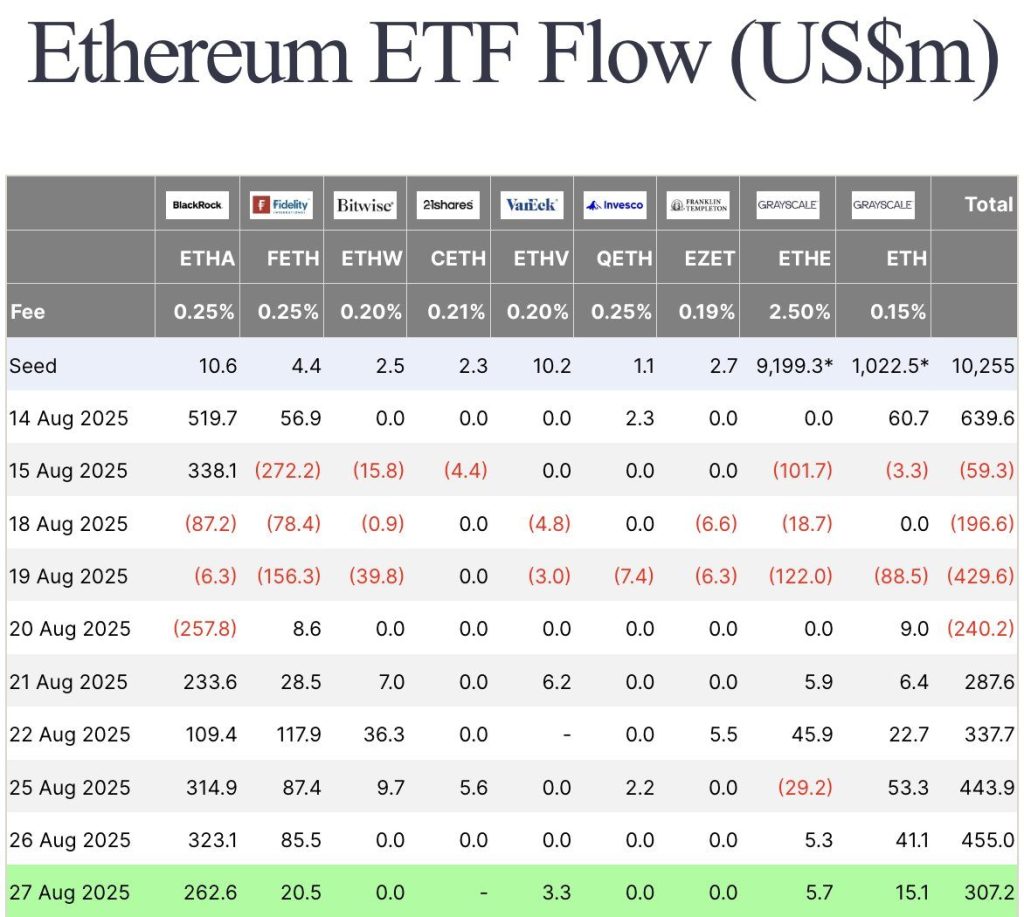

Ethereum ETFs See Unprecedented Growth with $307M Inflows in One Day

Ethereum exchange-traded funds (ETFs) have staged a dramatic surge in investor interest, drawing in more than $307 million in net inflows on August 27 alone, leaving their Bitcoin counterparts trailing once again. This wave of capital shows accelerating institutional demand for Ether, with Wall Street funds increasingly positioning around the second-largest cryptocurrency.

