Ethereum’s Price Struggles: Understanding the Challenges Ahead

Ethereum (ETH) has experienced a significant decline of 11% over the past week, despite reaching $3,400 on Saturday. This downturn coincided with a 4% correction in the Nasdaq index, erasing gains from the past two weeks. As traders discuss the possibility of ETH reclaiming the $3,900 mark, concerns about global economic growth have emerged due to weak quarterly results from consumer-focused companies and renewed concerns about high valuations in the artificial intelligence sector.

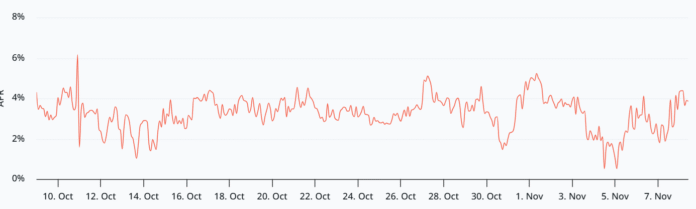

Market fears have grown following expectations for U.S. consumer sentiment falling to their lowest ever, according to a University of Michigan survey. The November reading, released Friday, was the second weakest since at least 1978 and was largely attributed to the U.S. government’s ongoing budget freeze. Monthly ETH futures premium on an annual basis. Source: laevitas.ch

Derivatives Premiums and Market Sentiment

Ether futures are trading at a 4% premium to spot markets, unchanged from the previous week. Data shows that appetite for bullish positions is limited, although it has not yet reached panic levels below 0%. Under normal market conditions, this premium is typically between 5% and 10% to reflect the longer settlement time. ETH/USD (blue) vs. total crypto capitalization (red). Source: TradingView

Part of Ether investors’ frustration comes from ETH underperforming the broader crypto market by 4% on a weekly basis. This suggests that, in addition to rising macroeconomic risks, other factors have likely caused traders to become more cautious about Ethereum. The total value locked on the Ethereum network fell to $74 billion – its lowest level since July – marking a 24% decline over the last 30 days. Total Value Locked (TVL) on Ethereum, USD. Source: DefiLlama

Ethereum DApps and Revenue

Ethereum decentralized applications (DApps) generated $80.7 million in revenue in October, down 18% from September. The decline is particularly concerning for ETH holders as lower on-chain activity puts downward pressure on native staking returns. Ethereum’s design includes a mechanism that burns ETH during periods of high demand for blockchain computing, helping to balance network activity and supply. Active addresses and transactions, 7 days. Source: Nansen

However, the first week of November shows the first signs of Ethereum’s strength compared to competing blockchains. Active addresses increased by 5% in the last seven days while transactions increased by 2%. In contrast, both Tron and BNB Chain saw a decline in on-chain activity. Daily flows of Ethereum spot exchange-traded funds, USD. Source: CoinGlass

ETH traders’ sentiment has been hit by a lack of demand for Ethereum spot exchange-traded funds (ETFs). According to data from Strategic ETH Reserve, US-listed products recorded net outflows of $507 million in November and there were no significant purchases of ETH corporate reserves. Currently, ETH’s only clear catalyst is the upcoming Fusaka upgrade, scheduled for early December. The update is intended to provide several scalability and security improvements to the network.

However, with derivatives markets signaling weakness and investors wary of a slowdown in the global economy, the chances of a near-term breakout towards $3,900 appear limited. For more information on Ethereum’s price movements and market analysis, visit https://cointelegraph.com/news/ethereum-faces-tough-path-to-3-9k-as-sentiment-and-demand-fizzle?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound