Ethereum Price Under Pressure as $6 Billion Options Expiry Looms

Ether (ETH) has been struggling to maintain a price above $3,400 over the past 40 days, raising concerns among traders that bears may remain in control for longer. The upcoming $6 billion ETH options expiry on Friday has added to the pressure, as bulls had expected year-end prices of $4,000 or more before November’s 28 percent plunge.

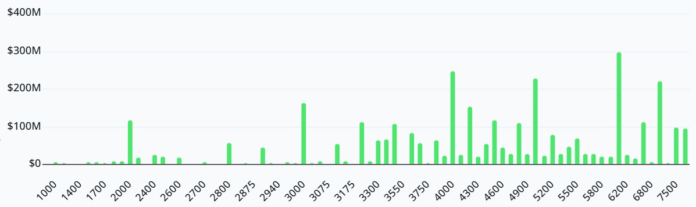

According to data from laevitas.ch, the aggregated open interest for ETH call options on Friday is valued at $4.1 billion, with Deribit accounting for 70% of the total open interest, followed by Chicago-based CME at 20%. However, most of these call options will expire worthless on Friday, as traders had focused on bullish bets on year-end Ether prices between $3,500 and $5,000.

Less than 15% of total call options were positioned at $3,000 or less, indicating that bulls were overly optimistic about the year-end price. Even excluding overly optimistic purchase prices of $5,000 and above, which likely incurred limited costs to buyers, the data shows that less than 25% of these instruments were placed below $3,200.

ETH Options Traders See Increased Risk

Traders often sell covered calls at year-end strike prices of $8,000 and $10,000 without realistic expectations of reaching these levels. While bulls were overconfident that Ether would reclaim $3,400 by year-end, bearish strategies may also have gone too far by concentrating bets between $2,200 and $2,900.

If Ether trades above $2,950 on Friday, more than 60% of the total $1.9 billion in put options will expire worthless. Nevertheless, bearish positions remain better placed as long as ETH stays below $3,200. The aggregated open interest of ETH put options on Friday is valued at $1.9 billion, with Deribit accounting for the majority of the open interest.

Investors reacted to reports that Intel had failed in its push to make advanced chips in the United States, as it tried to challenge global leader Taiwan Semiconductor (TSMC US). According to Bloomberg, Nvidia (NVDA US) has stopped production testing that relied on Intel’s manufacturing processes.

$3,100 is Key for Ether Bulls

As traders priced in weaker prospects for the economic impact of artificial intelligence in the US, many moved to hedge their ETH positions. Demand for bearish ETH options strategies increased, including “Bear Diagonal Put Spread,” “Bear Put Spread,” and “Bear Call Spread,” especially after multiple failed attempts to recapture the $3,400 mark over the past five weeks.

Below are four likely scenarios for ETH aggregate options expiration at year-end based on current price action:

-

$2,700 to $2,900: The net result favors put instruments by $580 million.

-

$2,901 to $3,000: The net result favors put instruments by $440 million.

-

$3,101 to $3,200: Balanced result between call and put options.

-

$3,201 to $3,300: The net result favors the call instruments by $150 million.

A break below $2,900 on Friday could further weaken Ether investor sentiment. However, Ether bulls still have an opportunity to push prices towards $3,100 on Friday, which would help balance positioning and distance Ether price from December lows of $2,775.

This article is for general information purposes and is not intended to constitute, and should not be construed as, legal, tax, investment, financial or other advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect the views and opinions of Cointelegraph.

Source: https://cointelegraph.com/news/ethereum-price-under-pressure-6-billion-options-expiry