of clarity in the US employment situation continues to undermine traders’ confidence. It remains unclear whether Ether can reclaim $4,000 before fresh liquidity injections arrive from major central banks to support global growth.

Currently, investors appear to be more focused on tech stocks and bond markets, leaving limited room for ETH to move higher in the short term.

This article is for general information purposes and is not intended to constitute, and should not be construed as, legal or investment advice. The views, thoughts, and opinions expressed herein are those of the author alone and do not necessarily reflect the views and opinions of Cointelegraph.

For more information, visit https://cointelegraph.com/news/eth-whales-cautious-as-data-shows-slim-chance-of-rally-to-dollar4k