Ethereum’s Recent Surge: A Sign of a Potential Price Rally?

Ether (ETH) has experienced a significant 7% increase over the past day, reclaiming its 50-week moving average (MA) near $3,300. This event has historically preceded strong price increases, sparking interest among investors and analysts alike. The current price of $3,362 represents a 20% rise from the support level at $2,800, which may indicate a local floor for the cryptocurrency.

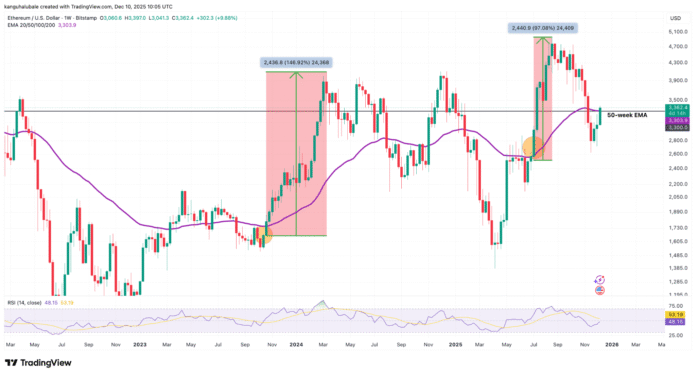

Data from Cointelegraph Markets Pro and TradingView shows that ETH’s price has broken out above the 50-week exponential moving average (EMA), increasing the likelihood of a steeper rise in the coming days or weeks. Previous examples demonstrate that ETH tends to rise sharply when the price closes above the 50-week EMA, with gains of 147% between October 2023 and March 2024 and 97% in the third quarter of 2025.

Past Performance and Future Projections

Investor StockTrader_Max notes that ETH is back above its 50-day MA and expects a break above the 200-day MA at $3,500, which could lead to a push towards the all-time high (ATH) of $5,000. Fellow analyst CyrilXBT also emphasizes the importance of holding the 50-week MA to increase the likelihood of a push towards the $4,000 area.

As Cointelegraph reported, ETH price has ended its five-month downtrend against Bitcoin and is forecasting a 170% increase to 0.09 BTC in less than two months. This uptrend is supported by increased accumulation of large investors, with Ethereum whales buying approximately 934,240 ETH over the past three weeks, worth $3.15 billion at current prices.

Ethereum Whales and Institutional Investment

Market research firm Santiment notes that Ethereum is a standout gainer, climbing +8.5% and seeing an encouraging accumulation pattern from whales and sharks. Additional data from CryptoQuant shows that whale wallets with values between 10,000 ETH and 100,000 ETH have reached record highs, indicating an upward trend among larger cohorts and institutions.

The revival of interest in whales coincides with a surge in demand for spot Ethereum ETF inflows, which recorded $177 million in inflows on Tuesday, the largest since October 28, according to data from SoSoValue. The ETH Coinbase Premium Index, a measure of US investor interest, remained positive last week after being negative for about a month, indicating a return of demand from US investors.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/ethereum-rising-3-3k-proves-bottom-is-in-is-eth-price-rally-next