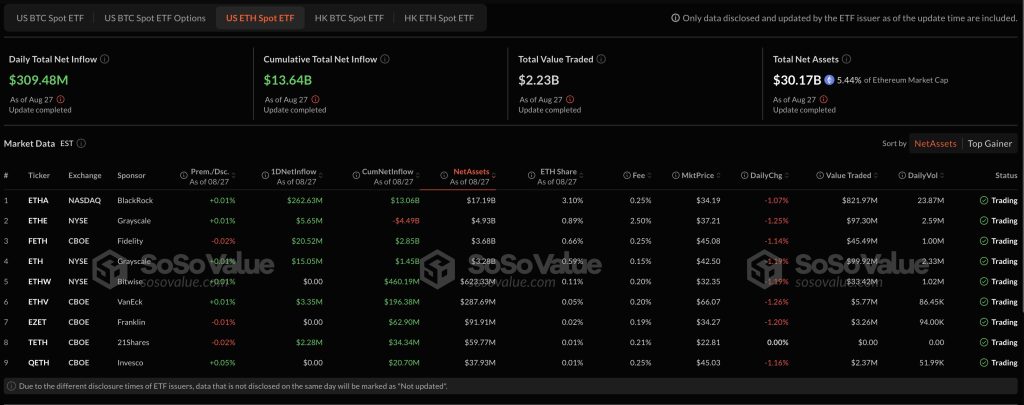

According to data from SoSoValue, U.S.-listed Ethereum spot ETFs now hold $30.17 billion in net assets, equal to 5.4% of Ether’s total market capitalization. The daily inflows on Tuesday were led by BlackRock’s iShares Ethereum Trust (ETHA), which pulled in $262.6 million, while Fidelity’s FETH attracted $20.5 million. In a sign of shifting sentiment, Grayscale’s flagship ETHE product, which has suffered heavy redemptions since launch, managed to record a rare positive day with $5.7 million in inflows.

Source: Lark Davis

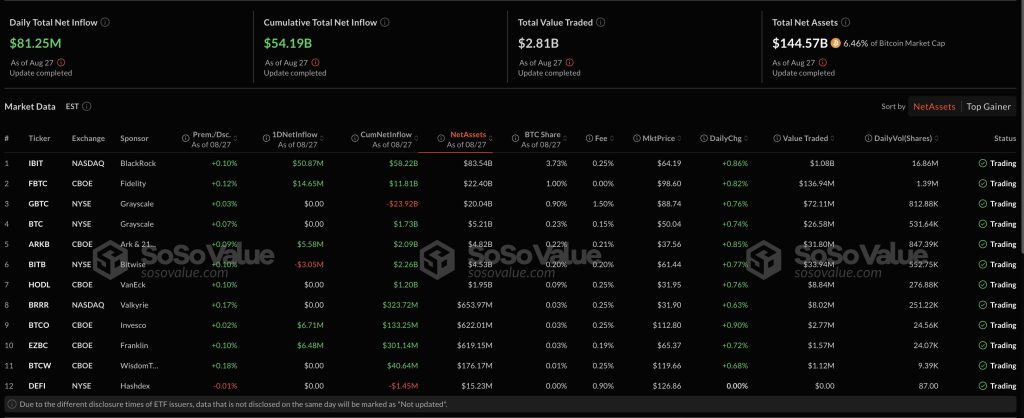

ETH ETFs Catch Up to BTC, But Bitcoin Still Leads at $144B AUM

The latest surge caps an extraordinary two-week turnaround for Ethereum ETFs. On August 19, the group suffered its worst trading session to date, with a $429 million net outflow, driven largely by redemptions from Fidelity and Grayscale. But flows rebounded sharply, with August 21 bringing $233.6 million in new capital, followed by $337.7 million on August 22 and a record $455 million on August 26.

Cumulatively, Ethereum ETFs have now absorbed $13.6 billion since launch, with nearly one-third of that total arriving in just the past few weeks. Trading activity has been robust, with $2.23 billion in daily turnover across Ether ETF products.

Source: SoSoValue

BlackRock Remains the Dominant Player

BlackRock remains the dominant player by far, with its ETHA fund controlling $17.19 billion in net assets, more than half of the market. Fidelity’s FETH, at $3.68 billion, and Bitwise’s ETHV, at $3.23 billion, round out the sector’s second tier, while Franklin’s EZET holds under $1 billion.

Analysts See Trillions Flowing Into Crypto as Advisers Expand ETF Exposure

Investment advisers are emerging as the largest identifiable holders of Bitcoin and Ether exchange-traded funds (ETFs), according to new data from Bloomberg Intelligence. Bloomberg ETF analyst James Seyffart said on X that advisers invested over $1.3 billion in Ether ETFs during Q2, representing 539,000 ETH, a 68% increase from the previous quarter.

A similar trend was seen in U.S. spot Bitcoin ETFs, where advisers now hold $17 billion across 161,000 BTC. Their exposure is nearly double that of hedge funds. Fox Business has previously projected that trillions in assets could enter crypto markets through adviser allocations.

Institutional interest comes as whales shift strategies. Blockchain analytics firm Arkham reported that nine large wallets purchased $456.8 million worth of Ether this week, with several transactions routed through BitGo and Galaxy Digital.

Source: SoSoValue

For more information, visit the original source: https://cryptonews.com/news/ethereum-etfs-explode-with-307m-inflows-in-one-day-leaving-bitcoin-etfs-behind-again/